Powering Progress: Inside America's Propane-Driven Manufacturing Revolution

Manufacturing

2025-04-26 13:00:00

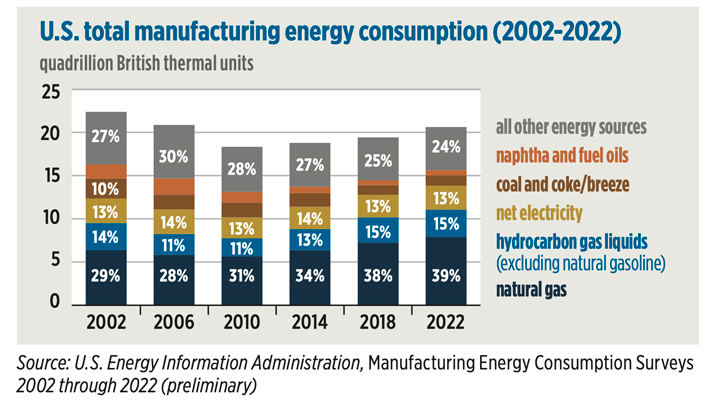

Recent data from the U.S. Energy Information Administration (EIA) reveals a promising trend in the manufacturing sector's energy consumption, signaling potential economic growth and industrial resilience. The latest report highlights a notable increase in energy usage across various manufacturing industries, reflecting renewed economic activity and technological advancements. Manufacturers are experiencing a surge in energy demand, driven by expanding production capabilities and a gradual recovery from recent economic challenges. The EIA's comprehensive analysis shows that energy consumption in manufacturing has risen significantly, indicating a robust comeback for industrial sectors that were previously impacted by global economic disruptions. Key factors contributing to this energy consumption increase include: • Technological upgrades in manufacturing processes • Increased production to meet growing market demands • Expansion of industrial capabilities • Renewed investment in manufacturing infrastructure The data suggests a positive outlook for the manufacturing sector, with energy consumption serving as a key indicator of economic vitality. As industries continue to modernize and expand, this trend points to potential job creation, economic growth, and increased industrial productivity. Experts view this rise in energy consumption as a promising sign of economic recovery and industrial strength, highlighting the manufacturing sector's critical role in driving national economic progress. MORE...

From Cupertino to Chennai: How Apple is Reshaping Global Manufacturing in India

Manufacturing

2025-04-26 11:43:00

In response to escalating geopolitical tensions between the United States and China, Apple is rapidly advancing its strategy to diversify iPhone manufacturing beyond Chinese borders. The tech giant is taking proactive steps to reduce its dependence on Chinese production facilities, signaling a significant shift in its global supply chain approach. Driven by complex diplomatic challenges and potential trade uncertainties, Apple is exploring alternative manufacturing locations that can provide similar efficiency and scale to its current Chinese operations. Countries like India and Vietnam are emerging as promising alternatives, offering attractive manufacturing ecosystems and potential cost advantages. This strategic realignment reflects Apple's commitment to mitigating potential risks associated with concentrated production in a single geographic region. By spreading its manufacturing footprint, the company aims to enhance supply chain resilience and maintain its competitive edge in the rapidly evolving global technology market. The move is not just a reactive measure but a calculated long-term strategy that demonstrates Apple's adaptability in an increasingly complex international business landscape. As geopolitical dynamics continue to evolve, the company's proactive approach positions it to navigate potential future disruptions with greater flexibility and strategic foresight. MORE...

Manufacturing Renaissance: How Trump's Economic Strategies Revitalize Tennessee's Industrial Landscape

Manufacturing

2025-04-26 11:00:41

Tennessee's Economic Landscape Transforms Under Trump-Era Trade Policies Tennessee is experiencing a remarkable economic renaissance, driven by strategic trade policies that are attracting manufacturers and spurring significant business expansion across the state. The Trump administration's approach to trade and tariffs has created a business-friendly environment that is drawing companies to invest in Tennessee's robust manufacturing sector. Manufacturers are increasingly recognizing Tennessee as a prime destination for new facilities and operational growth. The state's strategic positioning, combined with supportive federal trade policies, has made it an attractive hub for industrial development. Companies are not just exploring Tennessee; they are actively establishing and expanding their manufacturing footprints, bringing new jobs and economic vitality to local communities. The impact of these policies is tangible. Businesses are finding Tennessee's economic ecosystem increasingly compelling, with streamlined regulations and a focus on domestic manufacturing creating unprecedented opportunities. From automotive suppliers to advanced technology manufacturers, the state is witnessing a surge of corporate interest and investment. These developments signal a promising future for Tennessee's economy, with trade policies serving as a catalyst for sustained growth, job creation, and industrial innovation. The state stands as a compelling example of how targeted economic strategies can revitalize manufacturing and create meaningful economic opportunities. MORE...

Engines of Heritage: Oxford Revs Up to Commemorate Manufacturing Legacy on Drive It Day

Manufacturing

2025-04-26 04:00:00

Classic Car Lovers Unite: MINI Plant Cowley Hosts Spectacular Automotive Heritage Celebration Vintage car enthusiasts will have the opportunity to step back in time this Sunday at the iconic MINI Plant in Cowley, Oxford. The event promises to be a thrilling journey through the rich manufacturing history of the region, showcasing the evolution of automotive engineering and design. Visitors can expect a vibrant gathering that celebrates the legacy of Oxford's automotive industry, with an impressive display of classic vehicles that tell the story of local manufacturing prowess. The MINI Plant, a symbol of industrial innovation, will serve as the perfect backdrop for this nostalgic celebration. Car lovers and history buffs alike will be treated to a unique experience that honors the craftsmanship and technological advancements that have defined Oxford's automotive heritage. Don't miss this extraordinary opportunity to connect with the past and appreciate the mechanical marvels that have shaped the region's industrial landscape. MORE...

Retail Revolution: Walmart's Beauty Gambit, M&A Cooling, and the Manufacturing Transformation Reshaping America's Economy

Manufacturing

2025-04-26 04:00:00

Retail Roundup: Deals, Beauty, and Sustainable Manufacturing

In this week's exciting episode of the Modern Retail Podcast, industry experts dive deep into three compelling trends shaping the retail landscape. From the current slowdown in retail promotions to Walmart's strategic expansion in the beauty market, and the innovative world of circular manufacturing, listeners are in for an insightful journey.

The podcast explores the nuanced shifts in retail deal-making, highlighting how brands and retailers are adapting to changing consumer behaviors and economic conditions. Walmart's bold moves in the beauty sector take center stage, revealing the company's ambitious strategy to capture market share in this lucrative industry.

Perhaps most intriguingly, the discussion turns to circular manufacturing—a cutting-edge approach that promises to revolutionize how products are designed, produced, and recycled. This forward-thinking concept could be a game-changer for sustainability-conscious businesses and consumers alike.

Tune in to gain valuable insights into these transformative retail trends that are reshaping the industry's future.

MORE...Trade War Fallout: How Trump's Tariffs Are Crushing DMV Manufacturing

Manufacturing

2025-04-26 03:23:00

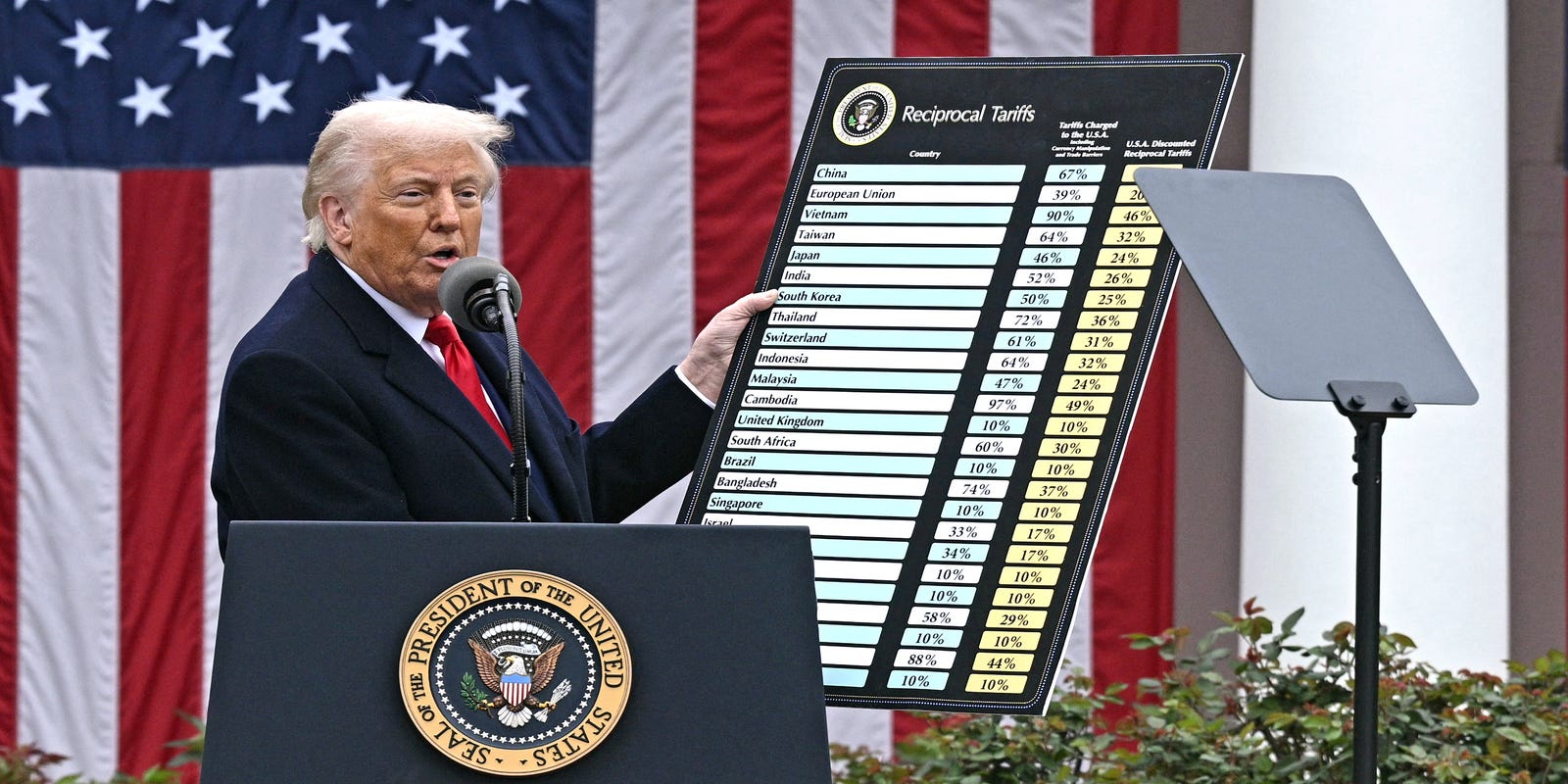

The ripple effects of the Trump administration's trade policies are sending shockwaves through American manufacturing, with companies like Man and Machine grappling with unprecedented economic challenges. As tariffs reshape the international trade landscape, small to medium-sized manufacturers are finding themselves caught in a complex web of increased production costs and strategic uncertainties. Man and Machine, a precision manufacturing firm, exemplifies the struggles faced by many businesses in this turbulent economic environment. The company now confronts significant hurdles as import taxes and trade restrictions dramatically escalate their operational expenses. These tariffs not only inflate the cost of raw materials but also complicate the intricate global supply chains that many manufacturers depend on for their survival. The broader implications extend far beyond a single company, highlighting the delicate balance of international trade and the potential long-term consequences of protectionist economic policies. Manufacturers are being forced to reimagine their strategies, exploring alternative sourcing options, and seeking innovative ways to maintain competitiveness in an increasingly volatile global market. MORE...

Manufacturing Mobilization: NJ Business Leaders Rally to Boost State's Industrial Backbone

Manufacturing

2025-04-26 01:59:58

Manufacturing in New Jersey has navigated a turbulent landscape in 2025, confronting a complex web of economic challenges that have tested the resilience of the state's industrial sector. The industry has been buffeted by a perfect storm of economic pressures, including escalating tariff complications, significant reductions in state funding for critical capital equipment, and shifting market dynamics that have kept manufacturers on edge. Industry leaders have been forced to adapt quickly, reimagining their strategies and exploring innovative approaches to maintain competitiveness in an increasingly unpredictable economic environment. The combination of financial constraints and external economic pressures has created a high-stakes scenario for New Jersey's manufacturing community, challenging them to find creative solutions and demonstrate remarkable adaptability in the face of mounting obstacles. As the year progresses, manufacturers continue to seek stable ground, carefully balancing cost management, technological innovation, and strategic investments to weather the current economic turbulence and position themselves for future growth. MORE...

Biotech Giant Amgen Pumps $900M into Ohio Expansion, Signaling Major Growth Strategy

Manufacturing

2025-04-25 22:40:33

Amgen, a global biotechnology leader, is set to make a groundbreaking investment in Ohio's life sciences landscape. The company has announced a massive $900 million expansion of its New Albany manufacturing facility, signaling a significant boost to the state's pharmaceutical manufacturing sector. This transformative project will not only enhance Amgen's production capabilities but also create 350 new high-skilled jobs in the region. The investment represents the largest life sciences and pharmaceutical manufacturing project in Ohio's history, underscoring the state's growing importance in the biotech industry. The expansion will significantly strengthen New Albany's position as a key hub for advanced biotechnology manufacturing. By investing in cutting-edge infrastructure and creating numerous employment opportunities, Amgen is demonstrating its commitment to driving economic growth and innovation in central Ohio. Local and state officials have praised the project, highlighting its potential to attract additional high-tech companies and talent to the area. The investment is expected to have a ripple effect on the local economy, supporting related industries and showcasing Ohio's competitive edge in the life sciences sector. MORE...

Wall Street Titan Ken Griffin Delivers Brutal Reality Check on Trump's Trade Promises

Manufacturing

2025-04-25 22:40:03

Ken Griffin, the influential founder of Citadel, is pushing back against the Trump administration's trade strategy, offering a nuanced critique of its approach to reviving American manufacturing. In a bold statement, Griffin argues that the current tariff-based policy is fundamentally misguided and unlikely to achieve its intended goals of job restoration. The financial leader suggests that instead of relying on protectionist trade measures, the United States should focus on leveraging its core economic strengths. Griffin believes that simply imposing tariffs won't magically resurrect manufacturing jobs, as the administration seems to hope. His perspective highlights the complexity of economic revitalization and calls for a more strategic, forward-thinking approach to industrial policy. By challenging the prevailing narrative, Griffin brings attention to the need for innovative economic strategies that align with the realities of a rapidly changing global marketplace. His critique underscores the importance of adaptability and playing to national competitive advantages rather than attempting to artificially preserve outdated economic models. MORE...

Manufacturing Boost: Mass. Receives $4M Injection to Fuel Local Industry Growth

Manufacturing

2025-04-25 22:33:57

Massachusetts is taking bold steps to bolster its manufacturing sector, with Governor Healey's administration and the Massachusetts Technology Collaborative's Center for Advanced Manufacturing (CAM) making a significant investment of nearly $3.8 million to support innovation and growth across 23 manufacturing companies. This substantial funding initiative aims to strengthen the state's industrial landscape, providing critical financial support to local manufacturers who are driving technological advancement and economic development. By strategically allocating resources, the administration demonstrates its commitment to maintaining Massachusetts' reputation as a hub of cutting-edge manufacturing and technological innovation. The grants will empower these 23 selected companies to enhance their capabilities, invest in new technologies, and potentially create additional job opportunities within the state's robust manufacturing ecosystem. This targeted approach underscores the government's proactive strategy to support local businesses and maintain Massachusetts' competitive edge in the rapidly evolving manufacturing industry. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238