Luxury Giant LVMH Plots US Manufacturing Shift in Response to Trump's Trade Pressure

Manufacturing

2025-04-15 05:27:30

In a recent statement, the company's Chief Financial Officer revealed strategic plans to restructure its manufacturing approach. While exploring potential shifts in production segments, the executive emphasized that such transformations would be a gradual process, cautioning that significant changes won't occur instantaneously. The organization is carefully evaluating its current manufacturing landscape to implement strategic improvements methodically and efficiently. MORE...

Navigating the Trade Tremors: Can India Forge a Manufacturing Powerhouse in Trump's Global Reshuffle?

Manufacturing

2025-04-15 04:27:15

As the United States and China continue their high-stakes economic chess match, India finds itself at a potential turning point. The ongoing trade war presents a golden opportunity for India to emerge as a manufacturing powerhouse, but significant challenges loom on the horizon. The current geopolitical tensions have created a unique window for India to attract global manufacturers looking to diversify their supply chains away from China. With rising labor costs and increasing trade tensions, multinational companies are actively seeking alternative production bases. India, with its large, young workforce and growing economic potential, stands poised to capitalize on this strategic shift. However, the road to manufacturing supremacy is far from smooth. India's industrial infrastructure remains fragmented and underdeveloped compared to China's well-established manufacturing ecosystem. Critical challenges include inadequate infrastructure, complex regulatory environments, and a skills gap in the workforce. While the potential is immense, India must undertake substantial reforms to truly transform this opportunity into tangible economic growth. Key areas of focus must include: • Streamlining bureaucratic processes • Investing in industrial infrastructure • Enhancing workforce skills • Creating more business-friendly policies • Improving logistics and transportation networks The next few years will be crucial. India has the demographic dividend and economic ambition, but success depends on swift, strategic action. The trade war's fallout could be India's manufacturing moment—if the country can rise to the challenge and implement bold, comprehensive reforms. MORE...

Innovators Reshaping Europe's Future: AI and Green Tech Pioneers Under 30 Revolutionize Manufacturing

Manufacturing

2025-04-15 04:15:00

Innovators Shaping Europe's Technological and Sustainable Future In a groundbreaking showcase of technological prowess, this year's list highlights visionary builders who are revolutionizing multiple sectors through cutting-edge robotics, advanced drone technologies, and intelligent machine learning solutions. These forward-thinking innovators are not just pushing technological boundaries, but are also driving meaningful progress towards creating more sustainable and environmentally conscious economies across Europe. From developing sophisticated robotic systems that transform industrial processes to engineering intelligent drones that redefine aerial capabilities, these pioneers are demonstrating the transformative potential of emerging technologies. Moreover, their strategic application of machine learning is enabling smarter, greener economic models that promise to address critical environmental challenges. These remarkable innovators represent the vanguard of European technological innovation, proving that creativity, technical expertise, and environmental consciousness can converge to create powerful solutions for our rapidly evolving world. MORE...

India's Moment: Can It Capitalize on the US-China Trade Showdown?

Manufacturing

2025-04-15 04:00:12

India's ambitious vision of emerging as a global manufacturing powerhouse is facing significant challenges that threaten to derail its industrial transformation. Despite the government's bold "Make in India" initiative, manufacturers are confronting a complex web of obstacles that are testing their resilience and strategic planning. At the heart of these challenges lies a critical skills gap in the workforce. Companies are struggling to find workers with the technical expertise and specialized training needed to drive advanced manufacturing processes. This shortage of skilled labor is creating bottlenecks in production and hindering the country's ability to compete on the international stage. Supply chain complexities further compound the problem. Manufacturers are grappling with difficulties in securing essential components, navigating intricate procurement networks, and maintaining consistent production quality. The bureaucratic red tape, characterized by complex regulations and administrative hurdles, adds another layer of complexity to their operational challenges. While India possesses immense potential with its large, young workforce and growing technological capabilities, these systemic barriers are preventing the country from fully realizing its manufacturing ambitions. Overcoming these challenges will require a coordinated effort from government, educational institutions, and industry leaders to develop targeted skills training programs, streamline regulatory processes, and create a more supportive ecosystem for industrial growth. The road to becoming a global manufacturing hub is fraught with obstacles, but India's determination and innovative spirit continue to fuel hope for a transformative industrial future. MORE...

Breaking Barriers: How Next-Gen Testing is Revolutionizing AAV Therapies

Manufacturing

2025-04-15 00:07:25

Dive into the Cutting-Edge World of Gene Therapy: A Comprehensive Exploration Join us for an illuminating GEN webinar that brings together three distinguished experts from academia, biopharma, and biotech sectors. These thought leaders will unveil groundbreaking insights into the complex landscape of gene therapy characterization, offering a holistic view of the field's most critical aspects. Our distinguished speakers will guide participants through an in-depth journey, covering key domains including: • Advanced vector development strategies • Innovative manufacturing techniques • Sophisticated potency testing methodologies • Comprehensive biodistribution analysis This unique webinar promises to provide a panoramic perspective on the evolving gene therapy ecosystem, bridging theoretical knowledge with practical, real-world applications. Attendees will gain unprecedented insights from leading professionals who are actively shaping the future of cellular and genetic medicine. Don't miss this opportunity to expand your understanding of gene therapy's most cutting-edge research and development approaches. MORE...

Breaking: Sev-Rend Dodges Trade Barriers with Bold Domestic Production Strategy

Manufacturing

2025-04-15 00:00:00

Sev-Rend is revolutionizing its manufacturing approach by producing clip wire directly at its Collinsville, Illinois headquarters, marking a strategic shift towards domestic production. This innovative move not only reduces the company's dependence on international suppliers but also delivers significant economic and operational advantages. By leveraging 100 percent American-sourced steel, Sev-Rend is now crafting high-quality clip wire with versatile zinc, copper, and tin coatings in various sizes to precisely meet diverse industry requirements. The in-house production strategy enables the company to dramatically cut costs, circumvent complex import tariffs, and dramatically improve lead times. Beyond the immediate business benefits, this localized manufacturing approach champions American manufacturing, bolsters the domestic economy, and minimizes the environmental footprint associated with long-distance shipping. Sev-Rend's commitment to domestic production represents a forward-thinking model of sustainable and efficient manufacturing in today's competitive industrial landscape. MORE...

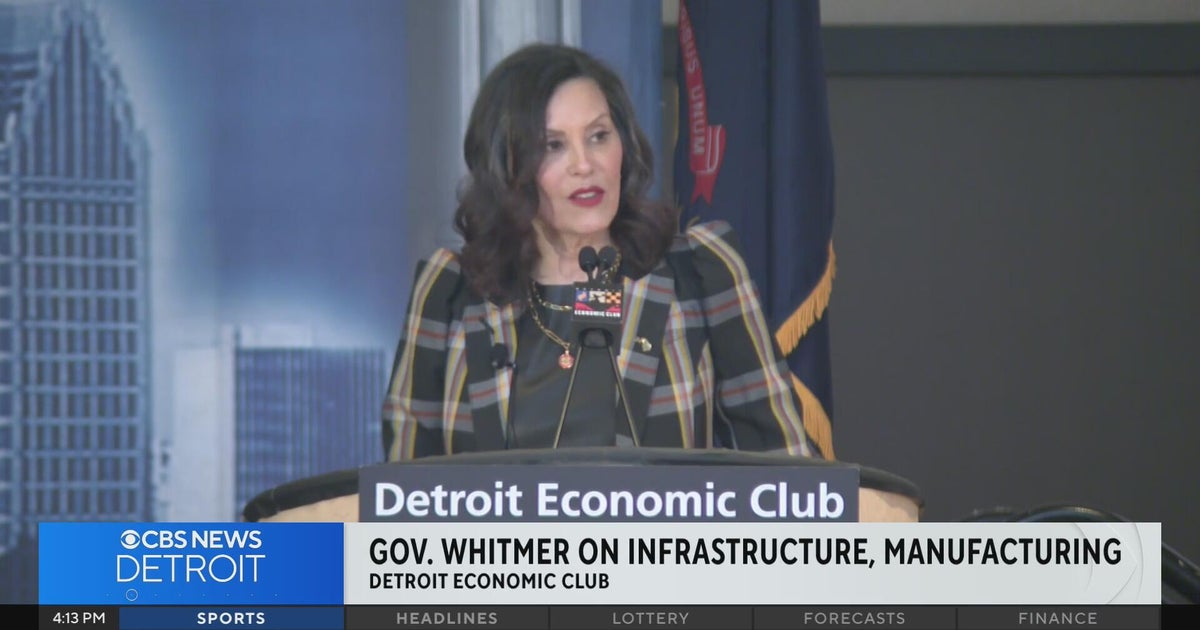

Motor City Momentum: Whitmer Unveils Blueprint for Michigan's Economic Revival

Manufacturing

2025-04-14 23:27:00

In a bold move to secure Michigan's future, Governor Gretchen Whitmer recently returned from Washington D.C. with renewed determination to champion her state's economic and infrastructure priorities. Fresh from high-stakes meetings at the White House, Whitmer is now laser-focused on translating her federal funding efforts into tangible progress for Michigan residents. The governor's strategic trip to the nation's capital underscores her commitment to bringing critical resources back to the Great Lakes State. By directly engaging with federal officials, Whitmer aims to unlock substantial funding that could transform Michigan's infrastructure, support local communities, and drive economic growth. While details of her specific plans are still taking shape, sources close to the governor suggest she is prioritizing key areas such as infrastructure improvements, workforce development, and economic revitalization. Her proactive approach signals a comprehensive strategy to address long-standing challenges and position Michigan as a competitive, forward-thinking state. As Whitmer continues to leverage her political connections and negotiate federal support, Michigan residents are watching with anticipation, hopeful that her Washington efforts will translate into meaningful improvements for their communities. MORE...

Boston Becomes Biotech Hub: Amsino Unveils Cutting-Edge Manufacturing Campus

Manufacturing

2025-04-14 22:37:00

Amsino Marks a Milestone in Global Healthcare Innovation In a groundbreaking move that underscores its commitment to transforming healthcare, Amsino has unveiled a strategic initiative that promises to reshape medical solutions on a global scale. The company today announced a significant advancement that reflects its unwavering dedication to pushing the boundaries of medical technology and patient care. With a vision to drive meaningful progress in healthcare, Amsino is positioning itself at the forefront of medical innovation. This latest development represents more than just a corporate milestone—it's a testament to the company's passion for improving health outcomes and delivering cutting-edge solutions to medical professionals and patients worldwide. The announcement signals Amsino's continued commitment to excellence, innovation, and its mission of making quality healthcare more accessible and effective. By leveraging advanced technologies and a forward-thinking approach, the company is set to make a substantial impact in the medical landscape. As Amsino moves forward, healthcare professionals and stakeholders can anticipate transformative solutions that have the potential to redefine medical practices and patient experiences. MORE...

Inferno Engulfs Industrial Complex: Massive Blaze Reduces Pipe Factory to Ashes in Joliet

Manufacturing

2025-04-14 22:20:00

Fortunately, the blaze remained contained, sparing nearby residential areas from any damage. Firefighters were aided by favorable wind conditions that prevented the smoke from drifting onto the busy Interstate 55, minimizing potential disruptions to traffic. The fire chief noted that the wind direction played a crucial role in their successful containment efforts, allowing them to quickly bring the situation under control. MORE...

Gearing Up Futures: Louisiana Central Launches Teen Manufacturing Career Bootcamp

Manufacturing

2025-04-14 21:36:23

Unlocking Career Opportunities: Louisiana Central Empowers Students in Manufacturing Central Louisiana is taking a bold step to bridge the skills gap and inspire the next generation of industrial professionals. Louisiana Central is offering students an exciting pathway to explore and pursue rewarding careers in manufacturing right in their own backyard. Through innovative educational programs and hands-on training, local students are getting unprecedented access to the dynamic world of manufacturing. This initiative not only provides valuable career insights but also highlights the diverse and technologically advanced opportunities available in the region's industrial sector. By connecting students directly with local manufacturing employers, Louisiana Central is creating a powerful pipeline of talent that can drive economic growth and provide young professionals with stable, well-paying career prospects. Students will gain practical skills, understand industry trends, and discover the potential for innovation within manufacturing careers. This forward-thinking approach demonstrates Central Louisiana's commitment to developing local talent and ensuring a bright, prosperous future for its emerging workforce. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238