Sweet Solidarity: Prairie Farms Joins Forces with Alex's Lemonade Stand in Childhood Cancer Fight

Companies

2025-05-02 12:56:19

In a powerful display of corporate social responsibility, Prairie Farms Dairy and Hiland Dairy Foods have joined forces with Alex's Lemonade Stand Foundation to wage a compassionate battle against childhood cancer. This heartfelt partnership represents a beacon of hope for families facing one of the most challenging medical battles imaginable. The collaboration aims to raise awareness and critical funds to support groundbreaking research and provide comfort to children and families impacted by pediatric cancer. By leveraging their extensive distribution networks and community connections, these dairy companies are transforming everyday purchases into a lifeline of support for young cancer patients. Alex's Lemonade Stand Foundation, inspired by the courageous story of young Alexandra "Alex" Scott, has been a pioneering force in childhood cancer research and support since its inception. Through this strategic partnership, Prairie Farms and Hiland Dairy are helping to continue Alex's remarkable legacy of turning personal struggle into a nationwide movement of hope and healing. Consumers can participate in this meaningful initiative simply by purchasing specially marked dairy products, knowing that each purchase contributes directly to the foundation's mission of finding better treatments and ultimately a cure for childhood cancer. MORE...

Wall Street Cheers: Piper Sandler Crushes Q1 Expectations with Stellar Financial Performance

Companies

2025-05-02 12:15:03

Piper Sandler Companies Delivers Impressive Financial Performance, Signaling Potential Investor Optimism Investors are taking a closer look at Piper Sandler Companies (PIPR) after the firm's remarkable quarterly earnings report that has sparked considerable market interest. The financial services powerhouse has significantly outperformed expectations, posting a stunning 69.01% earnings surprise and a robust 7.79% revenue surge for the quarter concluding in March 2025. These standout numbers aren't just statistical anomalies—they represent a potential turning point for the company's stock trajectory. The substantial earnings beat suggests strong operational efficiency and strategic financial management that could attract both institutional and individual investors. Market analysts are now speculating whether this exceptional performance is a one-time event or indicative of a broader positive trend for Piper Sandler. The impressive financial metrics hint at the company's resilience and potential for continued growth in an increasingly competitive financial services landscape. Investors and market watchers will be closely monitoring the stock's movement in the coming weeks, using these latest results as a critical benchmark for future performance expectations. The significant earnings and revenue surprises could very well be a harbinger of exciting developments ahead for Piper Sandler Companies. MORE...

Inside Arnold Motor Supply: The Workplace Revolution That's Turning Heads in 2025

Companies

2025-05-02 12:05:15

Arnold Motor Supply Celebrates Prestigious USA TODAY Top Workplaces Recognition Arnold Motor Supply has been honored with a coveted USA TODAY Top Workplaces 2025 award, solidifying its position as one of the most exceptional employers in the United States. This prestigious recognition highlights the company's commitment to creating an outstanding work environment that prioritizes employee satisfaction and professional growth. The award is a testament to Arnold Motor Supply's dedication to fostering a positive workplace culture, where employees feel valued, supported, and motivated. By consistently prioritizing team member experiences and implementing innovative workplace strategies, the company has distinguished itself among top-tier employers nationwide. Being named to the USA TODAY Top Workplaces list represents more than just an accolade—it's a reflection of the organization's strong leadership, collaborative atmosphere, and commitment to employee well-being. This recognition underscores Arnold Motor Supply's ongoing efforts to create a dynamic and rewarding work environment that attracts and retains top talent in the industry. The company's achievement demonstrates its ability to provide meaningful career opportunities, competitive benefits, and a supportive workplace that empowers employees to excel in their professional journeys. MORE...

Campus Uprising: Students Force USF to Cut Ties with Defense Firms Linked to Israeli Conflict

Companies

2025-05-02 12:00:58

After an intense 18-month campaign of persistent activism, pro-Palestinian student protesters achieved a significant victory by successfully pressuring their university to divest from several major defense and technology corporations. The targeted companies—Palantir, L3Harris, GE Aerospace, and RTX Corporation—were removed from the university's investment portfolio, marking a notable triumph for student-led divestment efforts. The activists celebrated their hard-won success, highlighting the power of sustained grassroots organizing and collective action. Their strategic protests and advocacy demonstrated how student movements can effectively challenge institutional investments in companies they believe are complicit in human rights concerns. This divestment represents more than a financial decision; it symbolizes a broader statement of solidarity with Palestinian communities and a critique of corporate involvement in geopolitical conflicts. The students' persistent campaign underscores the growing momentum of campus activism focused on ethical investment practices and social justice. MORE...

Wall Street Stunned: Bausch Health's Q1 Earnings Fall Short of Analyst Predictions

Companies

2025-05-02 10:10:48

Bausch Health Companies Delivers Strong Q1 2025 Financial Performance

Bausch Health Companies (NYSE:BHC) has reported impressive financial results for the first quarter of 2025, showcasing robust growth and strategic momentum. The pharmaceutical giant demonstrated solid financial performance with key highlights that underscore the company's resilience and market positioning.

Key Financial Highlights

- Revenue: US$2.26 billion, representing a notable 4.9% year-over-year increase

- Continued expansion of market share across core therapeutic segments

- Strong operational efficiency and strategic cost management

The company's revenue growth reflects its ongoing commitment to innovation, strategic investments, and adaptability in a dynamic healthcare landscape. Investors and analysts are viewing these results as a positive indicator of Bausch Health's future potential and market strategy.

Management remains optimistic about the company's trajectory, emphasizing continued focus on operational excellence and targeted growth initiatives throughout 2025.

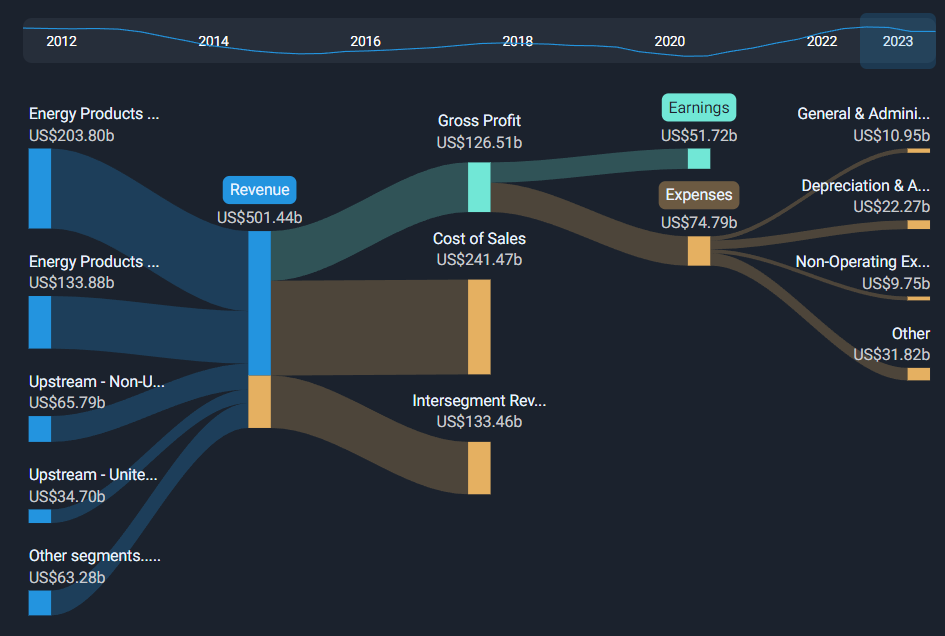

MORE...Paradise Under Siege: Hawaii Launches Legal Assault on Big Oil's Climate Sins

Companies

2025-05-02 10:05:00

Hawaii has taken a bold stand against major oil companies, filing a groundbreaking lawsuit in state court that alleges decades of deliberate misinformation about climate change. The islands, already experiencing severe environmental challenges, are now seeking accountability from fossil fuel giants for their alleged decades-long campaign of deception. The lawsuit claims that these oil companies have systematically misled the public about the devastating environmental consequences of their operations, knowingly contributing to climate change while obscuring the potential impacts on vulnerable regions like Hawaii. By deliberately suppressing scientific evidence and continuing to promote fossil fuel consumption, the state argues that these corporations have directly endangered Hawaii's delicate ecosystem, infrastructure, and way of life. With rising sea levels, increasingly intense storms, and ecological disruption threatening the islands, Hawaii is demanding that these oil companies be held responsible for the environmental and economic damage caused by their alleged deliberate misinformation. The legal action represents a significant moment in the ongoing global battle against climate change, potentially setting a precedent for how corporations are held accountable for their environmental impact. MORE...

Heat Death Controversy: Trump's OSHA Pick's Corporate Connections Exposed

Companies

2025-05-02 09:57:49

A troubling pattern emerges in the background of Doug Parker, President Biden's nominee to lead the Occupational Safety and Health Administration (OSHA). As a former high-ranking safety executive at UPS and Amazon, Parker has a complex history that raises serious questions about worker protection. During his tenure at these logistics giants, workers experienced alarming rates of heat-related illnesses and fatalities. Simultaneously, the companies he worked for actively lobbied against implementing more robust heat safety regulations, potentially putting employee lives at risk. Investigative reporting by Sam Pollak of The Lever has shed light on this controversial professional trajectory. Parker's nomination to head OSHA now brings his past safety practices under intense scrutiny, as labor advocates and workers' rights groups demand accountability. The nomination highlights a critical tension between corporate safety practices and meaningful worker protection, challenging the incoming leadership to prioritize employee well-being over corporate interests. As Parker awaits confirmation, his history at UPS and Amazon will undoubtedly be a focal point of discussions about workplace safety standards. MORE...

Tax Crackdown: Chinese Firms Brace for Seismic Shift in U.S. Loophole Closure

Companies

2025-05-02 09:21:51

A long-standing tax loophole that has enabled American consumers to enjoy a flood of inexpensive products from China and Hong Kong is finally coming to an end. Starting this Friday, shoppers will face significant changes in how they purchase and import international goods. The previously exploited customs exemption has allowed U.S. consumers to bypass tariffs and complex customs documentation, making cross-border shopping remarkably convenient and cost-effective. However, this era of unrestricted international purchasing is now drawing to a close. Meaghan Tobin, a seasoned business correspondent for The New York Times specializing in Asian markets, highlights the profound implications of this regulatory shift. The closure of this loophole signals a more stringent approach to international trade and consumer imports. Consumers who have grown accustomed to seamless, low-cost shopping from Chinese and Hong Kong merchants will need to adapt to new regulations and potentially higher costs. The change represents a significant transformation in the landscape of cross-border e-commerce and international retail. MORE...

Tariff Tsunami: How Businesses Are Passing the Buck to Consumers

Companies

2025-05-02 09:03:14

The Impact of Trump's Trade Policies: A Growing Pinch for American Shoppers As President Trump's trade strategies continue to unfold, everyday Americans are feeling the economic ripple effects where it matters most - their wallets. Consumers across the nation are increasingly noticing a significant uptick in prices at grocery stores and retail outlets, a direct consequence of the administration's aggressive trade approach. The complex web of tariffs and trade tensions has begun to translate into tangible costs for ordinary citizens. From electronics to household goods, and even everyday groceries, prices are creeping upward, creating a noticeable strain on household budgets. What initially seemed like abstract economic policy is now a concrete reality for millions of Americans who are watching their purchasing power gradually erode. Economists warn that these price increases are not just a temporary fluctuation but potentially a long-term consequence of the current trade policies. Consumers are caught in the crossfire of international economic negotiations, bearing the brunt of increased import costs and retaliatory tariffs. As the debate continues, one thing becomes clear: the real-world impact of trade policies extends far beyond diplomatic negotiations, directly affecting the daily lives and financial well-being of American families. MORE...

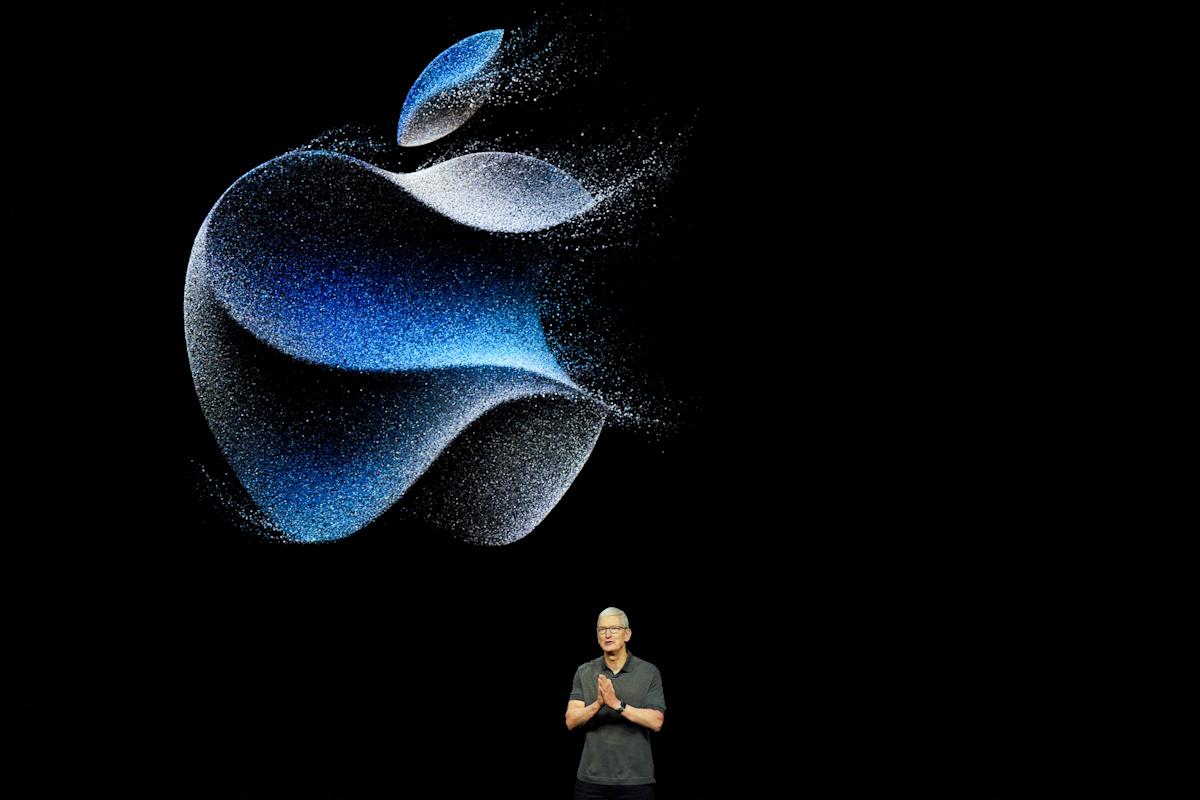

Trade War Bite: Apple Braces for $900M Tariff Tsunami

Companies

2025-05-02 08:31:41

Apple Defies Market Expectations with Stellar Q2 Performance In a remarkable display of resilience, Apple has once again proven its market dominance by delivering a standout second-quarter earnings report that surpassed Wall Street's predictions. The tech giant's impressive performance was primarily driven by robust iPhone sales, which demonstrated the company's continued strength in the competitive smartphone market. Investors and analysts were pleasantly surprised by Apple's ability to navigate challenging economic conditions, with the company's iPhone segment showing particular vigor. The strong sales figures suggest that consumer demand for Apple's flagship product remains remarkably solid, even in the face of global economic uncertainties. This stellar performance not only highlights Apple's enduring brand appeal but also underscores the company's strategic prowess in maintaining consumer interest and loyalty. The better-than-anticipated results serve as a testament to Apple's innovative approach and its ability to consistently deliver products that resonate with global consumers. As the tech world continues to watch Apple's every move, this Q2 earnings report stands as a powerful reminder of the company's remarkable resilience and market leadership. Investors and tech enthusiasts alike are now eagerly anticipating what Apple will unveil next in its ongoing quest for technological innovation. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293