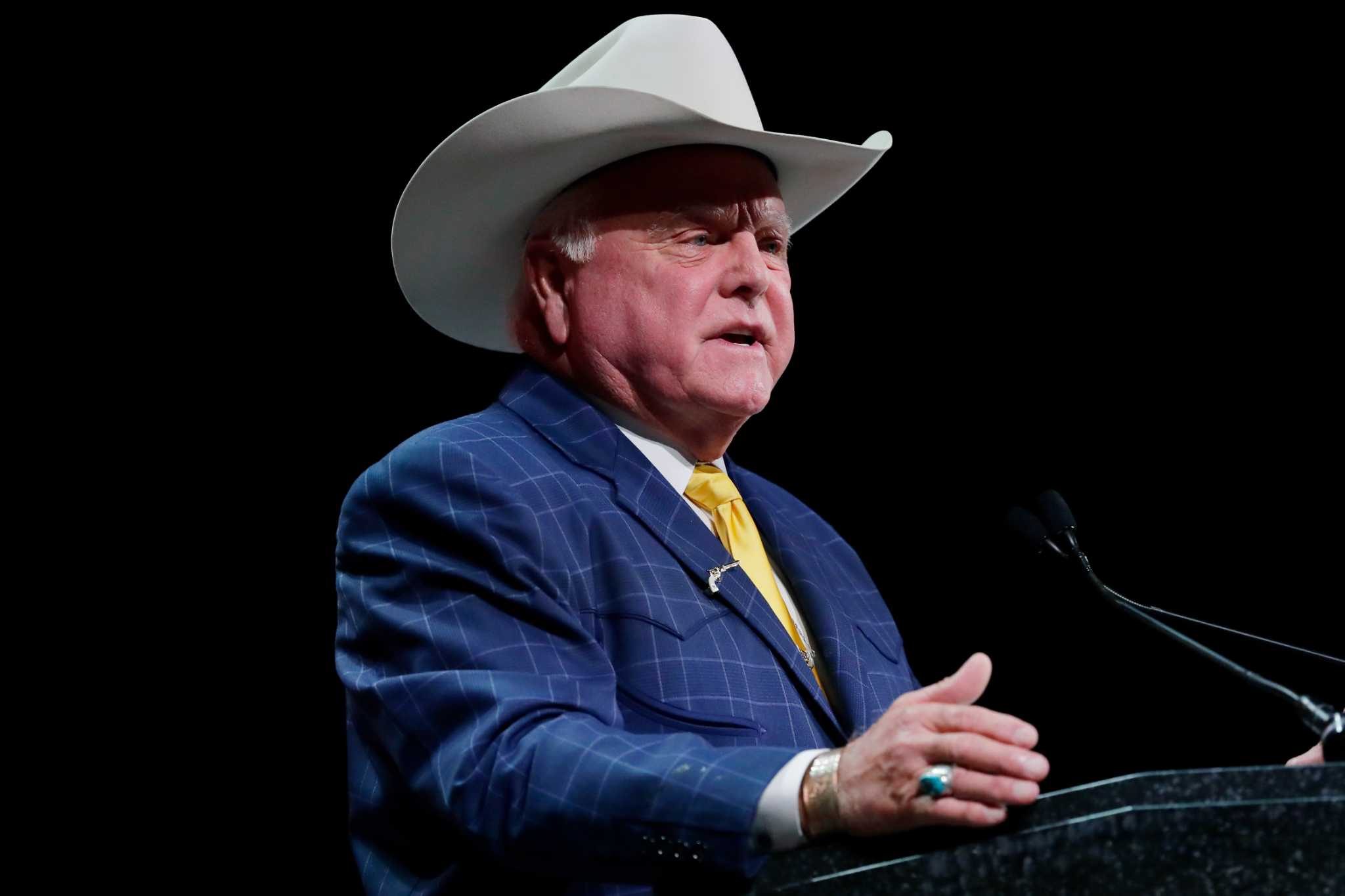

Toothpaste Titans Targeted: Paxton Blasts Brands for Alleged Child Marketing Tactics

Companies

2025-05-03 18:39:15

Attorney General Ken Paxton is raising serious concerns about the marketing tactics used by toothpaste companies targeting children. He argues that these companies are employing manipulative strategies that go beyond simple product promotion, potentially exploiting young consumers' vulnerabilities. Paxton's critique highlights how toothpaste brands are crafting colorful, playful packaging and advertisements specifically designed to capture children's attention. These marketing approaches often use cartoon characters, bright colors, and playful messaging that can make oral hygiene products seem more like entertainment than a health necessity. The core of Paxton's argument centers on the ethical implications of such marketing techniques. By creating highly appealing visual and emotional experiences, these companies may be encouraging children to make purchasing decisions without fully understanding the product's actual benefits or potential limitations. This scrutiny reflects a growing concern among consumer protection advocates about how brands strategically target younger audiences, potentially influencing their purchasing behaviors and perceptions from an early age. MORE...

Breaking: Groundbreaking Financial Tracker Exposes Corporate Accountability Gaps

Companies

2025-05-03 18:30:00

In a groundbreaking collaboration, researchers from the University of Cambridge have joined forces with Bloomberg to develop an innovative global bond index specifically designed to challenge and track fossil fuel expansion. This pioneering financial tool represents a significant step towards promoting sustainable investment strategies and addressing climate change concerns. The new index aims to provide investors with a comprehensive and transparent mechanism to assess and monitor the financial activities of companies actively involved in expanding fossil fuel infrastructure. By creating this specialized index, the research team hopes to shed light on investment patterns that contribute to environmental challenges and encourage more responsible financial decision-making. This collaborative effort underscores the growing intersection between academic research, financial technology, and environmental sustainability. By leveraging Bloomberg's extensive financial data and the University of Cambridge's research expertise, the project offers a unique approach to understanding and potentially mitigating the financial dynamics of fossil fuel expansion. MORE...

Sole Survivors: Shoe Giants Plea to Trump for Tariff Lifeline

Companies

2025-05-03 15:45:00

In a powerful collective statement, 76 leading shoe companies have united to sound the alarm on potentially devastating trade tariffs. Addressing President Biden directly through an open letter, these industry leaders argue that proposed tariffs represent an "existential threat" to the American footwear sector. The coalition, representing a significant cross-section of the shoe industry, warns that continued tariffs could trigger a cascade of economic challenges. These potential consequences include substantial job losses, increased consumer prices, and potential disruption of a sector that employs thousands of Americans. Their letter emphasizes that current trade policies could undermine the industry's ability to compete globally and maintain affordable pricing for consumers. By highlighting the intricate supply chains and economic complexities involved in shoe manufacturing, the companies are making a compelling case for trade policy reconsideration. The unprecedented unified front demonstrates the severity of the situation, with companies typically competing in the marketplace now standing shoulder-to-shoulder in their opposition to these potentially harmful tariffs. As the Biden administration weighs its trade strategies, this collective plea from shoe industry leaders represents a critical moment of advocacy, urging policymakers to carefully consider the broader economic implications of their decisions. MORE...

Capitol Hill's China Crackdown: Lawmakers Push SEC to Axe Chinese Stocks

Companies

2025-05-03 15:22:25

In a bold move that could significantly impact international tech investments, two prominent congressional committee chairs are pushing the Securities and Exchange Commission (SEC) to take decisive action against Alibaba Group Holding and other Chinese companies with alleged military connections. Representatives John Moolenaar (R-Mich.), who chairs the House China committee, and his colleague are calling for the delisting of Alibaba from the New York Stock Exchange (NYSE:BABA). Their request, reported by the Financial Times late Friday, highlights growing tensions between the United States and Chinese corporations suspected of having strategic ties to China's military apparatus. The potential delisting represents a serious escalation in the ongoing scrutiny of Chinese companies operating in U.S. financial markets. By challenging Alibaba's market presence, these lawmakers aim to address what they perceive as national security risks and potential conflicts of interest between private Chinese corporations and their government's military infrastructure. This development could have far-reaching consequences for international investors and the global tech industry, signaling a continued hardline approach to cross-border economic relations between the United States and China. MORE...

Buffett's Berkshire Doubles Down: Why Japanese Trading Giants Just Won the Investor Lottery

Companies

2025-05-03 15:21:01

In a powerful vote of confidence, Warren Buffett lavished praise on the five Japanese trading giants that have captured Berkshire Hathaway's investment interest. The legendary investor's enthusiastic endorsement underscores his growing optimism about these strategic business powerhouses. During the annual shareholders meeting of Berkshire Hathaway, Buffett highlighted the exceptional potential of these Japanese trading houses, signaling his deep belief in their robust business models and future growth prospects. His investment, which represents a significant strategic move, reflects his renowned ability to identify valuable long-term opportunities in global markets. The billionaire investor's commitment to these Japanese firms demonstrates his continued global investment strategy, expanding Berkshire Hathaway's international portfolio with carefully selected, high-potential enterprises. Buffett's endorsement is likely to draw increased attention from global investors to these Japanese trading companies, potentially influencing market perceptions and investment strategies. This latest move further cements Buffett's reputation as a visionary investor who looks beyond traditional market boundaries, seeking value and potential in diverse and sometimes unexpected economic landscapes. MORE...

Qiagen's Turning Point: Activist Investor Reveals 3 Game-Changing Strategies for Explosive Growth

Companies

2025-05-03 14:47:42

Qiagen's management has successfully navigated challenging terrain, demonstrating strategic prowess and resilience. While the company has effectively managed complex operational hurdles, a compelling opportunity now emerges for accelerated and more targeted growth. The leadership team has methodically addressed critical internal challenges, laying a robust foundation for future expansion. By streamlining processes and maintaining operational discipline, Qiagen has positioned itself at a strategic inflection point where focused innovation and strategic investments can drive significant value creation. With a proven track record of overcoming obstacles, the company is now primed to leverage its strengths and explore new avenues for growth. The current landscape presents an ideal moment for Qiagen to pivot towards more aggressive, yet calculated, strategic initiatives that can unlock substantial potential and drive long-term shareholder value. MORE...

Wall Street Stunned: Estée Lauder Shatters Earnings Expectations in Surprising Quarterly Triumph

Companies

2025-05-03 14:41:25

Estée Lauder Companies Unveils Quarterly Performance: Navigating Challenges in a Dynamic Beauty Market The beauty industry giant, Estée Lauder Companies Inc. (NYSE:EL), recently released its latest quarterly earnings report, offering investors and market watchers a comprehensive look into the company's financial health and strategic positioning. In an increasingly competitive landscape, the company has demonstrated resilience and adaptability. While facing headwinds from global economic uncertainties and shifting consumer behaviors, Estée Lauder continues to leverage its strong brand portfolio and innovative product strategies. The quarterly results provide crucial insights into the company's performance, highlighting both challenges and opportunities in the premium beauty and cosmetics sector. Investors and analysts are closely examining the report for signals of the company's future growth trajectory and its ability to maintain market leadership. Key areas of focus include the company's revenue streams, geographic market performance, and strategic initiatives aimed at addressing changing consumer preferences and emerging market trends. As the beauty industry continues to evolve rapidly, Estée Lauder's ability to innovate, adapt, and maintain its premium brand positioning will be critical to its ongoing success and shareholder value creation. MORE...

Silicon Valley's High-Stakes Balancing Act: Navigating the Trump Tech Terrain

Companies

2025-05-03 13:30:53

In a surprising and unprecedented move, Microsoft has sent shockwaves through the gaming industry by dramatically increasing the price of its Xbox console. On Thursday, the tech giant announced a substantial $100 price hike, pushing the flagship gaming system to a hefty $600—a staggering 20% increase that defies traditional market expectations. Typically, gaming consoles that have been on the market for five years, like the current generation of Xbox, see price reductions to maintain consumer interest and competitiveness. However, Microsoft's bold pricing strategy breaks this long-standing trend, challenging the conventional wisdom of console pricing. This unexpected price increase raises numerous questions about the company's strategy, market positioning, and the potential impact on consumer purchasing decisions. Gamers and industry analysts alike are now speculating about the reasoning behind this unconventional approach and what it might mean for the future of gaming hardware pricing. MORE...

Price Strategists Face New Challenge: Navigating the Tariff Maze

Companies

2025-05-03 12:00:03

In the dynamic world of pricing strategy, professionals are facing an unprecedented challenge: anticipating and adapting to potential massive shifts across multiple economic dimensions. Today's pricing experts are walking a tightrope of uncertainty, carefully analyzing how rapidly changing input costs, evolving economic landscapes, and unpredictable consumer behaviors could dramatically reshape market dynamics. The current business environment demands unprecedented agility. Pricing strategists must now be part economist, part psychologist, and part futurist—constantly monitoring subtle signals that might indicate significant market transformations. They're not just setting prices; they're decoding complex economic puzzles where each variable could trigger a cascade of strategic adjustments. From supply chain disruptions to changing consumer sentiment, the variables at play are more interconnected and volatile than ever before. Successful pricing strategies will require a combination of data-driven insights, predictive modeling, and the flexibility to pivot quickly when unexpected changes emerge. The stakes are high: companies that can navigate these turbulent waters with precision will gain competitive advantages, while those slow to adapt risk being left behind in an increasingly dynamic marketplace. MORE...

Utility Giants Scramble as Consumers Demand Radical Energy Shift

Companies

2025-05-03 11:00:12

Meeting the Rising Challenge: Adapting to Escalating Market Demands In today's rapidly evolving business landscape, organizations must proactively address the surging market requirements with strategic and innovative approaches. The growing demand presents both a significant challenge and an extraordinary opportunity for companies willing to transform their operational capabilities. Successful enterprises recognize that simply reacting to market pressures is no longer sufficient. Instead, they must anticipate and strategically prepare for emerging trends, developing robust infrastructure and flexible systems that can seamlessly scale with increasing consumer needs. Key strategies for effectively managing growing demand include: • Investing in advanced technological solutions • Enhancing workforce skills and adaptability • Implementing agile operational frameworks • Continuously monitoring market dynamics • Developing scalable production and service models By embracing a forward-thinking mindset and maintaining organizational resilience, businesses can not only cope with expanding market demands but also position themselves as industry leaders in an increasingly competitive environment. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293