Behind Amazon's Empire: The Secret Sauce of Tech Dominance

Companies

2025-04-16 15:59:03

Fred Alger Management Unveils Insights into Alger Spectra Fund's Q1 Performance In a recent investor letter, Fred Alger Management provided a comprehensive overview of the Alger Spectra Fund's first quarter performance, highlighting the complex market landscape of 2025. The investment management firm candidly addressed the significant market dynamics that shaped the quarter's investment environment. The investment landscape was characterized by heightened volatility, primarily driven by evolving trade policies, shifting monetary strategies, and dynamic fiscal approaches. These interconnected factors created a challenging yet intriguing investment ecosystem for U.S. stocks. Adding another layer of complexity to the market was the emergence of advanced artificial intelligence (AI) models from China, which introduced unprecedented technological and economic dimensions to the investment landscape. The introduction of these cutting-edge AI technologies signaled potential transformative changes in global market interactions and investment strategies. Investors and market analysts are closely monitoring these developments, recognizing the profound implications for portfolio management and strategic investment decisions in an increasingly interconnected and technologically driven global economy. MORE...

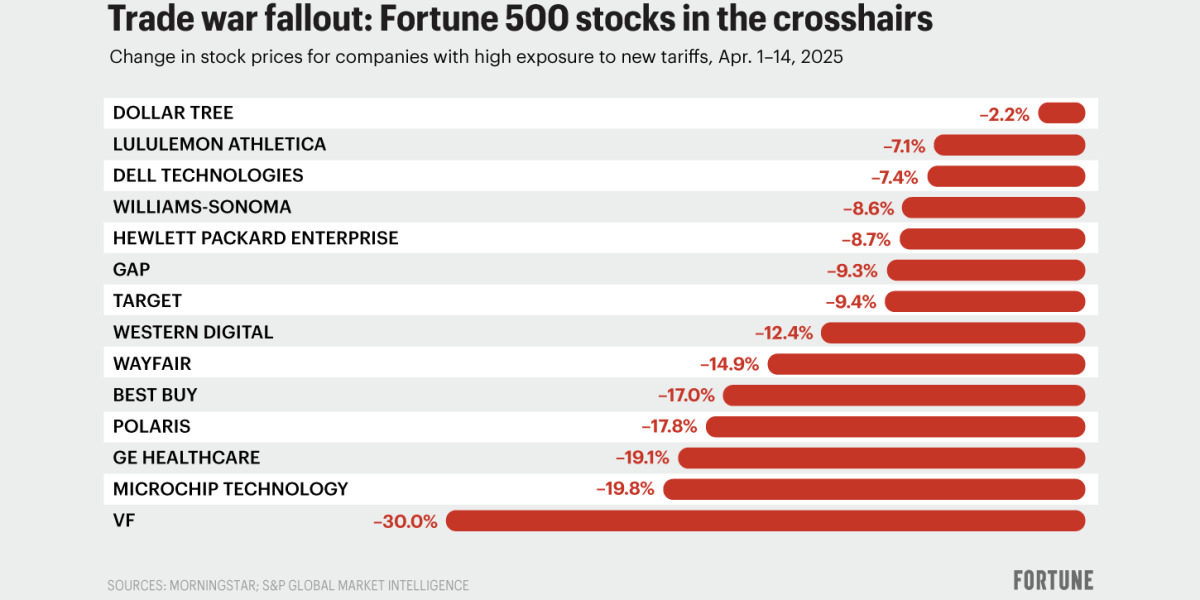

Trade War Casualties: 14 Fortune 500 Giants Caught in the Crossfire

Companies

2025-04-16 15:52:57

The economic downturn has cast a wide net, impacting diverse industries with significant force. Among the hardest-hit companies are a cutting-edge medical device manufacturer, a leading semiconductor technology firm, and VF Corporation, the parent company behind the iconic Vans sneaker brand. These companies are experiencing substantial challenges that reflect the broader economic pressures currently affecting multiple sectors. MORE...

Behind the Buyout: What You Need to Know About the Company Transforming Muskegon's Manufacturing Landscape

Companies

2025-04-16 15:49:27

In a strategic expansion move, Wisconsin Aluminum Foundry has recently completed the acquisition of Anderson Global, a prominent aluminum parts manufacturer based in Muskegon Heights. The newly acquired company specializes in producing high-quality tooling solutions that serve a diverse range of industrial sectors, marking an exciting growth milestone for Wisconsin Aluminum Foundry. Anderson Global brings a wealth of expertise in precision manufacturing, with a proven track record of delivering innovative tooling components to various industries. This acquisition is expected to enhance Wisconsin Aluminum Foundry's manufacturing capabilities and broaden its market reach, positioning the company for continued success in the competitive aluminum parts manufacturing landscape. MORE...

Brewing Trouble: Coffee Giant Seeks Financial Lifeline in Bankruptcy Bombshell

Companies

2025-04-16 15:11:33

In a shocking turn of events, a prominent coffee exporter has sought bankruptcy protection, sending ripples through the global coffee industry. The company, known for its significant role in international coffee trade, has taken this strategic step to restructure its financial operations and navigate challenging market conditions. Industry experts are closely watching the developments, as this bankruptcy filing could potentially impact coffee supply chains and pricing worldwide. The move highlights the increasing economic pressures facing major agricultural exporters in today's volatile global marketplace. While the specific details of the financial challenges remain confidential, sources suggest that a combination of factors, including fluctuating commodity prices, supply chain disruptions, and increased operational costs, may have contributed to the company's current financial situation. Stakeholders and coffee industry analysts are eagerly anticipating further information about the company's restructuring plans and the potential long-term implications for global coffee trade. MORE...

Aircall Expands West Coast Footprint with Strategic Seattle Launch

Companies

2025-04-16 14:12:49

Aircall Expands West Coast Presence with New Bellevue Office Cloud communications platform Aircall has strategically positioned itself for further growth by launching its latest office in Bellevue, Washington. This milestone marks the company's ninth global location, underscoring its rapid international expansion and commitment to serving diverse markets. Led by CEO Scott Chancellor, Aircall continues to strengthen its footprint across key business regions. The new Bellevue office represents a significant step in the company's strategic development, providing enhanced support for West Coast clients and tapping into the region's vibrant tech ecosystem. The expansion reflects Aircall's ongoing momentum and ambition to deliver innovative communication solutions to businesses worldwide. By establishing a presence in this dynamic tech hub, the company demonstrates its dedication to proximity and accessibility for its growing customer base. With nine global offices now in its portfolio, Aircall is positioning itself as a truly international player in the cloud communications landscape, offering seamless communication technologies to businesses across different geographical markets. MORE...

Dividend Royalty: Why Lowe's Is Crushing the Market and Rewarding Investors

Companies

2025-04-16 14:11:28

Lowe's Companies: A Deep Dive into Dividend Royalty

In the world of dividend investing, savvy investors are always on the hunt for companies that consistently reward shareholders. While terms like Dividend Aristocrats and Dividend Kings are familiar to many, understanding how specific companies like Lowe's Companies, Inc. (NYSE:LOW) stack up against these elite dividend performers is crucial for making informed investment decisions.

Our recent exploration of the top 10 Dividend Monarchs highlighted the importance of consistent dividend growth and financial stability. Today, we're taking a closer look at Lowe's and its position in the dividend landscape, examining how this home improvement giant measures up to other dividend powerhouses.

Investors seeking reliable income streams will find Lowe's an intriguing case study in sustainable dividend strategies. By delving into the company's financial performance, dividend history, and market position, we'll provide insights that go beyond surface-level analysis.

Stay tuned as we unpack the details that make Lowe's a potential standout in the world of dividend investing.

MORE...Tariff Tangle: Maine Businesses Caught in Economic Crossfire of Domestic Supply Chains

Companies

2025-04-16 13:05:00

Despite sourcing all materials domestically, Maine businesses are bracing for significant challenges as new tariffs threaten to disrupt their economic landscape. Local manufacturers and producers are discovering that even with a purely American supply chain, the ripple effects of trade policies can still impact their bottom line. These companies are finding themselves caught in a complex economic crossroads, where national trade decisions can unexpectedly squeeze local enterprises. The tariffs, originally designed to protect domestic industries, are ironically creating unexpected financial pressures for businesses that pride themselves on using 100% U.S.-sourced materials. Small and medium-sized enterprises in Maine are particularly vulnerable, as they may lack the financial cushion to absorb increased costs. The potential economic strain could force some businesses to reconsider their production strategies, potentially impacting local employment and regional economic stability. While the full extent of the tariffs' impact remains to be seen, one thing is clear: even businesses with seemingly insulated supply chains are not immune to broader economic shifts. Maine's local industries are now navigating a challenging landscape where national trade policies can create unforeseen complications for regional economic health. MORE...

Breaking: Top 2025 Internships Revolutionize Career Paths with Killer Compensation and Meaningful Work

Companies

2025-04-16 13:01:00

In an exciting revelation for aspiring professionals, Glassdoor has unveiled its annual ranking of the top internship destinations, with tech and finance giants leading the pack. Nvidia, Capital One, and McKinsey have emerged as the most coveted internship spots, earning high praise from students and recent interns who shared their experiences on the popular career insights platform. The rankings highlight these companies' commitment to providing exceptional learning environments, competitive compensation, and meaningful work opportunities for young talent. Nvidia, known for its cutting-edge technology in graphics and AI, stands out as a particularly attractive destination for tech-savvy students. Financial powerhouses like Capital One continue to demonstrate their ability to nurture emerging talent, while consulting leader McKinsey offers unparalleled exposure to complex business challenges. These top-rated internships not only provide valuable professional experience but also serve as potential launching pads for future career success, giving students a critical edge in today's competitive job market. MORE...

Breaking: 5 Groundbreaking HIV Therapeutics Startups Poised to Revolutionize Treatment in 2025

Companies

2025-04-16 13:00:00

The Quest for an HIV Cure: Biotechnology's Bold Frontier

In the relentless battle against HIV, biotechnology companies are pushing the boundaries of medical innovation, offering renewed hope for millions living with the virus. The journey towards a potential cure is complex, but recent scientific breakthroughs are illuminating promising pathways.

Cutting-edge research is focusing on several groundbreaking strategies. Some companies are exploring gene editing techniques that could potentially eliminate HIV from infected cells, while others are developing advanced immunotherapies designed to strengthen the body's natural defense mechanisms against the virus.

Key approaches include:

- CRISPR gene-editing technologies targeting viral DNA

- Innovative immunological treatments that boost viral suppression

- Long-acting antiretroviral therapies with extended protection

While a complete cure remains elusive, scientists are making remarkable progress. The combination of sophisticated research, unprecedented technological capabilities, and a deep understanding of viral mechanisms brings us closer than ever to potentially transforming HIV from a life-threatening condition to a manageable chronic disease.

As biotechnology continues to evolve, the dream of an HIV cure moves from the realm of possibility to a tangible, achievable goal.

MORE...Price Squeeze: Nearly Half of Businesses Set to Shift Tariff Burden onto Consumers

Companies

2025-04-16 12:23:26

In a revealing new survey, businesses are showing their strategic approach to navigating the complex landscape of tariff-related expenses. Nearly half of the companies surveyed are planning to transfer these additional costs to consumers, but they're doing so with remarkable finesse to minimize potential customer backlash. The study highlights a nuanced strategy among businesses: instead of abruptly raising prices, many are exploring creative ways to absorb or redistribute tariff-related expenses. Some companies are implementing subtle price adjustments, optimizing their supply chains, or finding innovative cost-saving measures to protect their customer relationships. Executives are keenly aware that transparency and strategic communication are crucial in maintaining consumer trust during these economic challenges. By carefully managing how and when they adjust pricing, businesses aim to demonstrate value and fairness, even in the face of increasing economic pressures. This approach reflects a sophisticated understanding of modern consumer dynamics, where customers are not just price-sensitive, but also value-conscious and responsive to honest, clear communication about economic realities. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293