Trade War Casualties: Who's Bleeding Red in Trump's Tariff Battlefield

Companies

2025-04-13 09:30:00

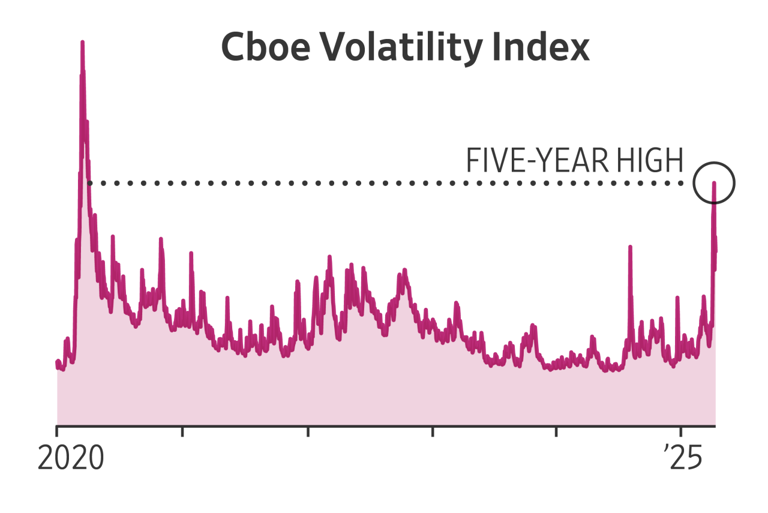

In a rollercoaster ride of financial markets, investors have witnessed unprecedented volatility across multiple asset classes over the past week and a half. Stocks, oil, and U.S. Treasury bonds have experienced dramatic price swings that have kept traders and analysts on the edge of their seats. The recent market turbulence reflects a complex interplay of global economic factors, geopolitical tensions, and shifting investor sentiment. From sudden market corrections to unexpected rallies, these ten days have demonstrated the unpredictable nature of financial markets in today's interconnected global economy. Dramatic price fluctuations have become the new normal, challenging traditional investment strategies and keeping market participants constantly alert. Whether you're a seasoned investor or a casual market observer, the recent market movements underscore the importance of adaptability and strategic thinking in navigating today's financial landscape. As uncertainty continues to ripple through global markets, investors are closely monitoring economic indicators, geopolitical developments, and potential policy shifts that could further impact asset prices in the coming weeks. MORE...

Squeezed Dry: How U.S. Firms Are Hitting a Wall in China's Supply Chain Pressure Cooker

Companies

2025-04-13 08:58:01

In the high-stakes chess game of international trade, American companies are desperately seeking relief from escalating tariff pressures by squeezing Chinese suppliers for price reductions. However, supply chain experts are sounding a stark warning: the well of potential cost savings has run dry. As trade tensions continue to simmer, U.S. businesses are finding themselves in an increasingly challenging position. Manufacturers and importers are attempting to negotiate lower prices from their Chinese counterparts, hoping to offset the financial burden of punishing tariffs. Yet, the reality on the ground tells a different story. Supply chain specialists argue that Chinese suppliers have already been operating on razor-thin margins, having absorbed previous rounds of tariffs through aggressive cost-cutting and efficiency improvements. With little to no room for further price reductions, companies are confronting a harsh economic reality. The result is a complex economic standoff where neither side can easily give ground. U.S. firms are caught between rising costs and the need to maintain competitive pricing, while Chinese suppliers are struggling to preserve their already minimal profit margins. As the trade war continues to evolve, businesses are being forced to explore alternative strategies, including diversifying supply chains, relocating manufacturing, or accepting higher consumer prices – each option fraught with its own set of challenges and potential consequences. MORE...

Tax Loophole Bonanza: How Oil Giants Are Slashing Billions from Their Tax Bills in the North Sea

Companies

2025-04-13 04:00:21

Strategic Corporate Transformations: Tax Loss Utilization Drives Merger Trends In a series of recent high-stakes corporate maneuvers, companies are leveraging strategic mergers to optimize their financial positioning. Operators burdened with substantial tax losses are finding innovative solutions by combining forces with profitable rivals, effectively transforming potential financial challenges into strategic opportunities. These carefully orchestrated mergers represent a sophisticated approach to corporate restructuring, where companies with significant tax loss carryforwards strategically align with businesses boasting robust asset portfolios. By joining forces, these organizations can offset tax liabilities, unlock hidden value, and create more resilient corporate structures. The trend highlights the complex financial engineering increasingly employed in today's competitive business landscape, where smart consolidation can turn potential financial limitations into powerful strategic advantages. Such mergers not only provide immediate tax benefits but also create pathways for long-term growth and operational synergy. MORE...

Navigating Potential: Is Mermaid Maritime Charting a Course to Investment Success?

Companies

2025-04-13 01:44:49

Navigating the Investment Landscape: Beyond the Compelling Narrative In the dynamic world of investing, many newcomers fall into a common trap: becoming captivated by an enticing corporate story and rushing to invest without deeper analysis. While a compelling narrative can be seductive, successful investors understand that a great story alone is not a guarantee of financial success. Experienced investors know that behind every attractive company pitch lies a complex web of financial metrics, market conditions, and strategic performance. The most prudent approach involves looking beyond the surface-level storytelling and conducting thorough due diligence. Key considerations should include: • Comprehensive financial health • Sustainable business model • Competitive market positioning • Management team's track record • Long-term growth potential By moving past the initial allure of a persuasive corporate narrative and diving into substantive research, investors can make more informed decisions that align with their financial goals and risk tolerance. Remember, in the investment world, substance trumps style every time. MORE...

Trade War Tremors: How Trump's China Tariffs Are Shaking Up Corporate America

Companies

2025-04-12 22:36:32

As the trade tensions between the United States and China continue to intensify, President Trump's aggressive tariff strategy is sending shockwaves through the global economic landscape. These escalating trade barriers are not just numbers on a spreadsheet—they're fundamentally transforming international supply chains and dramatically impacting consumer prices across multiple industries. The ongoing tariff war is creating a ripple effect that reaches far beyond simple import-export transactions. Businesses are being forced to rethink their manufacturing strategies, with many companies rapidly exploring alternative sourcing options and relocating production to mitigate potential economic risks. Consumers are simultaneously experiencing the direct consequences, witnessing price fluctuations and increased costs for everyday goods. What makes this economic standoff particularly complex is its unpredictability. Each new tariff announcement introduces additional uncertainty, challenging businesses to adapt quickly and strategically. The intricate dance of international trade has become a high-stakes game of economic chess, with both nations maneuvering to protect their economic interests while navigating the potential long-term consequences of their actions. As the situation continues to evolve, economists and industry experts are closely monitoring how these trade tensions will reshape global economic dynamics in the months and years to come. MORE...

Green Dilemma: How Big Oil is Racing to Clean Up Its Carbon Footprint

Companies

2025-04-12 21:00:00

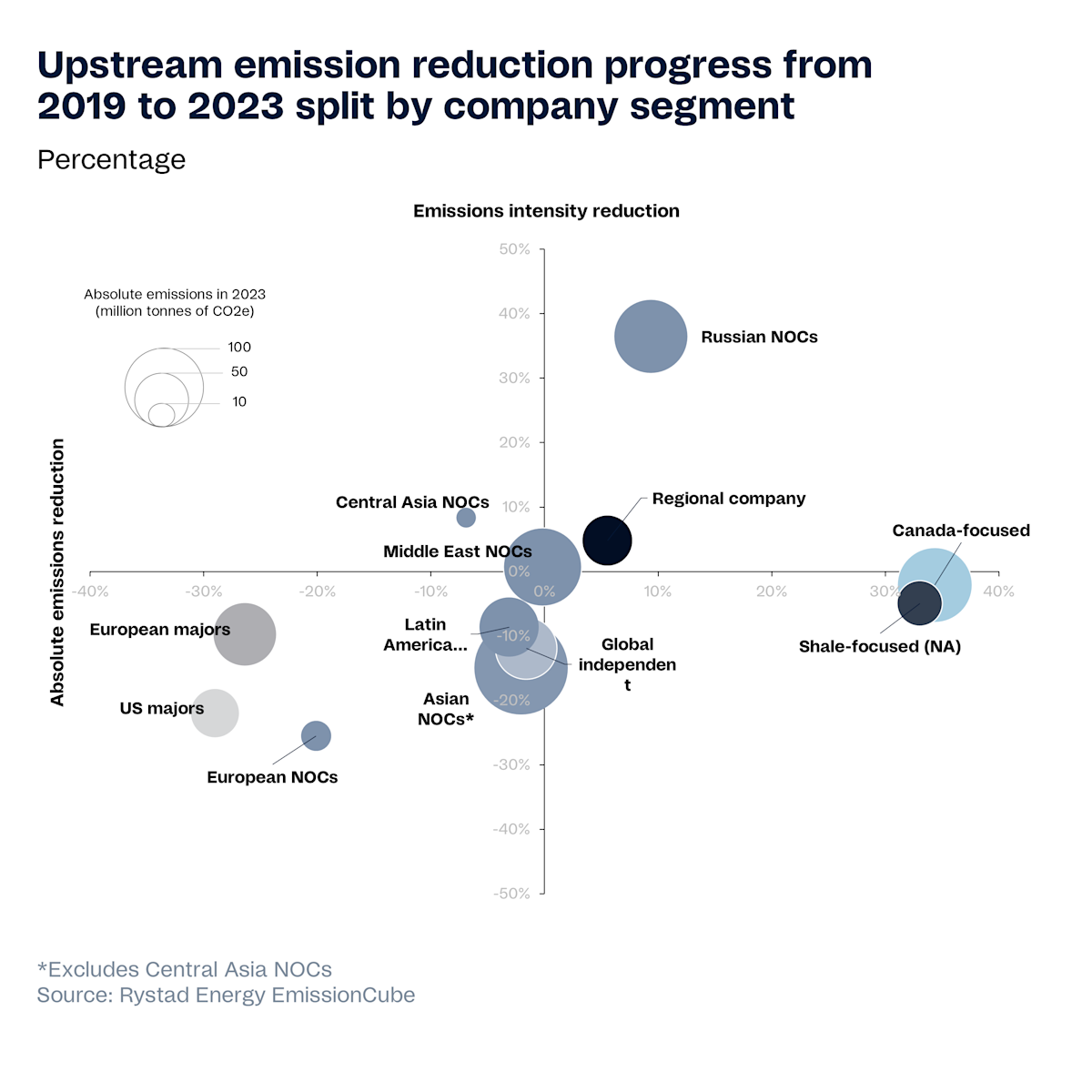

As the global energy landscape evolves, oil and gas companies are increasingly setting critical emission reduction milestones, with 2025 emerging as a pivotal year for interim climate targets. However, the industry faces a significant challenge: the lack of uniform standards for measuring and verifying these ambitious environmental commitments. While many companies are stepping up their sustainability efforts, the approaches to tracking and reporting emissions reductions remain inconsistent, creating a complex landscape of environmental accountability. MORE...

SEC's New Chief Paul Atkins Faces Pressure Cooker Debut

Companies

2025-04-12 20:15:56

As Paul Atkins prepared to face the Senate for his confirmation hearing to become the new chairman of the Securities and Exchange Commission (SEC) during the Trump administration, a critical question loomed large. The potential appointment was set to be a pivotal moment in the regulatory landscape, with Atkins poised to potentially reshape the agency's approach to financial oversight. The confirmation process promised to be a rigorous examination of Atkins' qualifications, vision, and potential impact on the SEC's future direction. Senators were ready to probe deeply into his background, philosophy on financial regulation, and his plans for leading one of the most important financial watchdog agencies in the United States. With the stakes high and the financial world watching closely, Atkins stood at the threshold of a potentially transformative role in overseeing market regulations, investor protection, and corporate accountability. The hearing would be a crucial test of his ability to navigate the complex and often contentious world of financial regulation. MORE...

Digital Showdown: How Copyright Laws Are Putting AI Training Data on Trial

Companies

2025-04-12 18:46:21

Court Delivers Blow to AI Art Copyright Claim

In a landmark decision that could reshape the landscape of artificial intelligence and intellectual property, a federal appeals court has dealt a significant setback to an artist seeking copyright protection for artwork generated by AI technology.

The ruling highlights the ongoing legal complexities surrounding creative works produced by artificial intelligence, raising critical questions about authorship, originality, and the boundaries of copyright law in the digital age.

This case represents a pivotal moment in the ongoing debate about the legal status of AI-generated creative content, signaling potential challenges for creators and technologists who are pushing the boundaries of machine-driven artistic expression.

The court's decision underscores the current legal perspective that AI-generated artwork may not meet the traditional threshold for copyright protection, which typically requires human creativity and originality.

Note: The views expressed in this article are those of the author and do not necessarily reflect the position of this publication. Readers are encouraged to share their perspectives through letters to the editor.

MORE...Flood of Fury: How Corporate Negligence Drowned Florida's Hope Two Years After Historic Deluge

Companies

2025-04-12 16:00:00

In a recent legal challenge, companies are facing accusations of negligence during infrastructure upgrades. The lawsuit alleges that these organizations failed to implement proper temporary drainage systems during construction projects, potentially exposing local communities to significant environmental and safety risks. The legal complaint highlights a critical oversight in urban development practices, where contractors reportedly neglected essential drainage management protocols. By not establishing adequate temporary drainage solutions, these companies may have compromised water flow management, risking potential flooding, property damage, and environmental disruption. Plaintiffs argue that the absence of proper drainage systems represents a serious breach of professional standards and municipal regulations. The lawsuit seeks to hold these companies accountable for their apparent disregard of essential infrastructure maintenance and public safety considerations during upgrade operations. As the legal proceedings unfold, the case underscores the importance of comprehensive planning and responsible infrastructure development, emphasizing the need for rigorous drainage management throughout construction projects. MORE...

Political Endorsements: The Corporate Minefield That Could Sink Your Brand's Reputation

Companies

2025-04-12 15:11:05

When Companies Take Political Stands: Navigating the High-Stakes World of Corporate Endorsements In today's hyper-connected political landscape, corporate endorsements of political candidates can be a double-edged sword. While companies might believe they're making a principled statement, the potential backlash can be swift and severe. Consumers are increasingly vocal about their expectations for corporate social responsibility, and a misaligned political endorsement can quickly transform brand loyalty into public criticism. The risks are multifaceted. A politically charged endorsement can alienate a significant portion of a company's customer base, potentially leading to boycotts, social media campaigns, and long-lasting reputation damage. What might seem like a strategic alignment with a particular candidate or ideology can rapidly unravel, exposing the organization to financial and public relations challenges. Moreover, in an era of intense political polarization, companies walk a razor-thin line. Customers from diverse political backgrounds are watching closely, ready to voice their disapproval through purchasing decisions. The potential loss of market share and customer trust can far outweigh any perceived benefits of a public political stance. Smart organizations recognize that maintaining neutrality or focusing on core business values often provides a more stable path. By prioritizing inclusive messaging and demonstrating commitment to broader societal goals, companies can avoid the potential pitfalls of direct political endorsements while still engaging meaningfully with their stakeholders. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293