The Office Dilemma: Why Remote-First Companies Are Rewriting the Workplace Rulebook

Companies

2025-04-26 19:19:25

Corporate leaders are facing a critical revelation that challenges traditional workplace assumptions. The real issue isn't about remote, hybrid, or in-office work—it's about fundamentally rethinking how success is measured and defined. This insight suggests that leadership must move beyond outdated metrics and rigid performance frameworks. Instead of fixating on physical location, organizations need to focus on creating clear, meaningful goals that empower employees to deliver exceptional results, regardless of where they work. The emerging perspective challenges long-held beliefs about productivity and workplace dynamics. It demands a more nuanced, flexible approach that prioritizes outcomes over arbitrary measures of time spent in a specific location. By reimagining success through a lens of performance and impact, companies can unlock greater potential and adaptability in an increasingly dynamic work environment. MORE...

Corporate Promises Unraveled: Trust Erodes as Giants Go Silent on Commitments

Companies

2025-04-26 17:30:00

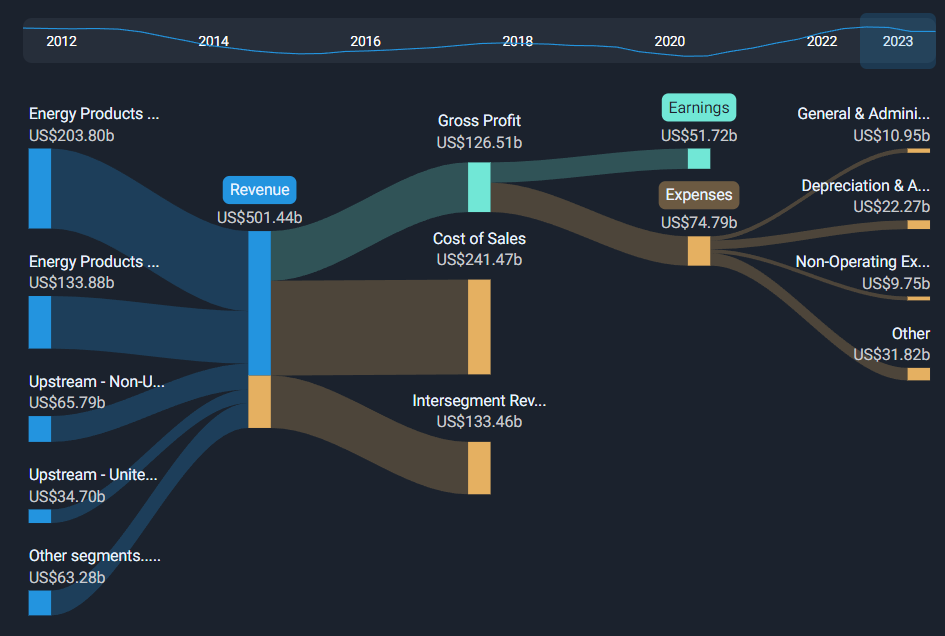

In a move sparking widespread controversy, major oil and gas corporations are facing intense scrutiny for their latest strategic pivot. These energy giants are doubling down on fossil fuel investments while simultaneously scaling back their previously touted commitments to renewable energy technologies. The shift has ignited a firestorm of criticism from environmental advocates, climate scientists, and sustainability experts who argue that this approach directly contradicts global efforts to combat climate change. By recommitting to traditional carbon-intensive energy sources, these companies appear to be prioritizing short-term profits over long-term environmental sustainability. Industry analysts suggest the decision stems from current market dynamics, including global energy uncertainties and potential economic pressures. However, critics contend that this strategy undermines critical progress toward reducing greenhouse gas emissions and transitioning to cleaner energy alternatives. The announcement signals a potential setback in the global fight against climate change, raising serious questions about corporate responsibility and the energy sector's genuine commitment to sustainable development. As the world grapples with increasing environmental challenges, these companies' strategic choices could have far-reaching consequences for our planet's future. MORE...

Kitchen Redesign Revolution: Lowe's Unleashes Cutting-Edge 3D Design with Apple Vision Pro

Companies

2025-04-26 17:20:37

Lowe's Revolutionizes Home Design with Cutting-Edge Apple Vision Pro Technology Lowe's Companies (NYSE:LOW) is pushing the boundaries of home renovation with its groundbreaking Lowe's Style Studio™, an immersive 3D design experience that's transforming kitchen planning in Northern California. By leveraging Apple Vision Pro's advanced technology, customers can now visualize and customize their dream kitchens with unprecedented realism and interactivity. This innovative initiative represents more than just a technological showcase—it's a strategic move to elevate customer engagement and redefine the home improvement shopping experience. The launch demonstrates Lowe's commitment to integrating state-of-the-art technology into traditional retail environments. While the exciting product announcement has generated buzz, Lowe's stock performance has remained closely aligned with broader market trends. Over the past week, the market has shown resilience, with a robust 5% increase that reflects growing investor confidence. By embracing cutting-edge technologies like Apple Vision Pro, Lowe's is positioning itself at the forefront of digital transformation in the home improvement sector, potentially setting a new standard for interactive retail experiences. MORE...

Remote Work Revolt: Why Forcing Staff Back to Office Is Backfiring on Employers

Companies

2025-04-26 16:30:44

The Professional Landscape: Navigating Unprecedented Workplace Transformation The world of work has undergone a seismic shift in recent years, leaving companies and employees alike navigating uncharted territories. The rapid evolution of workplace dynamics has challenged traditional business models and forced organizations to rethink their strategies for talent management, productivity, and employee engagement. In the wake of global disruptions, businesses are now confronting the long-term consequences of their pandemic-era decisions. The sudden pivot to remote and hybrid work models has fundamentally reshaped how companies operate, communicate, and retain talent. What seemed like temporary adaptations have now become permanent structural changes in the corporate ecosystem. Organizations are now carefully reassessing their workplace strategies, balancing the demands of employee flexibility with the need for collaboration, innovation, and organizational culture. The traditional office-centric model has been permanently disrupted, giving way to more fluid and adaptable work arrangements that prioritize both individual preferences and collective productivity. As companies continue to refine their approach, the key lies in creating flexible, technology-enabled work environments that can attract top talent while maintaining operational efficiency. The future of work is no longer about where employees work, but how effectively they can contribute to organizational goals in an increasingly dynamic global landscape. MORE...

Game Over? Indie Board Game Makers Unite in Unexpected Legal Battle Against Trump

Companies

2025-04-26 16:30:10

In a bold move that highlights the ongoing trade tensions, a coalition of tabletop game manufacturers is taking legal action against former President Donald Trump's controversial tariff policies. The gaming industry is pushing back, claiming these trade restrictions could devastate their businesses and potentially force significant price increases for consumers. One prominent game company has already warned that the tariffs could result in millions of dollars in additional expenses, threatening the financial stability of smaller game publishers and potentially disrupting the entire tabletop gaming ecosystem. The lawsuit represents a united front from game manufacturers who argue that the tariffs unfairly burden their industry, which relies heavily on manufacturing components and products internationally. The legal challenge underscores the broader economic impact of trade policies and how seemingly abstract economic decisions can have very real consequences for specialized industries. By challenging these tariffs in court, these game companies are not just fighting for their own bottom line, but also for the affordability and accessibility of tabletop gaming for enthusiasts across the country. MORE...

Inside the Interview Gauntlet: 10 Companies That Will Test Your Professional Mettle

Companies

2025-04-26 16:09:57

Navigating the Interview Gauntlet: Tech Giants' Notoriously Challenging Hiring Process Landing a job at top technology companies isn't just about having an impressive resume—it's about surviving one of the most grueling interview experiences in the professional world. According to employee insights shared on Glassdoor, tech giants like Google, Amazon, and Facebook have developed a reputation for implementing rigorous and intellectually demanding interview processes that test candidates far beyond traditional screening methods. These industry leaders don't just want qualified candidates; they seek exceptional talent capable of solving complex problems under pressure. Their interview strategies often include multiple rounds of technical assessments, behavioral evaluations, and brain-teasing problem-solving challenges that push candidates to their intellectual limits. While tech companies are particularly known for their intense interview experiences, the trend of challenging interviews isn't exclusive to Silicon Valley. Across various industries—from finance and consulting to healthcare and engineering—companies are increasingly adopting more sophisticated evaluation techniques that go well beyond standard question-and-answer formats. Candidates preparing to enter these competitive job markets should expect comprehensive assessments that examine not just their technical skills, but their critical thinking, adaptability, and potential for innovation. The message is clear: in today's competitive job landscape, standing out requires more than just meeting basic qualifications. MORE...

Silicon Valley's Tariff Tightrope: How Tech Giants Are Navigating Global Economic Turbulence

Companies

2025-04-26 12:00:00

As the tech sector kicks off its first full week of Q1 earnings, companies are navigating a complex landscape of global trade challenges. Executives are laser-focused on addressing customer demands while showcasing the resilience and adaptability of their supply chain strategies. The ongoing discussions around tariffs have become a central theme, with industry leaders demonstrating their ability to pivot and maintain operational efficiency in an increasingly unpredictable economic environment. Tech companies are leveraging the strategic flexibility developed over recent years, proving their capacity to mitigate potential disruptions and continue delivering innovative solutions. The current earnings season reveals a sector that is not just reacting to challenges, but proactively reshaping its approach to global market dynamics. MORE...

Weight Loss Drug Crackdown: Affordable Ozempic Alternatives Vanish Overnight

Companies

2025-04-26 11:00:00

Ozempic Roundup: Major Shifts in Weight Loss Landscape

The world of weight loss medications is experiencing seismic changes this week, with several dramatic developments that could reshape how Americans approach weight management.

First and foremost, the FDA has cracked down on compounded GLP-1 medications, effectively ending the era of custom-mixed weight loss drugs. This move signals a significant tightening of regulations in the rapidly evolving weight loss pharmaceutical market.

Meanwhile, the pharmaceutical industry is preparing to launch a new wave of over-the-counter weight loss pills, promising more accessible options for those seeking medical weight management solutions. This development could democratize access to weight loss treatments that were previously only available by prescription.

In a surprising turn of events, WeightWatchers—a long-standing titan in the weight loss industry—is reportedly preparing to file for bankruptcy. This stunning development underscores the massive disruption caused by prescription weight loss medications like Ozempic and Wegovy, which have dramatically altered traditional approaches to weight management.

These rapid changes suggest we're witnessing a transformative moment in how society approaches weight loss, with medical interventions increasingly taking center stage.

MORE...Shark Tank Entrepreneurs Brace for Impact: How Trump's Trade War Reshapes Small Business Survival

Companies

2025-04-26 10:30:00

Shark Tank Entrepreneurs Reveal the Brutal Impact of Tariffs on Small Business Survival

In the cutthroat world of entrepreneurship, small business owners are facing an unprecedented challenge that threatens to derail their dreams: escalating trade tariffs. Entrepreneurs who once celebrated their success on Shark Tank are now grappling with a harsh economic reality that is squeezing their profit margins and testing their resilience.

These innovative business owners are experiencing a perfect storm of economic pressures. Skyrocketing import costs are forcing them to make gut-wrenching decisions: raise prices and risk losing customers, absorb the additional expenses and watch profits evaporate, or completely restructure their supply chains.

The ripple effects are devastating. Production delays have become the new normal, with many businesses struggling to maintain consistent inventory. Orders that once took weeks now stretch into months, creating uncertainty and frustration for both entrepreneurs and their customers.

What makes this situation particularly challenging is the unpredictability. Small business owners who invested years of passion and personal savings into their ventures now find themselves navigating a complex and volatile economic landscape. Each tariff adjustment can mean the difference between survival and bankruptcy.

Despite these challenges, the entrepreneurial spirit remains unbroken. These business owners are adapting, innovating, and finding creative solutions to weather the storm—proving once again that resilience is the true currency of success.

MORE...Digital Blackout: Tech Giants' Services Collapse Across Ukraine in Unexpected Outage

Companies

2025-04-26 07:04:35

In a significant digital disruption, Ukraine's flagship digital government service platform, Diia, along with several major corporate online services, experienced widespread technical difficulties on April 26th. The unexpected outage has temporarily halted digital access to critical government and commercial services, potentially impacting millions of users across the country. The Diia mobile application, which has been a cornerstone of Ukraine's digital transformation efforts, suddenly became inaccessible, leaving citizens unable to access essential digital services. Simultaneously, multiple online platforms from prominent companies also reported service interruptions, suggesting a potentially coordinated technical issue. While the exact cause of the technical failures remains unclear, the incident highlights the ongoing challenges in maintaining robust digital infrastructure during times of ongoing national stress. Ukrainian tech teams are likely working diligently to restore services and investigate the root cause of these unexpected disruptions. Users are advised to remain patient and check official communication channels for updates on service restoration. The government and affected companies are expected to provide more detailed information about the technical failures in the coming hours. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293