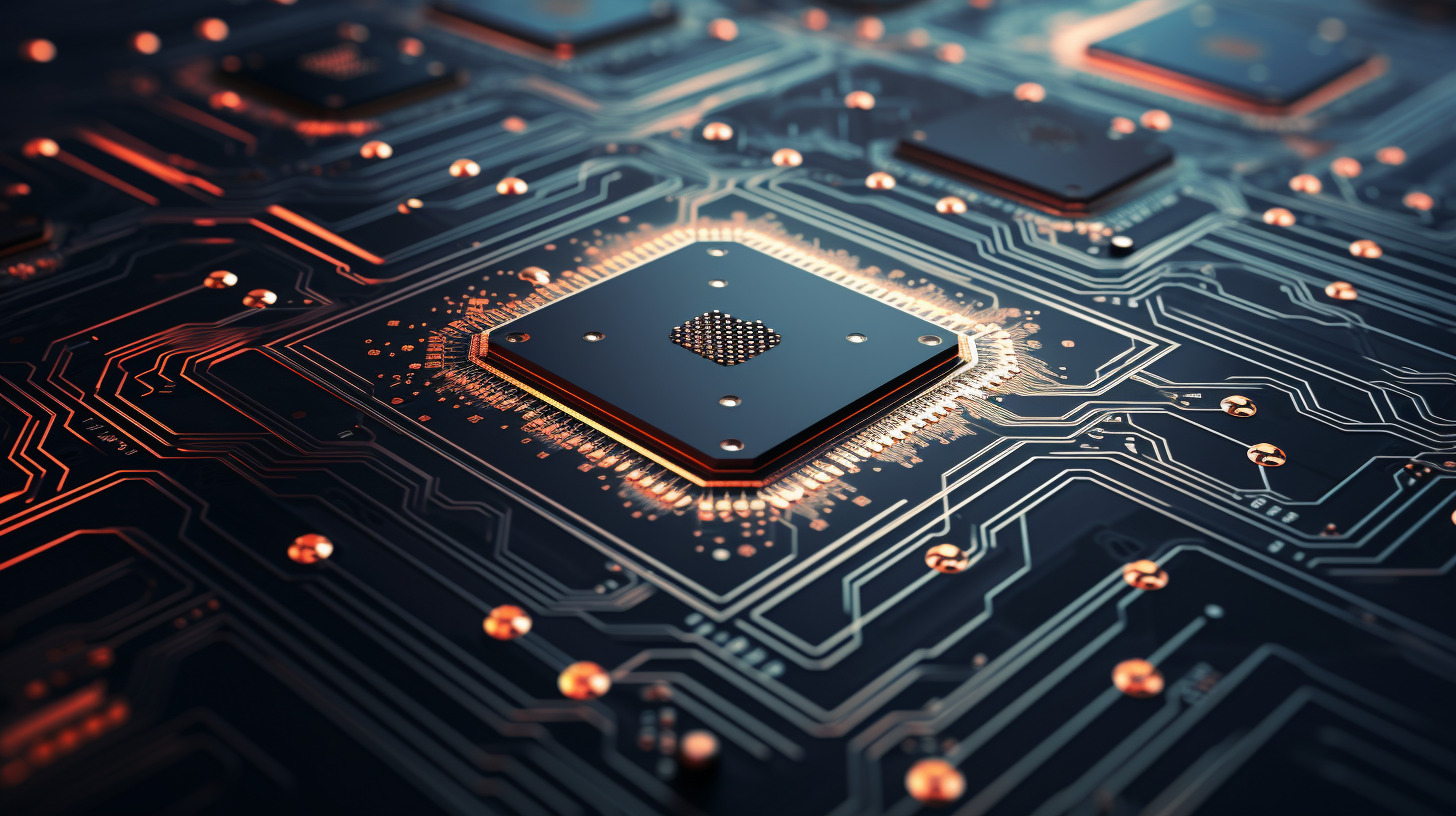

Chip Giant TSMC: Ken Fisher's Tech Bet That Could Revolutionize Investor Portfolios

Manufacturing

2025-05-03 14:19:57

In our latest deep dive into the world of tech investments, we're exploring the strategic moves of billionaire investor Ken Fisher and his compelling technology stock selections. At the heart of our analysis is Taiwan Semiconductor Manufacturing (TSMC), a powerhouse that has captured the attention of savvy investors and tech enthusiasts alike. TSMC isn't just another semiconductor manufacturer—it's the global foundry that powers the digital ecosystem. As the primary chip supplier for tech giants like Apple, Nvidia, and Qualcomm, the company sits at the critical intersection of innovation and manufacturing excellence. Fisher's keen eye for transformative companies has once again highlighted TSMC's potential for significant growth and market leadership. What makes TSMC particularly intriguing is its technological edge. The company consistently leads the semiconductor industry in cutting-edge manufacturing processes, producing the most advanced chips that drive everything from smartphones to artificial intelligence systems. This technological superiority positions TSMC not just as a manufacturer, but as a strategic enabler of global technological progress. Investors and market watchers are closely monitoring TSMC's strategic moves, recognizing that its performance is intrinsically linked to the broader tech ecosystem. With increasing global demand for advanced semiconductors and the company's robust research and development pipeline, TSMC represents a compelling investment opportunity in the rapidly evolving technology landscape. Stay tuned as we continue to unpack the nuanced strategies behind Ken Fisher's technology stock picks and explore the potential that lies within these innovative companies. MORE...

Manufacturing's Perfect Storm: How Tariffs and Robots Are Reshaping America's Industrial Landscape

Manufacturing

2025-05-03 14:05:00

The Rise of Automation: How Technology is Reshaping the Manufacturing Workforce In a dramatic transformation of the industrial landscape, automation has silently but powerfully reshaped the manufacturing sector, eliminating 1.7 million jobs across the United States. This staggering number reveals the profound impact of technological advancement on traditional employment. Robots and advanced machinery are increasingly replacing human workers, streamlining production processes and dramatically increasing efficiency. While this technological revolution brings unprecedented productivity, it also raises critical questions about the future of work and the economic challenges facing manufacturing employees. The job displacement isn't just a statistic—it represents real people and communities experiencing significant economic disruption. Regions historically dependent on manufacturing are being forced to reimagine their economic strategies and workforce development. However, this shift isn't entirely negative. As traditional roles disappear, new opportunities emerge in technology, robotics maintenance, and advanced manufacturing skills. The key lies in adaptation, retraining, and embracing the skills needed in this evolving technological ecosystem. As automation continues to advance, workers and policymakers must collaborate to create strategies that balance technological progress with human economic security, ensuring that the benefits of innovation are shared across society. MORE...

Green Power Revolution: California's Bold Plan to Supercharge Grid Manufacturing

Manufacturing

2025-05-03 12:00:59

As California faces increasingly complex climate challenges, the state's energy infrastructure stands at a critical crossroads. The power grid—a complex network of transmission lines, transformers, and interconnected systems—is the lifeline of California's energy resilience, and its strength lies in the quality and innovation of its individual components. Modern grid technology is no longer just a technological aspiration; it's a necessity for survival. With rising temperatures, more frequent extreme weather events, and the urgent need to transition to renewable energy sources, California must reimagine and reinforce its electrical infrastructure. The future of the state's climate adaptation strategy hinges on creating a power grid that is not just functional, but intelligent, adaptable, and robust. This means investing in cutting-edge technologies, implementing smart grid solutions, and developing a system that can dynamically respond to changing environmental conditions and energy demands. From advanced battery storage systems to sophisticated grid management software, each technological advancement represents a crucial piece of the resilience puzzle. The goal is to build a grid that can withstand environmental pressures, integrate renewable energy seamlessly, and provide reliable power to millions of Californians. Ultimately, the strength of California's energy future will be determined by its ability to innovate, adapt, and transform its power infrastructure into a model of modern, sustainable energy management. MORE...

Breaking: McCann Pioneers Advanced Manufacturing Tech Program with Inaugural Adult Cohort

Manufacturing

2025-05-03 06:55:00

Breaking New Ground: Local Students Complete Innovative Technical Training Program In a significant milestone for workforce development, eight dedicated students have successfully completed a groundbreaking 200-hour course, marking the inaugural program under the state's Career Technical Initiative grants. The achievement highlights North Adams' commitment to providing cutting-edge vocational training and creating pathways to promising career opportunities. The comprehensive program represents a strategic investment in local talent, equipping participants with specialized skills that are increasingly valuable in today's competitive job market. By offering intensive, hands-on training, the initiative aims to bridge the gap between traditional education and the practical expertise demanded by modern industries. These graduates stand as testament to the power of targeted technical education, demonstrating how focused learning can transform individual potential and contribute to the region's economic vitality. Their accomplishment not only reflects personal dedication but also underscores the importance of innovative educational approaches in preparing the workforce of tomorrow. MORE...

Racing Powerhouse High Performance Manufacturing Acquires Legendary Jerry Bickel Race Cars Empire

Manufacturing

2025-05-03 05:39:40

A long-standing rumor in the racing community has been officially confirmed: Jerry Bickel Race Cars has been acquired by Pro Mod racer Rick Hord and his High Performance Manufacturing LLC. The legendary chassis shop and parts manufacturer, originally established by Jerry Bickel in Moscow Mills, Missouri, continues its legacy of producing championship-caliber race cars. Despite the ownership transition, the company remains committed to maintaining the high standards of performance and innovation that have defined its reputation in the racing world. This strategic acquisition promises to breathe new life into the renowned racing brand, blending Rick Hord's racing expertise with the established reputation of Jerry Bickel Race Cars. Enthusiasts and professional racers alike can look forward to continued excellence in race car design and manufacturing. MORE...

Electric Shock: Kia's EV Sales Plummet Amid Production Overhaul

Manufacturing

2025-05-03 03:57:33

Kia's EV Sales Take a Dramatic Nosedive in April

The electric vehicle landscape just experienced a significant shake-up, and not in a good way for Kia. This month's sales figures have left EV enthusiasts and industry watchers stunned by the sharp decline in Kia's electric vehicle performance.

The Kia EV6, once a shining star in the electric vehicle market, has seen its sales numbers plummet dramatically. What was once a promising electric crossover that captured the imagination of eco-conscious drivers now appears to be struggling to maintain its momentum.

While the exact details of the sales drop are still being analyzed, this sudden downturn raises important questions about the current state of the electric vehicle market and Kia's strategy moving forward.

For those eager to stay informed about the latest developments in electric vehicle sales and trends, we recommend:

- Signing up for CleanTechnica's weekly Substack newsletter

- Subscribing to our daily newsletter

- Following us on Google News for real-time updates

Stay tuned as we continue to track and report on this developing story in the electric vehicle industry.

MORE...Reshoring Roulette: Nike's Bold Gamble to Bring Manufacturing Back Home

Manufacturing

2025-05-03 00:00:00

In the midst of the Trump administration's ambitious push to revitalize American manufacturing, the story of Nike's failed attempt to bring sneaker production back to North America offers a revealing glimpse into the complex challenges of reshoring industrial jobs. The sportswear giant's recent endeavor to relocate manufacturing closer to home quickly exposed the intricate web of global supply chains and economic realities that make such transitions far more complicated than political rhetoric suggests. Despite the compelling narrative of bringing jobs back to American workers, Nike discovered that the infrastructure, skilled labor, and cost-effectiveness required for large-scale shoe production are not easily replicated overnight. This case study underscores the nuanced economic landscape that confronts companies seeking to respond to political pressure and nationalist manufacturing sentiments. It highlights the significant barriers that exist between political aspirations and the practical realities of global manufacturing, demonstrating that simple solutions are rarely as straightforward as they might initially appear. As policymakers and business leaders continue to grapple with the future of American manufacturing, Nike's experience serves as a critical reminder of the complex economic ecosystem that underpins global production strategies. MORE...

Manufacturing Titans Converge: West Tennessee Leaders Forge Economic Strategies

Manufacturing

2025-05-02 22:59:51

Manufacturing Momentum: West Tennessee's Industrial Powerhouse Takes Center Stage Local industry leaders and economic development professionals gathered for a dynamic manufacturing forum that highlighted the region's robust industrial landscape. The event showcased the remarkable strength and growing momentum of West Tennessee's manufacturing sector, bringing together key stakeholders to discuss innovation, economic growth, and regional opportunities. Participants explored the vibrant manufacturing ecosystem, celebrating the area's industrial achievements and strategic potential. The forum served as a powerful platform for networking, sharing insights, and reinforcing West Tennessee's position as a critical hub of production and economic development. With passionate discussions and forward-thinking presentations, the event underscored the region's commitment to industrial excellence and economic resilience. Manufacturing continues to be a cornerstone of West Tennessee's economic strategy, driving job creation and regional prosperity. MORE...

Manufacturing Revival: Van Orden's Bold Strategy to Supercharge American Industry

Manufacturing

2025-05-02 22:50:29

Republican Congressman Derrick Van Orden Connects with Constituents in Western Wisconsin Congressman Derrick Van Orden embarked on a meaningful community tour through western Wisconsin on Friday, engaging directly with local residents and gaining firsthand insights into the region's priorities and concerns. The visit underscores Van Orden's commitment to maintaining strong connections with the communities he represents. During his tour, the congressman met with local leaders, business owners, and community members, listening intently to their perspectives and discussing key issues affecting the area. Van Orden's grassroots approach demonstrates his dedication to understanding the unique challenges and opportunities facing western Wisconsin's residents. The visit highlights the importance of direct constituent engagement and Van Orden's ongoing efforts to be an accessible and responsive representative for the region. By spending time on the ground, the congressman continues to build meaningful relationships and gather valuable local insights that can inform his legislative work in Washington. MORE...

STEM Sparks Fly: John Deere Transforms Classroom into Innovation Lab for Young Learners

Manufacturing

2025-05-02 22:15:00

John Deere Turns Classroom into Innovation Hub, Inspiring Young Minds Fifth graders at Fillmore Elementary experienced an extraordinary learning adventure when John Deere transformed their classroom into an interactive pop-up factory. The innovative workshop bridged the gap between classroom mathematics and real-world career opportunities in skilled trades, giving students a thrilling glimpse into how mathematical skills directly translate to exciting professional paths. During the immersive session, students discovered how mathematical concepts they're currently learning become powerful tools in advanced manufacturing and engineering. By bringing hands-on demonstrations and engaging activities directly into the classroom, John Deere demonstrated that math isn't just about solving problems on paper—it's a critical skill for designing, creating, and innovating in today's high-tech industries. The pop-up factory experience allowed students to see firsthand how calculations, spatial reasoning, and problem-solving skills are essential in careers they might never have considered before. From precision engineering to advanced manufacturing, these young learners were inspired to view mathematics as a gateway to endless professional possibilities. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238