Passport to Power: Travel Industry's Lavish Bet on Trump's Inaugural Celebration

Companies

2025-04-21 16:25:01

In a significant show of support, major players in the travel and tourism sector have pledged several million dollars towards President Donald Trump's anticipated 2025 inauguration celebration. Leading travel industry corporations have come together to financially back the upcoming inaugural events, demonstrating their commitment and alignment with the potential second Trump administration. The substantial financial contributions from these prominent travel companies underscore the industry's strategic interest in maintaining close ties with potential political leadership. By pooling their resources, these organizations aim to secure a prominent position at the inaugural festivities and potentially influence future policy discussions that could impact their business sectors. While the exact details of individual contributions remain confidential, the collective investment signals a strong vote of confidence from the travel industry's most influential companies. This financial backing represents more than just a monetary commitment—it's a strategic move to position themselves favorably in the potential political landscape of the next presidential term. MORE...

Tariff Tactics: How Companies Are Dodging Taxes in America's Trade Loopholes

Companies

2025-04-21 16:10:07

As trade tensions continue to simmer between the United States and its global trading partners, foreign trade zones are emerging as a strategic lifeline for businesses navigating the complex landscape of international commerce. These specialized areas offer companies a unique financial advantage: the ability to store imported goods without immediately incurring hefty tariff charges. With the ongoing trade war intensifying under the Trump administration, more businesses are turning to foreign trade zones as a smart economic buffer. These zones provide a critical financial breathing room, allowing companies to temporarily suspend or even reduce duty payments on imported merchandise. It's a strategic approach that can help businesses minimize their tax burden and maintain competitive pricing in an increasingly volatile global market. The growing popularity of these trade zones reflects the mounting challenges faced by importers in today's unpredictable economic environment. By offering a flexible and financially prudent alternative to traditional import processes, foreign trade zones are becoming an increasingly attractive option for companies looking to protect their bottom line and maintain agility in an era of escalating trade tensions. MORE...

Feathers, Tokens, and Tech Titans: Inside Trump's Record-Breaking Inauguration Fundraising Blitz

Companies

2025-04-21 16:09:43

In a remarkable display of financial support, President Trump's second inauguration campaign broke unprecedented fundraising records, amassing an impressive $239 million through contributions from a diverse range of corporate supporters. The extensive network of companies rallied behind the presidential campaign, demonstrating significant financial backing and strategic investment in the political landscape. The substantial fundraising achievement highlighted the robust corporate enthusiasm and strategic alliances that propelled the inauguration's financial success. With an unprecedented level of corporate engagement, the campaign showcased its ability to attract substantial monetary support from various business sectors, underscoring the complex interplay between political ambitions and corporate interests. This extraordinary fundraising milestone not only set new benchmarks for inaugural campaign financing but also reflected the deep-rooted connections between political leadership and the corporate world during this pivotal moment in American political history. MORE...

Workplace Excellence: MJ Companies Clinches Top Honors in Three States

Companies

2025-04-21 16:00:00

The MJ Companies Celebrates Multiple 'Best Place to Work' Recognitions Across Three Major Markets The MJ Companies is proud to announce its outstanding achievement of being named a Best Place to Work in three distinct metropolitan areas: Indiana, Denver, and Phoenix. This prestigious recognition highlights the company's commitment to creating an exceptional workplace environment that prioritizes employee satisfaction, professional growth, and innovative company culture. By earning this distinguished honor in multiple regions, The MJ Companies demonstrates its ability to consistently provide a supportive and dynamic work atmosphere that attracts and retains top talent. The award reflects the organization's dedication to fostering a positive workplace where employees feel valued, engaged, and motivated to excel in their professional roles. This multi-market recognition underscores The MJ Companies' strategic approach to workplace excellence and its ongoing efforts to create an inclusive, collaborative, and rewarding professional environment across different geographic locations. MORE...

Investor Alert: Bronstein, Gewirtz & Grossman Probes Potential Misconduct at Greenbrier Companies

Companies

2025-04-21 16:00:00

Bronstein, Gewirtz & Grossman, LLC Launches Comprehensive Investigation into Potential Investor Claims

In a proactive move to protect investor interests, the renowned legal firm Bronstein, Gewirtz & Grossman, LLC has initiated a thorough investigation into potential legal claims. The investigation aims to uncover and address any potential securities violations that may have impacted investors.

The law firm is currently reaching out to shareholders and investors who may have experienced significant financial losses during recent market transactions. Their dedicated legal team is committed to conducting a comprehensive review of the circumstances surrounding potential claims.

Investors who believe they may have been adversely affected are encouraged to contact the firm's legal representatives for a confidential consultation. The investigation is designed to provide transparency and seek potential remedies for those who may have suffered financial damages.

Bronstein, Gewirtz & Grossman, LLC has a long-standing reputation for representing investors and holding corporations accountable for potential misconduct. Their experienced legal professionals are prepared to provide expert guidance and support throughout the investigative process.

For more information or to discuss potential claims, interested parties can contact the firm directly through their official channels.

MORE...Pope Francis' Legacy of Change: The 5 Companies Reshaping Global Economics Through 'Inclusive Capitalism'

Companies

2025-04-21 15:34:00

Pope Francis emerged as a powerful advocate for a transformative economic vision, passionately promoting what Vatican experts described as compassionate capitalism. His groundbreaking approach sought to humanize economic systems, emphasizing social responsibility and ethical considerations alongside financial growth. By challenging traditional economic paradigms, the pontiff championed a more inclusive model of global commerce—one that prioritizes human dignity and social welfare over pure profit. His innovative perspective urged business leaders and policymakers to view economic development through a lens of empathy and shared prosperity. Through numerous speeches, encyclicals, and global dialogues, Pope Francis consistently argued that economic systems should serve humanity, not the other way around. His vision represented a radical reimagining of capitalism, calling for a more compassionate, equitable approach to global economic interactions. MORE...

Massive $1.3B Buyout: Local Insurance Giant Lands in Corporate Crosshairs

Companies

2025-04-21 15:26:58

In a groundbreaking merger that promises to reshape the industry landscape, two major players are set to join forces, creating a powerhouse with an impressive $12 billion in combined assets. This strategic alliance represents a significant milestone, bringing together complementary strengths and resources to drive innovation and market expansion. The newly formed company is poised to leverage its substantial financial foundation to unlock unprecedented opportunities, streamline operations, and deliver enhanced value to stakeholders. By combining their expertise, resources, and market reach, the merged entity is positioned to become a formidable competitor in the sector, with the potential to set new standards of excellence and drive transformative growth. Investors and industry experts are closely watching this development, anticipating the synergies and strategic advantages that will emerge from this bold corporate consolidation. The merger signals a new era of strategic collaboration and demonstrates the dynamic nature of today's competitive business environment. MORE...

Grocery Price War: Save Mart Slashes Prices in Bold Consumer Move

Companies

2025-04-21 15:25:27

Attention savvy shoppers! Save Mart and Lucky stores are offering an incredible opportunity to stock up on fresh, high-quality produce at unbeatable prices. Customers can now enjoy massive savings across thousands of items, with a special focus on the vibrant and fresh produce section. From creamy avocados and crisp cucumbers to juicy tomatoes, zesty onions, hearty potatoes, and colorful peppers, shoppers can fill their carts with farm-fresh goodness without breaking the bank. Whether you're planning a healthy meal, preparing a summer salad, or stocking up your kitchen, these incredible discounts make it easier than ever to eat fresh and save big. Don't miss out on this amazing opportunity to enjoy top-quality produce at prices that will make your wallet smile. Head to your local Save Mart or Lucky store today and take advantage of these unbeatable savings! MORE...

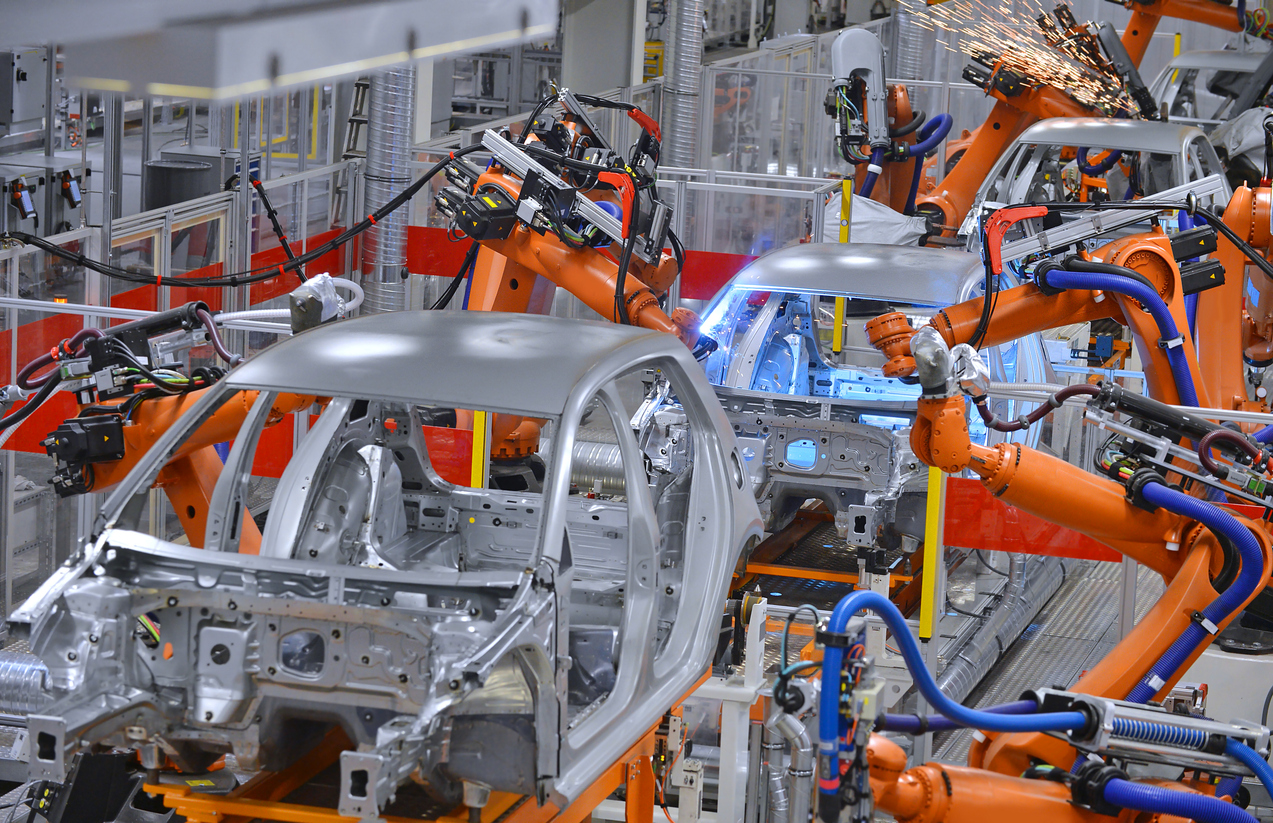

Wheels of Change: Inside the Auto Industry's Battle to Calm Sticker Shock

Companies

2025-04-21 14:45:29

Media Shockwaves: Papal Passing and Journalism Leadership Controversy

The recent passing of the Pope has sent ripples through the communication landscape, prompting extensive media coverage and reflection on the global significance of this momentous event. Simultaneously, the journalism world is abuzz with controversy surrounding the sudden dismissal of a prominent media leadership figure.

Papal Transition: Communication Challenges and Media Dynamics

The death of the Pope represents more than just a religious milestone—it's a complex communication event that tests media organizations' ability to report sensitively, accurately, and comprehensively. Newsrooms worldwide are navigating the delicate balance between historical documentation and respectful reporting.

CJR Leadership Dispute: A Dramatic Unfolding

In a parallel narrative of professional upheaval, the recently fired leader of the Columbia Journalism Review has launched a robust counteroffensive, challenging the circumstances of their dismissal and drawing significant attention to internal media industry dynamics.

These interconnected stories highlight the ever-evolving nature of media, communication, and institutional leadership in the 21st century.

MORE...Analysts Reveal: Why Coca-Cola Could Be Your Ultimate Dividend Powerhouse

Companies

2025-04-21 14:24:24

Coca-Cola: A Dividend Powerhouse in the American Stock Market

In the world of dividend investing, few stocks shine as brightly as The Coca-Cola Company (NYSE:KO). Following our recent exploration of the top 13 American dividend stocks recommended by analysts, we're diving deeper into why Coca-Cola stands out as a premier investment for income-seeking investors.

Dividend stocks have long been a cornerstone of smart investment strategies, offering investors a reliable stream of income and potential for steady growth. Coca-Cola, with its decades-long track record of consistent dividend payments, exemplifies the gold standard of dividend investing.

What sets Coca-Cola apart is not just its global brand recognition, but its remarkable ability to deliver value to shareholders through reliable dividend distributions. As economic landscapes shift and market conditions change, Coca-Cola has remained a beacon of stability for investors seeking dependable returns.

Investors looking to build a robust, income-generating portfolio would be wise to pay close attention to how Coca-Cola compares to other top dividend stocks in the American market. Its combination of brand strength, global reach, and financial consistency makes it a compelling choice for both conservative and growth-oriented investors.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293