Behind Jumbo Group's Ownership: Private Titans and Individual Investors Carve Up the Corporate Pie

Companies

2025-05-05 05:34:58

Key Insights: Navigating Jumbo Group's Strategic Ownership Landscape Jumbo Group's extensive private company ownership reveals a complex and strategic approach to corporate governance. The significant private stake suggests that key strategic decisions are not merely procedural, but deeply influenced by the core ownership structure. By maintaining substantial private ownership, the group demonstrates a nuanced approach to corporate control. This ownership model allows for more agile decision-making processes, enabling leadership to implement strategic initiatives with greater flexibility and precision. The intricate ownership framework provides insights into how Jumbo Group potentially leverages its private ownership to drive innovation, maintain competitive advantages, and swiftly respond to market dynamics. Such a structure implies a concentrated leadership approach where strategic vision can be rapidly translated into actionable business strategies. Understanding this ownership model is crucial for investors, stakeholders, and industry analysts seeking to comprehend the group's operational philosophy and potential future trajectories. The private ownership structure serves as a critical lens through which the company's strategic intentions and potential growth pathways can be interpreted. MORE...

Boardroom Revolution: How Virtual Meetings Are Silencing Sandwiches and Protests

Companies

2025-05-05 04:00:26

The UK government is set to provide much-needed clarity on a legal ambiguity surrounding corporate governance, specifically addressing the status of virtual shareholder meetings. As businesses increasingly embrace digital transformation, the ability to conduct meetings entirely online has become a critical consideration for many companies. Currently, organizations exist in a legal grey zone when it comes to hosting shareholder meetings exclusively through digital platforms. The upcoming government intervention aims to remove uncertainty and provide a clear legal framework that will enable companies to confidently transition to online-only shareholder gatherings. This potential regulatory update reflects the growing trend of digital communication and the need for more flexible corporate governance practices. By addressing this legal uncertainty, the government hopes to support businesses in adopting more efficient and accessible meeting formats that align with modern technological capabilities. The clarification is expected to offer companies greater flexibility in how they engage with shareholders, potentially reducing costs and increasing participation by removing traditional geographical and logistical barriers associated with in-person meetings. Stakeholders across the corporate landscape are eagerly anticipating the government's detailed guidance, which could significantly impact how businesses conduct their shareholder communications in the future. MORE...

Oil Price Plunge Triggers Saudi Corporate Downsizing Wave

Companies

2025-05-05 04:00:26

In the face of declining oil prices, businesses are strategically pivoting to explore innovative revenue streams while simultaneously preparing for potential economic headwinds. The sharp drop in crude oil prices is casting a long shadow over government spending, prompting companies to adopt proactive and adaptive strategies to maintain financial stability. As budget constraints tighten, organizations are looking beyond traditional revenue models, seeking creative ways to diversify their income and mitigate the impact of reduced government expenditure. Executives are conducting comprehensive strategic reviews, identifying new market opportunities, and developing resilient business models that can withstand economic fluctuations. The current economic landscape demands agility and forward-thinking approaches. Companies are investing in digital transformation, exploring emerging markets, and reimagining their service offerings to stay competitive. By anticipating challenges and embracing innovation, businesses are positioning themselves to navigate the uncertain terrain of a potentially slowing economic environment. MORE...

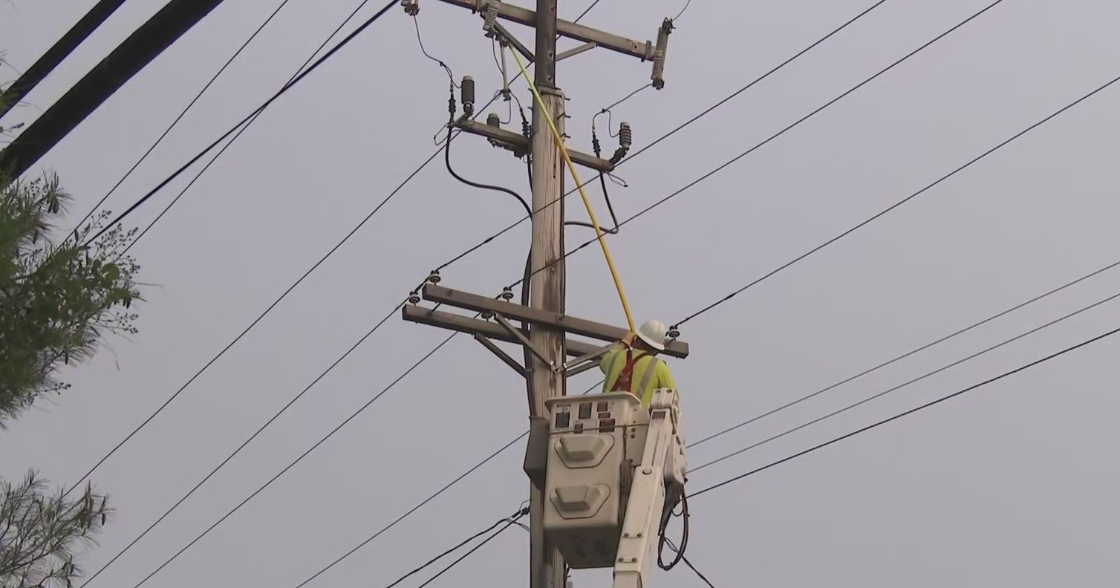

Lights Out: Pennsylvania Legislator Demands Accountability After Widespread Blackout Chaos

Companies

2025-05-05 03:48:57

In an upcoming hearing, residents who weathered the devastating storm will share their personal experiences alongside representatives from local power companies. The session promises to provide a comprehensive look at the storm's impact, giving voice to those who endured its most challenging moments while allowing utility providers an opportunity to explain their response and recovery efforts. Residents are expected to recount the hardships they faced during the storm's aftermath, detailing power outages, property damage, and the emotional toll of the natural disaster. Power company executives will have a chance to present their perspective, addressing community concerns and outlining steps taken to prevent similar disruptions in future extreme weather events. This hearing represents a critical moment of dialogue between affected communities and utility providers, offering a platform for understanding, accountability, and potential solutions to improve emergency preparedness and response. MORE...

Ownership Unveiled: Public Giants Dominate VSTECS Berhad's Shareholder Landscape

Companies

2025-05-05 03:25:11

Key Insights: Corporate Governance and Ownership Dynamics at VSTECS Berhad

VSTECS Berhad's ownership structure reveals a fascinating landscape of corporate influence, where significant public company stakes play a pivotal role in shaping strategic decision-making. The company's governance framework is characterized by substantial ownership from prominent public entities, which fundamentally impacts its operational and strategic direction.

The intricate web of ownership suggests that key corporate decisions are not made in isolation, but are instead carefully navigated through the lens of influential stakeholders. These public company shareholders bring not just capital, but also strategic perspectives that can profoundly shape the company's trajectory.

By examining the ownership patterns, it becomes clear that VSTECS Berhad operates within a complex ecosystem where institutional investors and public companies wield considerable influence. This interconnected ownership model ensures that strategic choices are meticulously evaluated, balancing corporate objectives with broader stakeholder interests.

Understanding these ownership dynamics provides crucial insights into the company's governance philosophy, revealing how external shareholders contribute to and potentially guide VSTECS Berhad's long-term strategic vision.

MORE...The AI Workplace Divide: Bridging the Gap Between Innovation and Equality

Companies

2025-05-05 03:19:20

The rapid advancement of artificial intelligence could potentially trigger significant economic disruption, with experts warning of potential job market challenges and widening social disparities. Pedro Uria-Recio from CIMB Group highlights the complex implications of the AI revolution, suggesting that the technology's transformative power might lead to increased unemployment and exacerbate existing economic inequalities. As AI technologies continue to evolve at an unprecedented pace, industries across the globe are grappling with the profound implications of automation and intelligent systems. While the technological breakthrough promises enhanced efficiency and innovation, it also raises critical concerns about the workforce's future and the potential socioeconomic consequences. Uria-Recio's insights underscore the need for proactive strategies to manage the AI transition, emphasizing the importance of reskilling, workforce adaptation, and inclusive technological development. The potential impact extends beyond mere job displacement, touching on broader questions of economic opportunity and social mobility in an increasingly digital world. MORE...

Earnings Surge Alert: Why IJM Corporation's Stock Could Be Your Next Smart Investment

Companies

2025-05-05 02:37:59

Understanding Investment Opportunities: A Beginner's Guide

For novice investors, the allure of a compelling business narrative can be incredibly tempting. The excitement of discovering a company with an inspiring story often leads many to make impulsive investment decisions without thoroughly examining the underlying financial fundamentals.

While an attractive company story can be captivating, seasoned investors understand that success requires more than just an appealing narrative. It demands careful analysis, strategic thinking, and a comprehensive understanding of market dynamics.

Before committing your hard-earned money, consider these critical factors:

- Financial performance and stability

- Market potential and growth prospects

- Management team's track record

- Competitive landscape

- Long-term sustainability

Remember, a great story might capture your imagination, but solid financial metrics and strategic vision are what truly drive successful investments.

MORE...Behind the Resilience: Why Japanese Firms Defy Business Odds

Companies

2025-05-05 00:49:19.jfif)

In a dazzling celebration of heritage and retail excellence, Matsuya Department Store commemorates a remarkable milestone—the centennial anniversary of its iconic Ginza location. This prestigious landmark, nestled in the heart of Tokyo's most glamorous shopping district, has been a beacon of luxury and style for an entire century. Founded in 1922, the Ginza outlet has witnessed Tokyo's dramatic transformation, evolving from a traditional retail space to a sophisticated shopping destination that seamlessly blends historical charm with contemporary elegance. Throughout its hundred-year journey, Matsuya has consistently set industry standards, offering discerning customers an unparalleled shopping experience. The anniversary celebration promises a series of special events, including retrospective exhibitions showcasing the store's rich history, limited-edition merchandise, and exclusive collaborations with renowned designers. Visitors can expect immersive displays that highlight Matsuya's significant contributions to Japanese retail culture and its enduring commitment to quality and innovation. As Tokyo's retail landscape continues to change, Matsuya Department Store remains a timeless institution, symbolizing resilience, tradition, and forward-thinking design. The Ginza outlet stands not just as a store, but as a living testament to Japan's remarkable retail heritage. MORE...

Insider Stakes: Asian Powerhouse Firms Where Leadership Owns the Game

Companies

2025-05-04 22:37:54

Navigating the Pulse of Asian Markets: Insider Ownership and Growth Potential As the global economic landscape continues to evolve, Asia emerges as a beacon of opportunity for discerning investors. The current market environment, characterized by gradually dissipating trade tensions and nuanced economic indicators, presents a complex yet promising investment terrain. At the heart of this dynamic ecosystem, companies with significant insider ownership stand out as particularly intriguing investment prospects. These organizations offer a unique value proposition, where management's substantial financial stake creates a powerful alignment of interests with external shareholders. This intrinsic connection suggests a deeper commitment to strategic decision-making and long-term value creation. Investors are increasingly recognizing that insider ownership can serve as a compelling indicator of confidence and potential. When company leaders have a meaningful financial investment in their own enterprise, it often translates to more prudent governance, strategic focus, and a genuine commitment to sustainable growth. As emerging markets continue to reshape the global economic narrative, Asia remains a pivotal region of interest. The interplay of insider ownership, strategic management, and robust market potential creates an exciting landscape for those willing to look beyond conventional investment paradigms. MORE...

Venture Capital Breakthrough: Uncork Secures Massive $300M Fund to Fuel Next-Gen Innovators

Companies

2025-05-04 22:23:42

Uncork Capital Expands Investment Portfolio with Impressive $300 Million Fundraise Venture capital firm Uncork Capital has made a significant stride in the startup ecosystem by successfully closing two new funds totaling $300 million. The milestone funding comprises Uncork VIII, a robust $225 million seed fund, and Uncork Plus IV, a strategic $75 million growth fund. This substantial capital injection underscores Uncork Capital's commitment to supporting innovative startups at critical stages of their development. The dual-fund approach allows the firm to provide comprehensive financial support, from early-stage seed investments to more mature growth opportunities. The new funds will enable Uncork Capital to continue identifying and nurturing promising entrepreneurial talent across various technology sectors, reinforcing their reputation as a key player in the venture capital landscape. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293