Revolutionary Robotics: Vention Transforms Workspace Customization with Groundbreaking 'Click & Customize' Solution

Manufacturing

2025-03-17 14:37:36

Solving Workforce Challenges in Manufacturing: Innovative Solutions for Machine Shops In today's competitive manufacturing landscape, machine shops and manufacturers are facing unprecedented workforce challenges. The skills gap and labor shortages continue to plague the industry, creating significant obstacles for businesses trying to maintain productivity and growth. Recognizing these critical challenges, industry experts have developed cutting-edge strategies to address workforce limitations. These innovative approaches go beyond traditional recruitment methods, offering comprehensive solutions that help manufacturers attract, train, and retain skilled talent. Key strategies include: 1. Advanced Training Programs - Implementing immersive apprenticeship models - Developing targeted skill development initiatives - Creating clear career progression pathways 2. Technology-Driven Recruitment - Leveraging digital platforms for talent acquisition - Utilizing AI-powered matching tools - Expanding recruitment reach through modern networking techniques 3. Workplace Culture Transformation - Fostering inclusive and supportive work environments - Offering competitive compensation packages - Providing continuous learning opportunities By embracing these forward-thinking approaches, machine shops can effectively combat workforce shortages, build a robust talent pipeline, and position themselves for long-term success in an increasingly competitive manufacturing ecosystem. MORE...

Storage Giant Vetter Unleashes Massive Warehouse Expansion, Signals Major Logistics Breakthrough

Manufacturing

2025-03-17 14:30:00

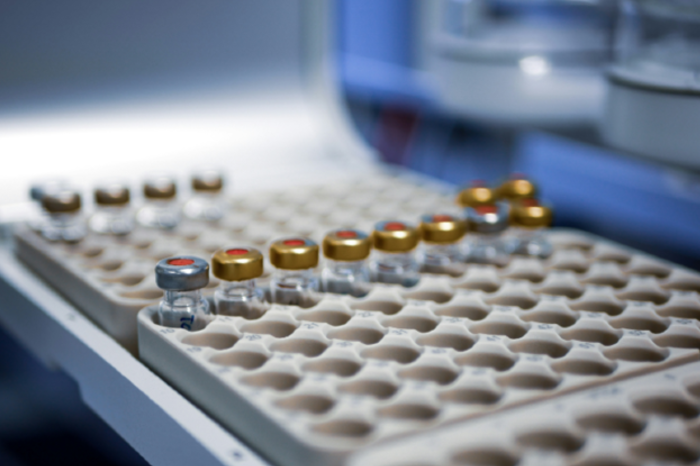

Vetter is taking a significant step forward in its strategic expansion, enhancing its pharmaceutical materials warehouse at its Ravensburg facility. The global Contract Development and Manufacturing Organisation (CDMO) is responding to growing market demands and positioning itself for continued organic growth. This strategic warehouse expansion demonstrates Vetter's commitment to meeting the evolving needs of the pharmaceutical industry. By increasing its storage and logistics capabilities, the company aims to provide more flexible and efficient support to its clients, ensuring rapid and reliable access to critical pharmaceutical materials. The investment underscores Vetter's proactive approach to scaling its operations and maintaining its competitive edge in the dynamic pharmaceutical manufacturing landscape. With this expansion, Vetter reinforces its reputation as a forward-thinking CDMO capable of adapting to market challenges and supporting the complex requirements of pharmaceutical development and production. MORE...

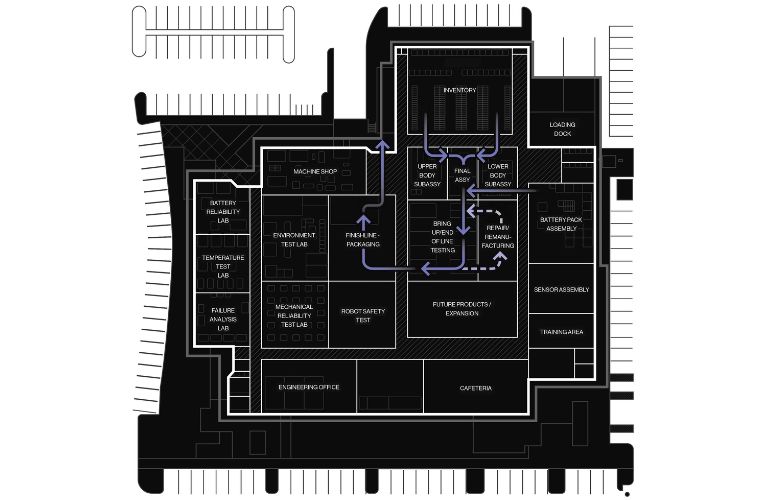

Powering Up America: The Battery Revolution Reshaping Industrial Might

Manufacturing

2025-03-17 14:00:59

At the recent Intersolar and Energy Storage North America conference, industry leaders unveiled critical strategies for boosting domestic battery production. The experts highlighted three pivotal factors driving the expansion of battery manufacturing in the United States: strategic collaboration, supportive policy frameworks, and intelligent site selection. By fostering robust partnerships between technology companies, manufacturers, and research institutions, the industry can accelerate innovation and scale up production capabilities. Simultaneously, proactive government policies that incentivize domestic battery manufacturing are creating a more competitive landscape for U.S. battery producers. Smart site selection emerges as another crucial element, with companies carefully evaluating locations that offer access to critical resources, skilled workforce, and favorable economic conditions. These comprehensive approaches are positioning the United States to become a global leader in battery technology and sustainable energy infrastructure. MORE...

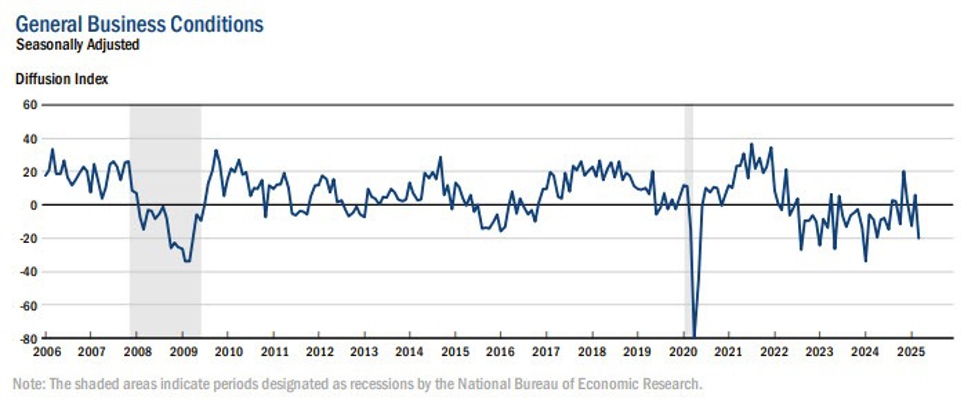

New York Manufacturing Hits Rough Patch: Confidence Wanes as Industry Struggles

Manufacturing

2025-03-17 13:30:29

New York's Manufacturing Sector Continues to Struggle in March The latest Empire State Manufacturing Survey, released by the Federal Reserve Bank of New York, reveals a challenging landscape for manufacturers in the state. The report indicates a continued contraction in manufacturing activity, signaling ongoing economic headwinds for the region's industrial sector. The survey's key findings highlight the persistent difficulties facing local manufacturers, who are grappling with complex market conditions and economic uncertainties. This downturn underscores the broader challenges confronting the manufacturing industry as businesses navigate a volatile economic environment. Manufacturers are closely watching these indicators, seeking insights into potential recovery strategies and market trends. The ongoing contraction suggests that businesses may need to adapt their operations and strategies to weather the current economic climate. MORE...

Machines with Minds: How Robots Are Reshaping Our Future

Manufacturing

2025-03-17 13:22:21

The pharmaceutical industry is undergoing a remarkable transformation, driven by the innovative power of robotics. From enhancing cybersecurity to revolutionizing decision-making processes, robotic technologies are fundamentally reshaping how pharmaceutical operations function. Modern robotics is not just about automation; it's about intelligent integration that elevates operational efficiency and precision. Advanced AI-powered systems are now capable of tackling complex challenges, streamlining traditionally mundane tasks with unprecedented skill and accuracy. Cutting-edge robotic solutions are enabling pharmaceutical companies to address critical areas such as data security, process optimization, and strategic decision-making. By leveraging sophisticated algorithms and machine learning capabilities, these technologies are creating smarter, more adaptive workflows that minimize human error and maximize productivity. The future of pharmaceutical operations is being written by these intelligent robotic systems, which promise to deliver unprecedented levels of performance, reliability, and innovation. As technology continues to evolve, we can expect robotics to play an increasingly central role in transforming how pharmaceutical organizations operate and deliver value. MORE...

Manufacturing Mayhem: How Tariffs and Economic Chaos Are Reshaping Industry Landscapes

Manufacturing

2025-03-17 13:00:00

Global Manufacturing Faces Perfect Storm of Economic Challenges In an increasingly complex global landscape, manufacturers are navigating a treacherous terrain marked by intensifying trade disputes, geopolitical tensions, and persistent supply chain vulnerabilities. These interconnected challenges are creating unprecedented pressures that are reshaping the industrial manufacturing sector. The current economic environment is characterized by a perfect storm of disruptions. Trade conflicts between major economic powers continue to escalate, creating uncertainty and volatility in international markets. Simultaneously, ongoing geopolitical tensions are forcing companies to reassess their global strategies and supply chain resilience. Supply chain disruptions, which emerged prominently during the global pandemic, have not fully stabilized. Manufacturers are now compelled to develop more adaptive and flexible production models that can withstand sudden global shifts and unexpected market interruptions. These multifaceted challenges are pushing companies to innovate, diversify their supply networks, and develop more robust risk management strategies. The ability to quickly adapt and respond to rapidly changing global conditions has become a critical competitive advantage in today's manufacturing landscape. MORE...

New York Manufacturing Takes a Steep Dive: Sharpest Contraction Since 2021

Manufacturing

2025-03-17 12:35:45

Empire State Manufacturing Index Plummets, Signaling Economic Challenges

The New York Empire State Manufacturing Index experienced a dramatic downturn in March 2025, dropping a substantial twenty-six points to reach -20.0. This significant decline marks the lowest reading since May 2023 and falls well short of market analysts' more optimistic projections of -0.75.

The report reveals a challenging landscape for manufacturers, with both new orders and shipments showing notable declines. Despite the overall negative sentiment, some stability emerged in other areas of the manufacturing sector. Delivery times and supply chain availability remained consistent, while inventory levels continued their gradual expansion.

The steep drop in the manufacturing index suggests potential headwinds for the regional economic outlook, raising questions about broader industrial performance and economic momentum. Investors and economists will likely be closely monitoring future indicators to assess the depth and potential duration of this manufacturing slowdown.

MORE...Manufacturing Mayhem: Empire State Index Plunges Deeper Than Expected in March Shock

Manufacturing

2025-03-17 12:31:08

New York's Manufacturing Sector Shows Resilience in March 2025 The Empire State Manufacturing Index delivered a surprising boost of optimism for the regional industrial landscape this month, revealing unexpected strength in economic activity. According to the latest report from the Federal Reserve Bank of New York, the index climbed to a robust 12.4 in March, significantly surpassing economists' initial projections. Key Highlights: • The index jumped from February's modest 6.7 to a more impressive 12.4 • New orders experienced a notable surge, indicating growing demand • Employment levels showed steady expansion • Business sentiment remains cautiously positive Economists interpret this uptick as a potential signal of manufacturing sector recovery, suggesting that regional industrial businesses are navigating current economic challenges with increasing confidence. The unexpected rise provides a glimmer of hope for New York's manufacturing ecosystem, which has been working to rebuild momentum in recent quarters. Manufacturers reported improved supply chain conditions and a gradual stabilization of input costs, contributing to the more optimistic outlook. While challenges remain, the March data points to a potentially brighter trajectory for the region's industrial sector. MORE...

Manufacturing Meltdown: NY Factory Sector Hits Steepest Decline in 12 Months

Manufacturing

2025-03-17 12:30:00

Manufacturing in New York state experienced a significant downturn in March, hitting its lowest point since the beginning of 2024. The decline comes alongside a notable uptick in pricing indicators, signaling potential economic shifts. Economists are closely watching these trends, which align with predictions of decelerating growth and accelerating inflation in the wake of new tariff implementations. The manufacturing sector's contraction reflects growing challenges for businesses, with price pressures mounting and economic momentum showing signs of cooling. This development provides a nuanced snapshot of the state's economic landscape, highlighting the complex interplay between production capabilities and market dynamics. Analysts suggest that the combination of reduced manufacturing activity and rising prices could be a harbinger of broader economic adjustments, potentially impacting both local industries and the wider economic ecosystem. MORE...

Breaking: Apple Amplifies India Manufacturing Push with AirPods Production Milestone

Manufacturing

2025-03-17 12:06:57

Apple is making significant strides in reshaping its global manufacturing landscape, with plans to expand AirPods production into India as early as April. This strategic move marks another important step in the company's ongoing efforts to diversify its supply chain and reduce its dependence on manufacturing in China. The tech giant is working closely with its assembly partners to establish local production capabilities in India, a country that has been increasingly attractive for international manufacturers seeking alternative production sites. By bringing AirPods manufacturing to India, Apple not only demonstrates its commitment to geographic diversification but also aligns with the Indian government's "Make in India" initiative. This development comes as part of Apple's broader strategy to mitigate supply chain risks and create more resilient manufacturing networks. The move is expected to provide greater flexibility in production, potentially reduce costs, and tap into India's growing market of tech-savvy consumers. As Apple continues to explore and expand its manufacturing footprint beyond traditional boundaries, the upcoming AirPods production in India represents a significant milestone in the company's global supply chain transformation. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238