Climate Showdown: Hawaii Takes Fossil Fuel Giants to Court in Landmark Legal Battle

Companies

2025-04-28 21:04:08

In the wake of the devastating Maui wildfires that decimated Lahaina, Hawaii Governor Josh Green is setting his sights on a new target: fossil fuel companies. As the community grapples with unprecedented destruction and loss, Green is exploring legal avenues to hold these corporations accountable for their potential role in climate change and its catastrophic consequences. The governor is signaling a bold approach to seeking justice and financial recovery for the community, suggesting that fossil fuel companies should contribute to the massive rebuilding efforts and compensate victims of the tragic wildfire. By turning his attention to these powerful corporations, Green aims to not only support Lahaina's recovery but also send a powerful message about corporate responsibility in the face of climate-related disasters. This strategic move comes as Lahaina continues to mourn its losses and begin the challenging process of reconstruction, with Green positioning the state to potentially pursue legal action that could provide critical financial resources for the community's healing and rebuilding. MORE...

Rogue Limo Services: Defying Regulations and Dodging Legal Warnings

Companies

2025-04-28 20:48:14

In a bold move to crack down on regulatory violations, state authorities have issued cease and desist letters to two dozen companies in 2024. Despite the official warnings, many of these businesses continue to operate with apparent disregard for the legal directives. The widespread non-compliance has raised eyebrows among regulators, who are now considering more stringent enforcement measures. These cease and desist letters, typically a serious signal of potential legal action, seem to have had little immediate impact on the targeted companies' operations. State officials are closely monitoring the situation, weighing their next steps to ensure businesses adhere to established regulations. The ongoing defiance suggests a potential escalation of regulatory tensions in the coming months, with the possibility of more severe penalties looming for those who fail to heed the initial warnings. MORE...

AI Revolution: How Appian Is Transforming Business Workflows Overnight

Companies

2025-04-28 20:30:00

At The Process Company, Appian champions a transformative vision: exceptional business performance is fundamentally driven by optimized processes. We believe that artificial intelligence represents a powerful catalyst for organizational excellence, but only when strategically integrated within existing workflow frameworks. Our approach goes beyond simply implementing AI technologies. We focus on creating intelligent process ecosystems where AI enhances human capabilities, streamlines operations, and unlocks unprecedented levels of efficiency. By embedding AI seamlessly into core business processes, organizations can achieve more dynamic, responsive, and intelligent workflows. We understand that true digital transformation isn't about replacing human expertise, but augmenting it. Our solutions are designed to empower teams, providing them with advanced tools that amplify their decision-making capabilities and drive meaningful business outcomes. With Appian, AI becomes a collaborative partner, not just a technological add-on. Our commitment is to help businesses reimagine their potential by leveraging AI-enhanced processes that are adaptive, scalable, and aligned with strategic objectives. We don't just offer technology; we provide a pathway to smarter, more agile business performance. MORE...

Breaking: Pulse of Innovation - PFA Technology Revolutionizes Heart Rhythm Landscape at 2025 Conference

Companies

2025-04-28 20:13:36

Pulse Field Ablation (PFA) Technologies Take Center Stage at Heart Rhythm 2025 The annual Heart Rhythm Society conference became a hotbed of innovation this year, with Pulse Field Ablation (PFA) emerging as the most talked-about breakthrough in cardiac treatment. Leading medical technology giants including Medtronic, Johnson & Johnson MedTech, Boston Scientific, Abbott, Kardium, and Field Medical converged to showcase groundbreaking research and clinical data. Each company presented compelling evidence demonstrating the remarkable safety and unprecedented effectiveness of their advanced PFA technologies. The presentations highlighted significant advancements in treating cardiac arrhythmias, signaling a potential paradigm shift in electrophysiology interventions. Researchers and clinicians were particularly excited about the nuanced improvements in PFA techniques, which promise more precise, less invasive treatment options for patients with complex heart rhythm disorders. The conference underscored the rapid evolution of this transformative medical technology and its potential to revolutionize cardiac care in the coming years. MORE...

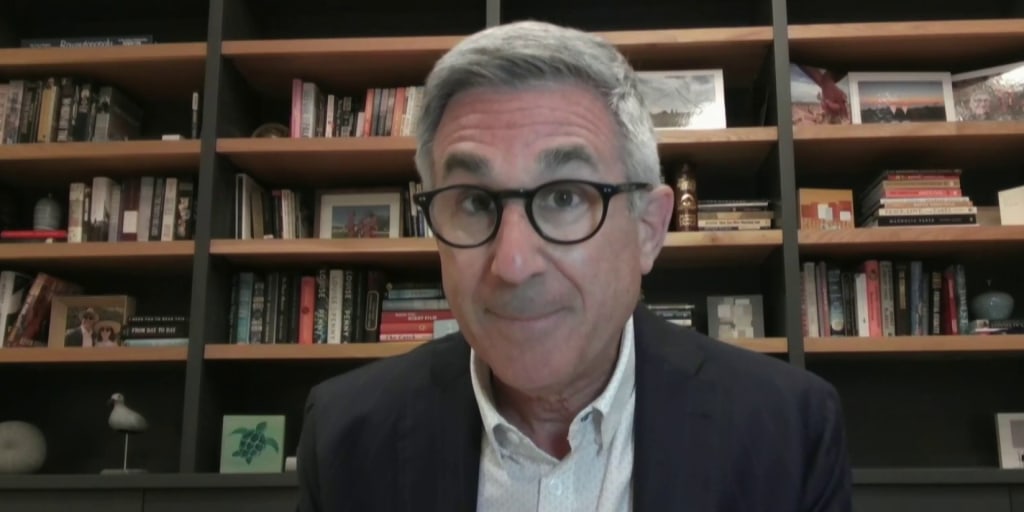

Texting Watchdogs: U.S. Attorney Pushes Telecom Giants to Combat Online Predators

Companies

2025-04-28 20:03:20

In a bold move that signals a potential shift in digital accountability, the newly appointed interim U.S. attorney is setting his sights on tech companies, proposing legal action to compel the development of more robust content-monitoring algorithms. This aggressive stance aims to address growing concerns about online safety, misinformation, and harmful digital content. The attorney's strategy involves using legal pressure to push technology firms into creating more sophisticated screening mechanisms that can proactively identify and filter problematic content. By leveraging the power of litigation, he hopes to drive innovation in digital content moderation and establish stronger protective measures across online platforms. This approach represents a significant escalation in the ongoing debate about tech companies' responsibilities in managing digital content, suggesting a potential new era of regulatory enforcement and technological accountability. MORE...

Tech Training Scandal: Ohio Funnels $1M to Phantom Companies in Shocking Fraud Expose

Companies

2025-04-28 19:25:17

In a strategic move to bridge the tech skills gap, the government is investing $25 million in workforce development. This substantial funding aims to empower local companies by providing financial support for employee training programs in cutting-edge technological skills. The initiative represents a forward-thinking approach to addressing the growing demand for tech talent across various industries. By offering companies direct financial incentives, the program seeks to transform workforce capabilities and create more opportunities for professional growth in the rapidly evolving digital landscape. Businesses can now leverage this significant investment to upskill their workforce, ensuring their employees remain competitive in an increasingly technology-driven job market. The funding will enable companies to develop comprehensive training programs that equip workers with the latest technical competencies, from coding and data analysis to cybersecurity and cloud computing. This innovative approach not only benefits individual employees by enhancing their career prospects but also strengthens local businesses by building a more skilled and adaptable workforce. As technology continues to reshape industries, this investment represents a critical step in preparing workers for the jobs of tomorrow. MORE...

Strategic Expansion: CIECA Welcomes Five Powerhouse Companies to Leadership Board

Companies

2025-04-28 19:13:45

In response to its remarkable membership growth, CIECA has strategically expanded its board of trustees, signaling the organization's continued momentum and increasing influence in the industry. The decision to add more board seats reflects the dynamic expansion and evolving leadership needs of the organization, ensuring broader representation and deeper expertise at the governance level. This expansion demonstrates CIECA's commitment to adapting to its growing community and maintaining a robust, diverse leadership structure that can effectively guide the organization's future strategic directions. By welcoming new board members, CIECA is positioning itself to better serve its expanding membership and address emerging challenges and opportunities in its sector. MORE...

Behind the Accolades: Sheldon Arora's Corporate Facade Crumbles Under Employee Testimonies

Companies

2025-04-28 19:13:31

Inside the Toxic Workplace: A Disturbing Portrait of Harassment and Fear

In a groundbreaking investigation spanning nearly a year, D CEO has uncovered a deeply troubling narrative of workplace misconduct that exposes the dark underbelly of corporate culture. Employees from multiple departments have come forward with harrowing accounts of systematic harassment, retaliation, and a pervasive atmosphere of intimidation.

The investigation reveals a workplace environment where fear is the dominant emotion, and speaking out against inappropriate behavior can lead to professional and personal consequences. Workers describe a culture that silences dissent, punishes those who challenge the status quo, and protects perpetrators of misconduct.

Key findings include:

- Widespread patterns of verbal and psychological harassment

- Systematic retaliation against employees who report misconduct

- A management structure that actively suppresses internal complaints

- Persistent power dynamics that enable toxic behavior

These revelations not only shed light on the organization's internal struggles but also raise critical questions about workplace ethics, accountability, and the fundamental rights of employees to work in a safe and respectful environment.

As the investigation continues, the stories of these courageous workers serve as a powerful reminder of the urgent need for meaningful cultural transformation in corporate settings.

MORE...Shocking Settlement: Local Electrical Firm Coughs Up $1.46 Million in PPP Loan Scandal

Companies

2025-04-28 18:28:20

In a significant legal dispute, the United States government has accused Slifco Electric of financial misconduct. The core of the allegation centers on the company's failure to transparently report personal expense payments made to its owner during a critical loan forgiveness period. This revelation suggests potential impropriety in how the company managed its financial disclosures and utilized loan forgiveness provisions. The accusation highlights potential violations of loan terms and raises questions about the company's financial integrity. By allegedly concealing payments to its owner, Slifco Electric may have breached the trust and transparency expected in loan forgiveness programs. The government's contention underscores the importance of accurate and complete financial reporting for businesses seeking loan relief. This case serves as a stark reminder to businesses about the critical need for full disclosure and ethical financial practices when participating in government-supported loan programs. MORE...

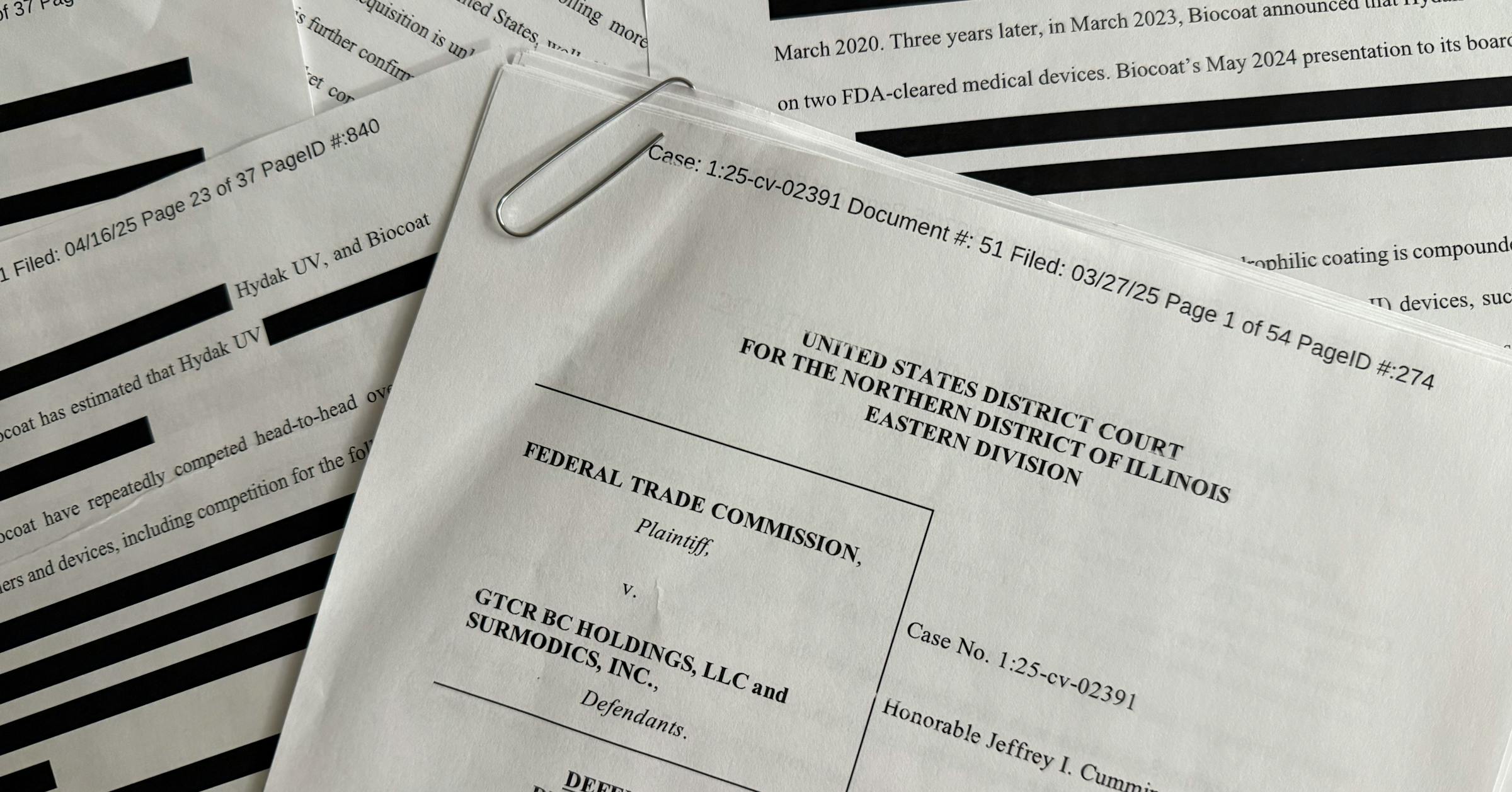

Regulatory Radar: Surmodics Navigates Choppy FTC Waters in Minnesota Showdown

Companies

2025-04-28 17:55:00

The legal landscape of private equity is set to face intense scrutiny as a landmark case emerges in the wake of heightened regulatory attention during the Biden administration. This closely watched legal battle highlights the growing focus on corporate actions within the private equity sector, signaling a potential shift in how such transactions are examined and regulated. During the previous administration, the Federal Trade Commission (FTC) increasingly turned its investigative lens toward private equity-related corporate maneuvers, creating a more challenging environment for investment firms. Now, this upcoming case promises to test the boundaries of regulatory oversight and potentially set new precedents for how private equity transactions are evaluated. The case represents a critical moment for both regulators and private equity firms, as it could reshape the understanding of corporate governance, market competition, and the complex interactions between investment strategies and regulatory frameworks. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293