Silicon Valley's New Frontier: Funding the Future of Firearms Technology

Companies

2025-04-27 09:03:54

In a groundbreaking development, the Supreme Court has once again waded into the complex landscape of gun rights, this time focusing on restrictions for young adults under 21. Contributing Writer Jake Fogleman and I delved deep into the latest judicial decision that could significantly reshape firearm regulations for younger Americans. The Court's recent ruling sends a powerful message about constitutional rights and age-based restrictions, challenging long-standing assumptions about gun ownership and individual freedoms. By scrutinizing the age limits that have traditionally limited firearm access for those under 21, the Supreme Court is sparking a critical national conversation about personal liberty and public safety. Our in-depth analysis explores the nuanced implications of this decision, examining how it might impact young adults' ability to exercise their Second Amendment rights. The ruling not only challenges existing legal frameworks but also highlights the ongoing tension between protecting individual freedoms and maintaining community safety. As the legal landscape continues to evolve, this Supreme Court decision represents a pivotal moment in the ongoing debate about gun rights, age restrictions, and constitutional protections for younger Americans. MORE...

Liquefied Gas Giants Clash with Trump-Era Shipping Restrictions: A Compliance Conundrum

Companies

2025-04-27 09:00:03

Maritime Industry Warns: Foreign Vessel Levies Could Derail US Energy Ambitions The maritime and energy sectors are sounding the alarm over proposed administrative levies that could potentially undermine the United States' strategic goals of achieving global energy leadership. Industry leaders argue that the new tariffs on foreign vessels will create significant obstacles to the country's ambitious energy expansion plans. Experts contend that these additional financial burdens will not only increase operational costs but also reduce the competitiveness of US energy infrastructure. The proposed levies threaten to complicate international shipping dynamics and potentially slow down the momentum of America's energy sector growth. Key stakeholders from shipping, energy, and trade associations have voiced strong concerns, emphasizing that such protectionist measures could backfire. They warn that the additional costs might discourage foreign investment and limit the flexibility needed to maintain the United States' position as a global energy powerhouse. The administration's current approach risks creating unintended consequences that could ultimately hinder rather than help the nation's energy dominance strategy. Industry representatives are calling for a more nuanced approach that balances protective measures with the need for international collaboration and economic efficiency. As the debate continues, the potential impact on global energy markets and international maritime trade remains a critical point of discussion for policymakers and industry leaders alike. MORE...

Trade War Tremors: Local Stocks Ride the Tariff Rollercoaster

Companies

2025-04-27 07:25:18

Local Investors Remain Calm as Toledo Companies Navigate Trade Tensions The stock performance of five prominent Toledo-area companies listed on the New York Stock Exchange appears remarkably resilient amid the ongoing global trade uncertainties. Despite the complex landscape of international tariffs and economic tensions, these local businesses have demonstrated a surprising stability that has caught the attention of regional financial analysts. Investors and market watchers are closely monitoring how these Toledo-based companies are strategically positioning themselves to weather potential economic headwinds. The measured response of these stocks suggests a combination of strategic planning and adaptability that has helped them maintain investor confidence during turbulent market conditions. While many sectors have experienced significant volatility due to international trade disputes, these local companies seem to have developed robust strategies to mitigate potential risks. Their ability to navigate challenging economic environments reflects the strength and innovation of Toledo's business community. Financial experts continue to track the potential long-term implications of current trade policies, but for now, these Toledo companies appear to be charting a steady course through uncertain economic waters. MORE...

Supply Chain Survival: How Global Trade Tensions Are Forcing Companies to Hoard Inventory

Companies

2025-04-27 07:09:34

In the complex world of international trade, businesses traditionally respond to tariff impositions by rapidly stockpiling goods. However, the unpredictable nature of the Trump administration's trade policies has transformed this once-straightforward strategy into a high-stakes game of economic uncertainty. Companies now find themselves navigating a volatile landscape where traditional stockpiling tactics no longer guarantee protection. The rapidly shifting trade positions and unexpected policy reversals have created an environment where strategic planning feels more like a complex chess match than a predictable business maneuver. Executives are increasingly cautious, recognizing that knee-jerk stockpiling could potentially expose them to significant financial risks. The dynamic trade tensions demand a more nuanced and adaptive approach, forcing businesses to remain agile and prepared for sudden changes in the global economic terrain. MORE...

Squeezed and Strategizing: Foreign Firms Navigate China's Economic Crossfire

Companies

2025-04-27 04:00:03

In today's complex global trade landscape, manufacturers face significant financial challenges as they navigate the intricate world of international tariffs. These economic barriers impact both incoming raw materials and outgoing finished products, creating a complex web of potential additional costs that can dramatically affect a company's bottom line. From imported components to exported goods, businesses must carefully strategize to mitigate the financial burden imposed by cross-border trade regulations. MORE...

Institutional Investors Take Backseat: Public Companies Dominate KLK's Shareholder Landscape

Companies

2025-04-27 02:20:11

Ownership Dynamics of Kuala Lumpur Kepong Berhad: A Comprehensive Analysis

The ownership landscape of Kuala Lumpur Kepong Berhad reveals a fascinating interplay of corporate stakeholders, with public companies playing a significant role in the company's shareholding structure. This substantial institutional presence offers critical insights into the firm's governance and strategic positioning.

Key Insights

- Public companies demonstrate a notable ownership stake, signaling strong institutional confidence in the company's potential

- The concentrated ownership pattern suggests a strategic alignment of corporate interests

- Institutional involvement potentially indicates robust corporate governance and long-term investment strategies

By examining the ownership composition, investors and analysts can gain valuable perspectives on the company's financial health, strategic direction, and potential for future growth. The significant public company involvement underscores the company's credibility and attractiveness in the corporate investment landscape.

MORE...Corporate Exodus: Independent Directors Jump Ship as Business Storms Intensify

Companies

2025-04-27 00:00:00

The corporate landscape is experiencing a notable shift as independent directors increasingly step down from board positions, with technology companies bearing the brunt of this exodus. Mounting regulatory scrutiny and concerns about potential corporate misconduct are driving a wave of resignations that go far beyond typical professional transitions. While official statements often cite vague reasons like "personal commitments" or "preoccupation," industry experts recognize these explanations as carefully crafted euphemisms masking deeper governance challenges. The surge in voluntary board departures signals a growing unease among independent directors about legal and compliance risks that could potentially implicate their professional reputations. This trend underscores a critical need for enhanced corporate governance mechanisms. Independent directors are now being called upon to exercise heightened diligence, robust oversight, and unwavering accountability. The changing dynamics suggest that mere symbolic board membership is no longer acceptable in an era of increasing transparency and regulatory complexity. As companies navigate these turbulent waters, the role of independent directors has never been more crucial. Their ability to provide impartial oversight, challenge management decisions, and protect stakeholder interests has become a paramount concern for investors and regulatory bodies alike. MORE...

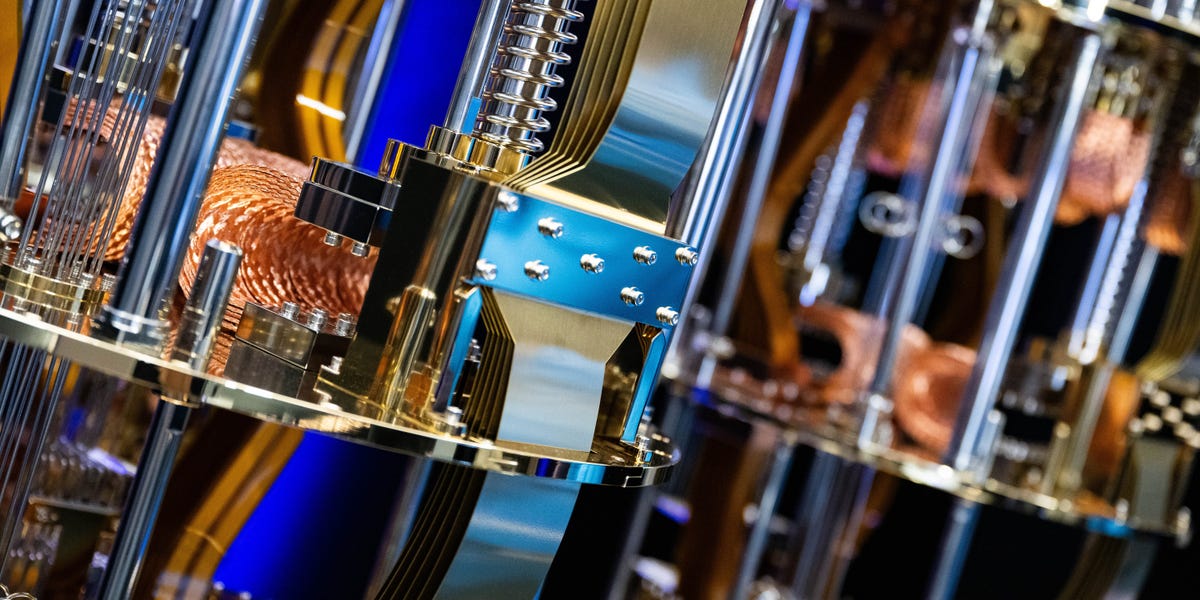

Silicon's Next Frontier: Can Quantum Computing Solve Its Talent Puzzle Before the AI Revolution?

Companies

2025-04-26 23:59:52

As the quantum computing industry rapidly evolves, innovative startups are taking a strategic approach to talent development by learning from the explosive growth and challenges of the AI sector. Recognizing that cutting-edge technology requires exceptional human expertise, these companies are proactively investing in comprehensive training programs designed to bridge the skills gap and cultivate the next generation of quantum computing professionals. Unlike the AI boom, which often struggled with talent shortages and rapid scaling, quantum computing startups are taking a more measured and intentional approach. They understand that developing quantum technology requires specialized knowledge that goes far beyond traditional computer science and engineering curricula. By creating targeted educational initiatives, these companies are not just recruiting talent but actively shaping the workforce of tomorrow. These training programs are multifaceted, offering internships, specialized workshops, and collaborative research opportunities that provide hands-on experience with quantum technologies. By partnering with universities, research institutions, and technical colleges, quantum computing startups are creating a robust pipeline of skilled professionals who can drive innovation in this complex and transformative field. The strategic investment in talent development reflects a mature understanding that technological breakthroughs are fundamentally powered by human creativity, expertise, and collaborative learning. As quantum computing continues to push the boundaries of computational possibilities, these forward-thinking startups are ensuring they have the intellectual capital needed to turn groundbreaking concepts into real-world solutions. MORE...

Power Play: Why Portland General Electric Could Be Your Next Dividend Goldmine

Companies

2025-04-26 21:49:06

Portland General Electric: A Hidden Gem in Dividend Investing

In the ever-changing landscape of investment strategies, dividend stocks have recently taken a backseat. However, savvy investors know that overlooked dividend opportunities can be treasure troves of steady income and potential growth. Today, we're diving deep into Portland General Electric Company (NYSE:POR) to uncover its potential as a standout performer in the dividend stock arena.

While many investors have shifted away from traditional equity income strategies, companies like Portland General Electric continue to offer compelling value propositions. Our recent comprehensive analysis of the top 10 overlooked dividend stocks has highlighted POR as a particularly intriguing candidate for investors seeking reliable returns.

In a market often characterized by volatility, dividend stocks provide a beacon of stability. Portland General Electric represents an excellent example of a utility company that not only maintains consistent dividend payments but also demonstrates potential for long-term appreciation.

Stay tuned as we break down the key factors that make Portland General Electric a noteworthy contender in the dividend stock landscape, offering insights that could help diversify and strengthen your investment portfolio.

MORE...Behind the Scenes: Healdsburg Senior Living's New Operator Emerges from Bankruptcy Shadows

Companies

2025-04-26 20:55:05

A new management team has taken the helm at Healdsburg Senior Living, but questions linger about its connection to the facility's previous financially troubled operator. The recently appointed company appears to have deep, intricate ties to the bankrupt former management, raising eyebrows among local stakeholders and community members. Despite the change in leadership, the underlying organizational links suggest a complex transition that goes beyond a simple management shift. Residents, families, and local officials are closely watching how these connections might impact the senior living facility's future operations, financial stability, and quality of care. The intertwined relationship between the new management and the previous bankrupt operator highlights the intricate nature of senior care administration, where organizational boundaries can often seem blurred. As the facility moves forward, transparency and clear communication will be crucial in maintaining trust and ensuring the well-being of its residents. Local authorities and community leaders are expected to continue monitoring the situation, seeking assurances that the senior living facility will maintain high standards of care and financial accountability, regardless of its management's historical connections. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293