Apple's Bold Move: U.S. iPhones Break Free from Chinese Production Lines

Manufacturing

2025-04-25 09:56:46

In a strategic shift that could reshape global manufacturing dynamics, Apple is set to dramatically reduce its reliance on Chinese production for iPhones by significantly expanding its manufacturing footprint in India. This bold move signals a major transformation in the tech giant's supply chain strategy, moving away from its traditional Chinese manufacturing base. The decision comes amid escalating geopolitical tensions and a desire to diversify production risks. India, with its growing tech ecosystem and supportive government policies, has emerged as a compelling alternative to China's long-standing manufacturing dominance. Apple is now positioning India as a critical hub for iPhone production, potentially reducing its vulnerability to global trade uncertainties. By accelerating its manufacturing investments in India, Apple aims to not only mitigate supply chain risks but also tap into the massive Indian market. The company has been gradually increasing its production capabilities in the country, with local manufacturers like Foxconn and Tata Group playing pivotal roles in this strategic realignment. This transition represents more than just a logistical change; it's a significant geopolitical and economic statement. As Apple moves to decentralize its production, the move could potentially inspire other global tech companies to reconsider their manufacturing strategies and explore alternative production landscapes. The shift promises multiple benefits: reduced dependency on a single manufacturing region, potential cost efficiencies, and alignment with India's "Make in India" initiative. For Apple, this could be a game-changing strategy that redefines its global manufacturing approach. MORE...

Trade Tensions Loom: Could New Tariffs Derail America's Industrial Comeback?

Manufacturing

2025-04-25 09:00:00

The Promise and Pitfall of Nostalgic Industrial Policies In the quest to revive America's industrial might, policymakers are chasing a mirage that could ultimately harm our technological innovation. While the allure of bringing back manufacturing jobs sounds appealing, the reality is far more complex and potentially counterproductive. Attempts to resurrect traditional manufacturing sectors are not just misguided—they risk undermining the very economic dynamism that has made the United States a global innovation leader. The modern economy doesn't thrive on preserving outdated industries, but on creating cutting-edge technologies and adaptable workforce skills. Today's global competitiveness isn't about manufacturing volume, but about innovation capacity. By fixating on recreating past industrial landscapes, we risk diverting critical resources and talent from the research and development that drive future breakthroughs. The most valuable economic assets are no longer factories, but the intellectual capital and technological ecosystems that generate transformative ideas. Moreover, these nostalgic policies often ignore the fundamental shifts in global economic structures. Automation, artificial intelligence, and advanced robotics are reshaping manufacturing faster than protectionist policies can respond. The jobs of tomorrow will require sophisticated skills and adaptive thinking—not attempts to resurrect yesterday's industrial models. Instead of looking backward, we should invest in education, research infrastructure, and creating environments where innovation can flourish. Our economic strategy must prioritize developing the skills, technologies, and collaborative networks that will define the next generation of global economic leadership. MORE...

Pioneers of 3D Printing: AMUG Celebrates Trailblazers Reshaping Manufacturing Frontiers

Manufacturing

2025-04-25 08:28:25

The Additive Manufacturing Users Group (AMUG), a passionate global volunteer organization, recently celebrated innovation and excellence at its 37th annual conference in Chicago. During this prestigious event, six outstanding individuals were honored with the coveted DINO (Distinguished Innovative) awards, recognizing their groundbreaking contributions to the additive manufacturing industry. The conference brought together leading experts, innovators, and enthusiasts from around the world, showcasing the latest advancements and cutting-edge technologies in 3D printing and additive manufacturing. The DINO awards highlight the remarkable achievements of individuals who have pushed the boundaries of technological innovation and demonstrated exceptional creativity in their field. By recognizing these talented professionals, AMUG continues to foster a culture of collaboration, learning, and continuous improvement within the additive manufacturing community. The annual conference serves as a critical platform for knowledge sharing, networking, and celebrating the remarkable progress made in this rapidly evolving industry. MORE...

Tariff Tides: How SourceDay Throws Manufacturing a Lifeline in Turbulent Trade Waters

Manufacturing

2025-04-25 08:00:00

Revolutionizing Supply Chain Intelligence: SourceDay's AI-Powered Predictive Insights In the fast-paced world of manufacturing, staying ahead of market trends and supplier performance is crucial. SourceDay is transforming supply chain management with its cutting-edge AI-driven indexing technology, offering manufacturers unprecedented foresight into potential disruptions and opportunities. By leveraging advanced artificial intelligence, SourceDay's innovative platform provides manufacturers with a strategic advantage, revealing critical shifts in supplier performance and market dynamics up to two full quarters before they materialize. This groundbreaking approach empowers businesses to proactively adapt their strategies, mitigate risks, and capitalize on emerging trends. The AI-powered indexes act like a sophisticated early warning system, analyzing complex data patterns and delivering actionable insights that traditional monitoring methods simply cannot match. Manufacturers can now make more informed decisions, optimize their supply chains, and maintain a competitive edge in an increasingly unpredictable global marketplace. With SourceDay's intelligent technology, businesses are no longer reactive but predictive, transforming supply chain management from a defensive strategy to a powerful tool for strategic growth and innovation. MORE...

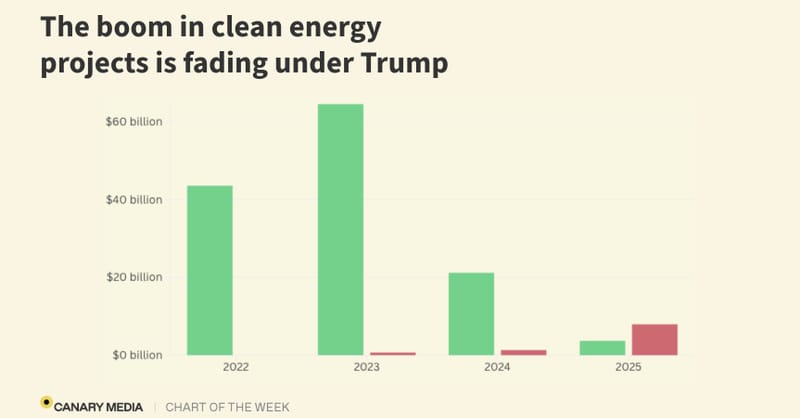

Green Industry in Peril: How Trump's Policies Are Derailing America's Clean Energy Manufacturing Boom

Manufacturing

2025-04-25 07:30:00

In a stunning reversal for the clean energy sector, U.S. companies have pulled the plug on nearly $8 billion worth of green energy projects during the first quarter of this year. The widespread cancellations, predominantly affecting manufacturing facilities, signal a significant shift in the renewable energy landscape. These project cancellations represent a dramatic downturn for an industry that had been experiencing remarkable growth and optimism. Factors such as economic uncertainties, supply chain challenges, and changing market dynamics appear to be driving this unexpected retreat from clean energy investments. The scale of these cancellations is particularly noteworthy, suggesting deeper challenges facing the renewable energy sector. Investors and industry experts are now closely watching how these developments might impact the broader green energy transition and future infrastructure plans. While the reasons behind these project cancellations are complex, they underscore the volatile nature of emerging technologies and the ongoing challenges in scaling up sustainable energy solutions. The clean energy sector will need to demonstrate resilience and adaptability in the face of these setbacks. MORE...

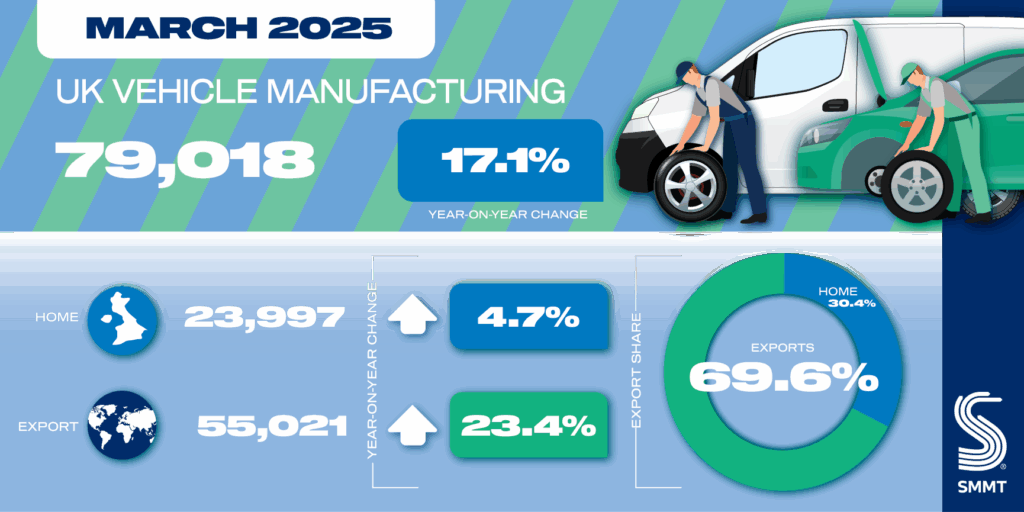

UK Auto Sector Struggles: March Surge Can't Rescue Sluggish Q1 Manufacturing

Manufacturing

2025-04-25 07:25:34

The automotive industry shows signs of resilience as vehicle production surged by 17.1% compared to the subdued manufacturing levels of March last year. Despite this promising monthly uptick, the first quarter's total output experienced a notable decline of 6.3%, casting a shadow over the sector's overall performance. This production increase comes at a critical time, with potential new US tariff announcements looming on the horizon. Manufacturers are navigating a complex landscape of economic challenges and market uncertainties, striving to maintain momentum and adapt to changing global trade dynamics. The mixed signals in vehicle production reflect the ongoing volatility in the automotive manufacturing sector, highlighting the industry's ongoing efforts to recover from previous disruptions and position itself strategically for future growth. MORE...

Inside the Boardroom: How Todd Wanek is Reshaping American Manufacturing in the Face of Global Challenges

Manufacturing

2025-04-25 02:27:08

In an exclusive interview, Todd Wanek, CEO of Ashley Furniture, offers a compelling perspective on the complex landscape of modern manufacturing, addressing critical challenges facing the furniture industry today. Navigating the intricate world of global trade, Wanek provides nuanced insights into the impact of tariffs and supply chain disruptions. With strategic vision, he discusses how Ashley Furniture is adapting to economic uncertainties by reimagining its manufacturing approach. The conversation delves deep into the company's innovative strategies for reshoring production, highlighting a commitment to bringing manufacturing capabilities back to the United States. Wanek emphasizes the importance of reducing dependency on international supply chains and creating domestic job opportunities. Automation emerges as a key theme in Wanek's discussion, showcasing how cutting-edge technology is transforming the furniture manufacturing sector. He explains how strategic investments in advanced manufacturing technologies are enhancing efficiency, quality, and competitiveness. By blending economic pragmatism with forward-thinking innovation, Ashley Furniture under Wanek's leadership is positioning itself at the forefront of industry transformation. His insights reveal a comprehensive approach to addressing global manufacturing challenges while maintaining a commitment to quality and innovation. As the furniture industry continues to evolve, Wanek's strategic vision offers a compelling blueprint for navigating the complex intersection of global trade, technology, and manufacturing excellence. MORE...

Economic Boost: Local Manufacturer Unveils $11.5 Million Expansion, Promises Job Surge in Shelbyville

Manufacturing

2025-04-25 00:22:00

In a strategic move to enhance its operational capabilities, the company is set to embark on an ambitious expansion project. The planned development will introduce an impressive 28,000 square feet of additional space, significantly boosting the company's current operational footprint. This substantial expansion promises to provide increased flexibility, improved workflow efficiency, and room for future growth, marking an exciting milestone in the company's ongoing development strategy. MORE...

Steel Giants Expand: Balmoral Tanks Breaks Ground in Ohio with Bold US Manufacturing Venture

Manufacturing

2025-04-25 00:00:00

Balmoral Tanks, a leading innovator in anaerobic digestion (AD) tank manufacturing, is set to make a significant expansion into the United States market. The company is preparing to launch its US operations and establish a state-of-the-art production facility in Northeast Ohio, scheduled to open in summer 2025. This strategic move will position Balmoral Tanks to exclusively produce and supply high-quality epoxy-coated steel tanks under their cutting-edge efusion brand. The new facility represents a major milestone for the company, signaling its commitment to growth and serving the expanding renewable energy and waste management sectors in North America. By bringing their specialized tank manufacturing capabilities directly to the US market, Balmoral Tanks aims to provide local customers with efficient, durable, and technologically advanced solutions for anaerobic digestion infrastructure. The Northeast Ohio location will not only streamline production but also enable closer collaboration with regional clients and partners in the sustainable energy industry. MORE...

Battery Battleground: Defense Logistics Pros Demand Supply Chain Revolution

Manufacturing

2025-04-25 00:00:00

The Defense Logistics Agency (DLA) is revolutionizing battlefield technology with its innovative BATTNET III project, targeting critical improvements in battery performance, efficiency, and affordability for military personnel. By focusing on cutting-edge battery solutions, the agency aims to provide warfighters with more reliable and advanced power sources that can withstand the most challenging operational environments. Through this strategic initiative, DLA is actively seeking collaboration with leading technology and defense industry companies to develop next-generation battery systems. These advanced power solutions will not only enhance the operational capabilities of military personnel but also reduce logistical challenges and support mission-critical requirements across various military platforms. The BATTNET III project represents a significant leap forward in military power technology, addressing the growing need for lightweight, high-performance, and cost-effective battery solutions. By prioritizing innovation and strategic partnerships, the Defense Logistics Agency is committed to equipping warfighters with the most advanced technological resources available, ensuring they have the power and reliability needed to succeed in complex and demanding operational scenarios. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238