The AI Revolution: Why Companies Are Trading SEO Tricks for Generative Edge Optimization

Companies

2025-05-04 14:39:14

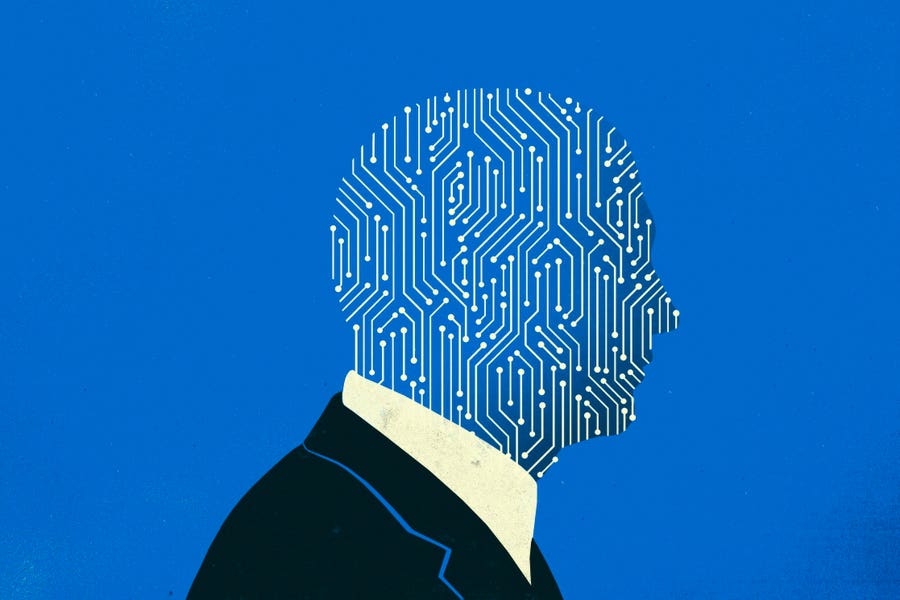

Generative Engine Optimization: The Future of AI-Driven Marketing

In the rapidly evolving digital landscape, a groundbreaking marketing strategy is emerging that's capturing the attention of businesses worldwide: Generative Engine Optimization (GEO). This innovative approach is specifically designed to attract and optimize content for Large Language Models (LLMs), revolutionizing how companies approach online visibility and content strategy.

What Businesses Need to Know About GEO

As artificial intelligence continues to transform the digital marketing ecosystem, companies are discovering the critical importance of understanding and leveraging GEO. Unlike traditional SEO, this cutting-edge technique focuses on creating content that resonates with AI algorithms and generative search engines.

Key Considerations for Implementing GEO

- Understand how AI interprets and ranks content

- Create highly relevant and contextually rich information

- Optimize content for AI comprehension and engagement

- Stay ahead of emerging AI content trends

By embracing Generative Engine Optimization, businesses can position themselves at the forefront of digital marketing innovation, ensuring their content stands out in an increasingly AI-driven world.

MORE...Ownership Revealed: Public Giants and Institutional Investors Dominate iQIYI's Shareholder Landscape

Companies

2025-05-04 13:53:41

Public Companies' Influence on iQIYI: A Deeper Look

The landscape of iQIYI's ownership reveals a fascinating dynamic where public companies wield substantial control, potentially reshaping the company's strategic direction and governance. This significant influence suggests that institutional investors and public shareholders have a more prominent role in shaping the platform's future than might be initially apparent.

By holding considerable stakes in iQIYI, these public companies are not merely passive investors but active participants in the company's decision-making processes. Their involvement can impact critical aspects such as corporate strategy, financial management, and long-term vision.

The implications of this control extend beyond simple financial investment. Public companies can leverage their positions to:

- Drive strategic initiatives

- Influence management decisions

- Guide corporate governance practices

- Ensure alignment with broader market objectives

This intricate ownership structure highlights the complex interplay between corporate entities and highlights the evolving nature of modern business ecosystems.

MORE...AI's Corporate Takeover: How Tech Giants Are Quietly Reshaping the Workforce

Companies

2025-05-04 13:52:20

The Rise of AI: A Double-Edged Sword in the Modern Workplace A transformative shift is sweeping through corporate landscapes, and it's raising serious concerns for workers nationwide. Companies are increasingly turning to artificial intelligence as a strategic tool to revolutionize their operations, but the human cost is becoming increasingly apparent. This emerging trend goes far beyond simple automation. Businesses are leveraging AI technologies to dramatically streamline workflows, significantly reduce operational expenses, and make substantial cuts to their workforce. The primary goal? Maximizing productivity while minimizing human resources. While AI promises unprecedented efficiency and cost-effectiveness, it simultaneously threatens job security for countless employees across various industries. From customer service to data analysis, no sector seems immune to this technological disruption. As organizations embrace these digital solutions, workers find themselves at a critical crossroads, wondering about their professional futures in an increasingly algorithmic workplace. The message is clear: adapt or risk being left behind in this rapidly evolving corporate ecosystem. MORE...

Race to the Top: How This Tech Giant Could Dethrone Apple and Become the World's Most Valuable Company in 2024

Companies

2025-05-04 09:52:00

The AI Revolution: How Tech Giants Are Dominating the Global Market In a stunning testament to the transformative power of artificial intelligence, seven of the world's most valuable companies have emerged as AI powerhouses, reshaping the global economic landscape. These technological titans are not just leading the charge in innovation, but are fundamentally redefining how businesses operate and compete in the 21st century. From Silicon Valley to global tech hubs, these companies have strategically positioned themselves at the forefront of AI development, leveraging cutting-edge machine learning algorithms, advanced data analytics, and breakthrough computational technologies. Their market valuations reflect not just current performance, but the immense potential of artificial intelligence to drive future growth and disruption. Investors and industry experts are closely watching these AI leaders, recognizing that their technological investments today are laying the groundwork for unprecedented economic opportunities tomorrow. As AI continues to evolve, these seven companies are poised to play a pivotal role in shaping our increasingly digital and intelligent world. The message is clear: artificial intelligence is no longer just a technological trend, but a fundamental driver of corporate value and global economic transformation. MORE...

Cyber Siege: 50% of Flemish Businesses Battled Digital Threats in Shocking Breach Wave

Companies

2025-05-04 08:45:00

Cyber Threats Surge: Nearly Half of Flemish Businesses Under Digital Attack In a stark revelation of the growing digital vulnerability, recent cybersecurity research shows that an alarming 45.8 percent of Flemish companies fell victim to cyber attacks in the past year. The comprehensive annual report, commissioned by leading cybersecurity experts, highlights the escalating risks facing businesses in the digital landscape. The statistics paint a sobering picture of the digital threat environment, underscoring the critical need for robust cybersecurity measures. With nearly one in two companies experiencing a digital breach, organizations are increasingly recognizing the importance of proactive digital defense strategies. As cyber criminals become more sophisticated, Flemish businesses are being challenged to continuously upgrade their technological safeguards and employee awareness to protect sensitive data and maintain operational integrity. The report serves as a wake-up call for companies to invest in comprehensive cybersecurity solutions and training. MORE...

Insider Victory: How Private Investors Rode Elbit Systems' Massive ₪2.0b Market Surge

Companies

2025-05-04 08:43:51

Elbit Systems: Unveiling Corporate Ownership Dynamics

The ownership structure of Elbit Systems reveals a fascinating landscape of corporate control that goes beyond traditional investment patterns. While private companies hold substantial stakes in the organization, this concentration of ownership actually presents an intriguing opportunity for public influence and strategic engagement.

Contrary to conventional wisdom, the significant private company ownership doesn't necessarily diminish public participation. Instead, it creates a unique environment where strategic shareholders can potentially drive corporate governance and decision-making processes. This nuanced ownership model suggests that informed investors and stakeholders have meaningful channels to impact the company's direction.

The intricate web of private company control highlights the complex nature of modern corporate ownership. By understanding these dynamics, shareholders and interested parties can better navigate the strategic landscape of Elbit Systems, recognizing both the challenges and opportunities inherent in this distinctive ownership structure.

Ultimately, the ownership configuration underscores the importance of transparency, strategic insight, and active stakeholder engagement in today's corporate ecosystem.

MORE...Corporate Whispers: The Two-Word Warning Signal Echoing Across Boardrooms

Companies

2025-05-04 07:00:50

In the unpredictable landscape of global business, companies are facing an unprecedented challenge: economic uncertainty driven by escalating trade tensions. Traditionally, businesses provide investors with forward-looking financial projections, offering insights into expected performance. However, the current tariff-induced turbulence has prompted many major corporations to take an extraordinary step—completely suspending their financial guidance. The widespread practice of forecasting corporate performance has been disrupted by the complex web of international trade disputes. As tariffs create ripple effects across industries, executives find themselves navigating a maze of economic unpredictability. Rather than risk providing potentially inaccurate predictions, numerous companies are choosing strategic silence, leaving investors to interpret the shifting economic terrain. This trend of guidance suspension reflects the profound uncertainty businesses are experiencing in today's volatile global marketplace. By withholding projections, companies are signaling the unprecedented complexity of making reliable financial forecasts amid ongoing trade conflicts and economic volatility. MORE...

Small Investors Take the Lead: How Everyday Shareholders Are Steering Orell Füssli AG's Corporate Destiny

Companies

2025-05-04 06:33:44

Public Power: Retail Investors' Substantial Influence on Orell Füssli

In a fascinating display of modern investment dynamics, retail investors have emerged as key players in shaping the ownership landscape of Orell Füssli. Their significant control over the company reveals a compelling narrative of how individual investors can wield substantial influence in today's financial ecosystem.

The remarkable level of public shareholding suggests that everyday investors are not merely passive participants, but active stakeholders with the potential to impact corporate governance and strategic direction. This trend highlights a growing democratization of investment, where traditional power structures are being challenged by collective individual investor actions.

By holding a considerable portion of the company's shares, retail investors demonstrate their confidence in Orell Füssli's potential and their commitment to being more than just financial spectators. Their involvement signals a shift towards more transparent and participatory corporate ownership models.

This phenomenon underscores the increasing importance of individual investors in modern financial markets, showcasing their ability to collectively make meaningful contributions to corporate decision-making processes.

MORE...Inside Elon Musk's Empire: Shocking Revelations and Future Blueprints

Companies

2025-05-04 01:42:06

In a recent appearance on 'My View with Lara Trump', tech visionary Elon Musk offered an illuminating glimpse into the future of his groundbreaking technological ventures. The DOGE cryptocurrency champion and multi-company innovator shared insights into the evolving landscapes of Tesla, Grok AI, and Neuralink, highlighting his relentless pursuit of technological advancement. Musk, known for his ambitious and transformative approach to technology, continues to push the boundaries of innovation across multiple sectors. From electric vehicles and artificial intelligence to neural interface technology, he remains committed to developing solutions that could fundamentally reshape human interaction with technology. While specific details of his discussion were not fully disclosed, Musk's appearance signals his ongoing dedication to driving forward-thinking technological progress. His strategic vision continues to captivate both tech enthusiasts and industry observers, as he works to transform theoretical concepts into tangible, world-changing innovations. As these projects develop, the tech world watches with anticipation, eager to see how Musk's latest initiatives will potentially revolutionize transportation, AI, and human-machine interaction in the coming years. MORE...

Climate Uprising: San Diego Protesters Confront Big Oil's Environmental Sins

Companies

2025-05-04 00:35:00

In a powerful display of environmental solidarity, over a thousand passionate activists took to the streets of Downtown on Saturday, demanding urgent action on climate change. The massive demonstration united citizens from all walks of life, calling for comprehensive climate policies at both local and federal levels. Marchers carried vibrant signs, chanted compelling slogans, and showcased their commitment to protecting the planet. The diverse crowd represented a cross-section of the community, from young students to seasoned environmental advocates, all sharing a common goal of pushing for meaningful climate solutions. The peaceful protest highlighted the growing public concern about environmental challenges and the need for immediate, decisive action to combat climate change. Participants emphasized the importance of transformative policies that can help mitigate global warming and create a sustainable future for generations to come. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293