Defying the Odds: Corporate America's Diversity Commitment Stands Strong

Companies

2025-04-05 01:39:49

DEI Commitment: Companies Holding Strong Amid Industry Shifts

While many corporations are scaling back diversity, equity, and inclusion (DEI) efforts, a notable group of forward-thinking companies remains steadfast in their commitment to creating more inclusive workplaces. These organizations understand that diversity isn't just a trend, but a critical strategy for innovation, employee engagement, and long-term success.

Despite recent pullbacks in DEI initiatives across corporate America, these companies are demonstrating that genuine commitment to workplace diversity goes beyond temporary corporate mandates. They recognize that building an inclusive environment is not just about meeting quotas, but about fostering genuine understanding, respect, and opportunity for all employees.

By maintaining their DEI programs, these organizations are sending a powerful message: workplace diversity is not a optional add-on, but a fundamental aspect of modern business strategy. They are investing in creating environments where talent from all backgrounds can thrive, innovate, and contribute meaningfully.

As the corporate landscape continues to evolve, these companies are proving that a genuine commitment to diversity and inclusion can be a significant competitive advantage in attracting top talent and driving organizational excellence.

MORE...Innovators Unveiled: The Secrets Behind Breakthrough Business Transformations

Companies

2025-04-05 01:26:00

The Promise and Pitfall of Food Innovation: Why Meal Kits and Plant-Based Meats Failed to Deliver Investors once saw immense potential in the culinary revolution of meal kits and plant-based proteins. The vision was tantalizing: convenient, sustainable food solutions that would transform how we eat. Yet, despite the initial excitement and bold predictions, these innovative food ventures have largely fallen short of financial success. What happened to the dream of reinventing our dining experience? The answer lies in a complex mix of consumer behavior, market dynamics, and the challenging economics of food technology. While the concepts were compelling—offering convenience, health-consciousness, and environmental sustainability—the execution proved far more difficult than anticipated. Meal kit services promised to simplify cooking, delivering pre-portioned ingredients and recipes directly to consumers' doors. Plant-based meat alternatives aimed to provide a sustainable protein option that could appeal to environmentally conscious and health-minded consumers. Investors poured millions into these concepts, believing they represented the future of food. However, reality painted a different picture. High prices, logistical challenges, and changing consumer preferences created significant barriers. What seemed revolutionary quickly became just another niche market struggling to achieve mainstream adoption and profitability. The lesson is clear: innovative ideas require more than just good intentions. They need scalable business models, competitive pricing, and a deep understanding of consumer needs to truly succeed in the competitive world of food technology. MORE...

Colorado's Public Companies Rocked: $43.7 Billion Market Value Evaporates in Single Trading Day

Companies

2025-04-05 00:48:59

Colorado's financial landscape continued to experience a sharp downturn, with natural resource companies bearing the brunt of investor panic. Following a tumultuous Friday, the stock market saw another day of significant value erosion, as investors rapidly divested their holdings and sought safer investment havens. The exodus was particularly brutal for sectors tied to natural resources, which saw dramatic declines in market capitalization and investor confidence. The ongoing sell-off reflects growing market uncertainty, with investors demonstrating a clear preference for moving away from volatile sectors and protecting their financial positions. Natural resource companies found themselves at the epicenter of this financial tremor, experiencing substantial losses as market sentiment shifted dramatically. MORE...

Tariff Tango: How US Fashion Brands Are Hunting for Deals in India's Garment Market

Companies

2025-04-05 00:00:00

In a complex trade landscape, US garment retailers are pressing Indian apparel manufacturers to mitigate the financial impact of President Trump's recent tariff policies. Despite the current 26% tariff on Indian products—which is comparatively lower than rates imposed on Vietnam, Bangladesh, Cambodia, and Pakistan—American buyers are seeking relief through strategic negotiations. Indian manufacturers are responding with a nuanced approach, proposing a potential 5% discount while simultaneously exploring government support to modernize and expand their manufacturing capabilities. This strategy aims to enhance their global competitiveness and maintain their attractiveness in the international textile market. By seeking targeted government subsidies and investing in factory upgrades, Indian manufacturers hope to offset the tariff challenges and position themselves as a more cost-effective and technologically advanced sourcing destination. The ongoing dialogue reflects the intricate dynamics of international trade and the collaborative efforts required to navigate economic uncertainties. MORE...

Cancer Lawsuit Shield Crumbles: Iowa House Blocks Pesticide Industry Protection

Companies

2025-04-04 23:19:44

House Speaker Pat Grassley acknowledges that his fellow lawmakers are increasingly worried about how the public is perceiving the proposed legislation. The concerns stem from potential misunderstandings or negative public sentiment surrounding the bill's key provisions, prompting internal discussions about communication and transparency. MORE...

Digital Disruption: The Hidden Trade War Squeezing Online Retailers

Companies

2025-04-04 23:02:57

In a stark shift of market dynamics, tech-driven businesses across e-commerce and financial technology sectors are strategically reassessing their growth trajectories. Facing mounting economic uncertainties, these companies are now scaling back their ambitious public offering plans and preparing for potential challenging market conditions. Payment processors and online marketplace platforms are taking a cautious approach, recognizing the need to conserve resources and maintain financial resilience. The once-bullish sentiment of rapid expansion has given way to a more measured and strategic outlook, with leadership teams prioritizing stability over aggressive growth. This pullback signals a broader trend of market recalibration, where companies are proactively adapting to a more complex and unpredictable economic landscape. By tempering expectations and fortifying their financial foundations, these businesses aim to weather potential economic headwinds and emerge stronger in an increasingly competitive digital marketplace. MORE...

Medical Misconduct: Local Physician Implicated in Massive Healthcare Fraud Scheme

Companies

2025-04-04 22:54:47

In a shocking case of medical fraud, a prominent Kansas City physician has pleaded guilty to orchestrating a complex kickback scheme that exploited the healthcare system for personal financial gain. The medical doctor from the Kansas City, Kansas metropolitan area has admitted to accepting substantial illegal payments in exchange for ordering unnecessary medical treatments and procedures. Federal prosecutors revealed that the doctor systematically accepted hundreds of thousands of dollars in illicit kickbacks, deliberately recommending medical interventions that served no legitimate clinical purpose. This calculated scheme not only represents a severe breach of medical ethics but also potentially endangered patient health while fraudulently draining healthcare resources. The guilty plea marks a significant moment in holding medical professionals accountable for corrupt practices that undermine the integrity of patient care. By accepting illegal financial incentives, the physician betrayed the fundamental trust placed in medical practitioners to prioritize patient well-being over personal profit. As the legal proceedings continue, this case serves as a stark reminder of the ongoing challenges in maintaining ethical standards within the healthcare industry and the critical importance of rigorous oversight to protect patients and prevent systemic abuse. MORE...

Local Businesses Unite: Jonesboro Firms Lead Community Cleanup Crusade

Companies

2025-04-04 22:51:53

In the wake of Wednesday night's devastating storms, local businesses are stepping up to support their community. PF Plumbing and PF Services have emerged as shining examples of corporate compassion, generously donating their time and resources to aid in the critical cleanup efforts. These hometown heroes are demonstrating the true spirit of community resilience, offering their expertise and manpower to help residents recover from the severe weather damage. Their selfless commitment showcases the power of local businesses coming together during challenging times, providing hope and practical assistance to those most affected by the storm. MORE...

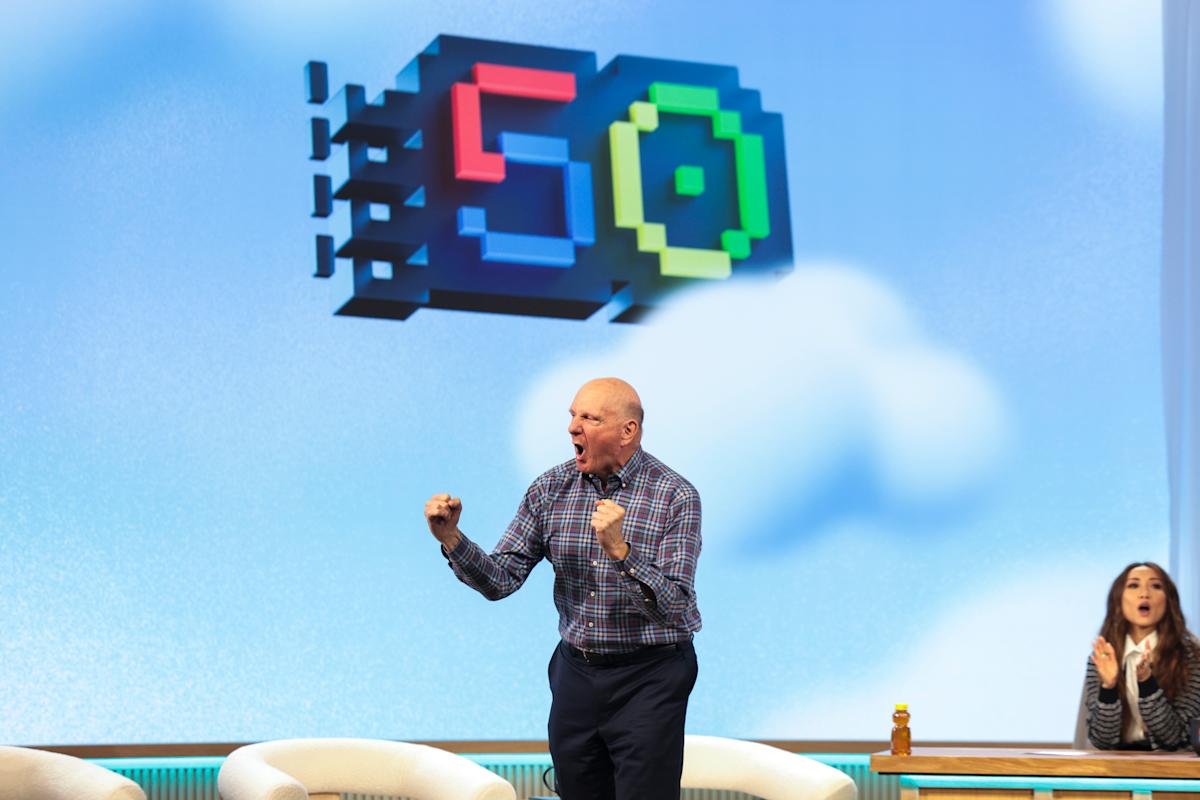

Tech Titan's Bold Advice: Ballmer Urges Firms to Double Down Despite Trade War Tensions

Companies

2025-04-04 22:36:22

In a bold statement that challenges conventional wisdom during economic uncertainty, former Microsoft CEO Steve Ballmer is urging companies to maintain their investment strategies even when markets become turbulent. Ballmer's perspective emphasizes the critical importance of continued strategic investment as a key to long-term success and resilience. Drawing from his extensive leadership experience at one of the world's most prominent technology companies, Ballmer argues that economic volatility should not deter businesses from making strategic investments. Instead, he suggests that challenging market conditions can actually present unique opportunities for forward-thinking organizations to gain competitive advantages. By recommending persistent investment during difficult times, Ballmer highlights the potential for companies to position themselves strategically, potentially emerging stronger when market conditions stabilize. His insights underscore the importance of maintaining a long-term vision and not succumbing to short-term market pressures. For business leaders and executives, Ballmer's advice serves as a powerful reminder that innovation and strategic investment should not be paused simply because of temporary economic challenges. His message resonates as a call for resilience, adaptability, and unwavering commitment to growth, even in the face of uncertainty. MORE...

Border Business Bombshell: How Trade Tariffs Could Reshape Logistics Landscape

Companies

2025-04-04 22:30:52

As President Trump's latest tariff policy takes effect, the ripple effects are being felt most acutely by logistics companies operating along the U.S.-Mexico border. These businesses are on the front lines of a complex trade landscape, experiencing firsthand the immediate and nuanced impacts of reciprocal import tariffs. The new trade measures promise to reshape cross-border commerce, creating both challenges and uncertainties for companies that have long relied on seamless economic exchange between the two nations. Logistics firms, with their intricate networks and deep understanding of international trade dynamics, are uniquely positioned to gauge the potential disruptions and adaptations required in this evolving economic environment. From transportation routes to supply chain strategies, these border-area businesses are recalibrating their operations to navigate the new tariff terrain. Their insights offer a critical window into how trade policies translate into real-world economic consequences, highlighting the delicate balance of international economic relationships. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293