AI Regulation Balancing Act: FTC's Measured Approach to Tech Innovation

Companies

2025-04-23 13:13:42

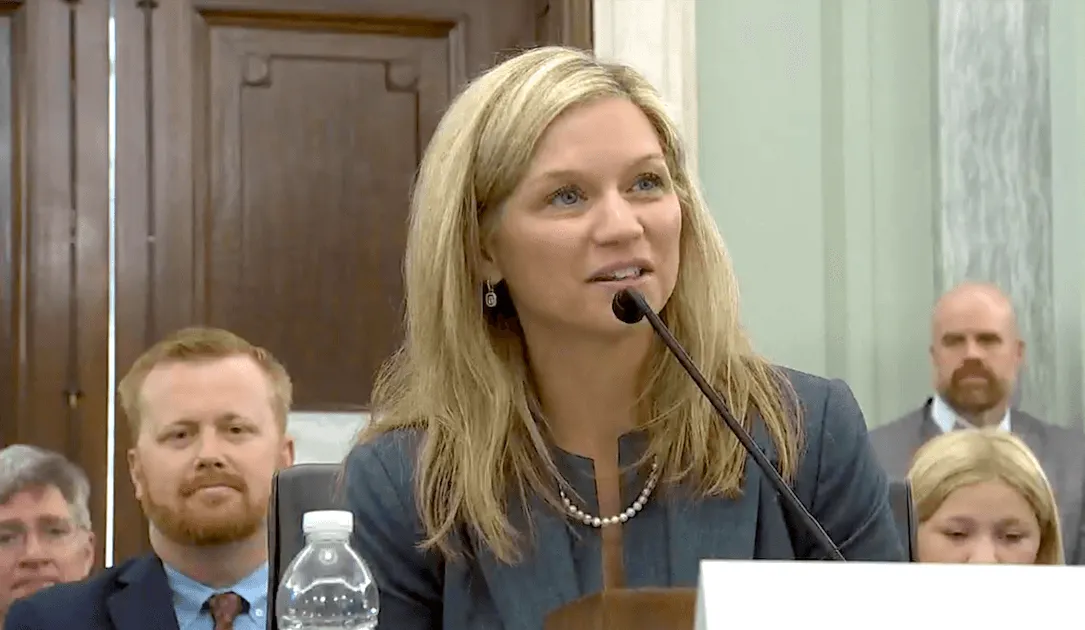

In a bold stance on technological advancement, Melissa Holyoak, a Republican commissioner at the Federal Trade Commission, is championing a pro-innovation approach to artificial intelligence. She emphasizes the agency's commitment to fostering AI growth, pledging to avoid overzealous enforcement and unnecessary regulatory barriers that could stifle technological progress. Holyoak's vision signals a balanced approach to AI development, focusing on creating an environment that encourages innovation while maintaining responsible oversight. Her statement underscores the FTC's intent to support emerging technologies without imposing restrictive measures that might impede the rapid evolution of artificial intelligence. MORE...

Biotech Breakthrough: Apogee Therapeutics Poised to Fuel Next-Gen Growth Strategy

Companies

2025-04-23 13:02:01

Investing in Unprofitable Companies: A Surprising Path to Wealth The world of stock investing often defies conventional wisdom, and nowhere is this more evident than in the potential of seemingly underperforming businesses. While profitability is typically the gold standard for investors, there's a fascinating strategy that challenges this traditional approach. Consider the remarkable journey of companies that initially appear unprofitable but harbor tremendous growth potential. These enterprises aren't just struggling businesses; they're often innovative disruptors on the cusp of transformative breakthroughs. Visionary investors understand that today's financial losses can be tomorrow's strategic investments. Take tech giants like Amazon, which spent years operating at a loss before becoming a global powerhouse. Their initial unprofitability didn't deter forward-thinking investors who recognized the company's long-term potential. Similarly, many startup ecosystems are built on the premise that short-term financial challenges can mask extraordinary future value. Successful investment in such companies requires more than blind optimism. It demands careful analysis of a company's underlying business model, technological innovation, market positioning, and growth trajectory. Investors must look beyond quarterly earnings and see the broader narrative of potential transformation. The key is to distinguish between genuinely promising companies with temporary financial constraints and those with fundamentally flawed business models. This nuanced approach separates strategic investors from speculative gamblers. While not every unprofitable company will become a success story, those who master this investment strategy can potentially reap extraordinary rewards. It's a testament to the complex and often counterintuitive nature of financial markets. MORE...

Trade Tensions Bite: German Businesses in China Reel from Tariff Tsunami

Companies

2025-04-23 13:00:09

In the current dynamic business landscape, companies are taking diverse approaches to their China strategy. While a significant portion of businesses remain cautious and observing market trends, a notable 38% are proactively intensifying their localization efforts in the Chinese market. This strategic move reflects a nuanced understanding of the complex and evolving business environment, with forward-thinking organizations recognizing the potential for growth and adaptation in one of the world's largest economies. These companies are not merely waiting on the sidelines but are actively investing in tailoring their products, services, and strategies to resonate more deeply with Chinese consumers and business practices. By prioritizing localization, they aim to build stronger connections, enhance market penetration, and create more meaningful engagement in this competitive and culturally rich marketplace. MORE...

Dairy Meets Slice: How Midwest Dairy is Revolutionizing Milk Consumption Through Pizza Partnerships

Companies

2025-04-23 13:00:00

In an exciting collaboration aimed at boosting dairy consumption, Midwest Dairy has joined forces with three popular pizza chains: Pizza Ranch, Marco's Pizza, and Godfather's Pizza. This strategic partnership is designed to explore creative and innovative approaches to bringing more dairy products directly to consumers' plates. By leveraging the widespread popularity of pizza as a beloved food item, these industry leaders are working together to develop unique strategies that will highlight dairy's versatility and nutritional value. The partnership seeks to not only increase dairy consumption but also showcase the delicious ways dairy can be incorporated into everyday meals. Through this collaborative effort, consumers can expect to see new menu offerings, promotional campaigns, and potentially groundbreaking culinary innovations that celebrate the rich, creamy goodness of dairy products. Midwest Dairy's proactive approach demonstrates their commitment to connecting consumers with high-quality, nutritious dairy options in exciting and unexpected ways. MORE...

Brexit Aftershock: UK Businesses Reel from Mounting Tariff and Tax Pressures

Companies

2025-04-23 12:49:38

The financial landscape of public finances is showing signs of strain, with the national balance sheet revealing growing challenges. Recent economic indicators suggest a complex picture of fiscal health that goes beyond simple numbers. Government budgets are feeling the pressure from multiple fronts, including rising infrastructure costs, increased social service demands, and the ongoing economic uncertainties. The traditional metrics of public financial stability are being tested like never before, highlighting the need for innovative fiscal strategies. Mounting debt levels and shrinking revenue streams are creating a perfect storm of financial complexity. Policymakers are now faced with the critical task of balancing economic growth, public service maintenance, and long-term financial sustainability. The ripple effects of recent global economic disruptions continue to impact public financial frameworks, forcing governments to reassess their economic approaches and seek more resilient financial models. This evolving scenario demands creative solutions and strategic financial planning to navigate the increasingly challenging economic terrain. MORE...

Silent Profit Drain: How Businesses Hemorrhage $98.5M Annually Without Knowing Why

Companies

2025-04-23 12:30:57

In the world of corporate finance, there's a sardonic quip that captures a peculiar organizational paradox: companies seemingly obsess over tracking down minuscule expenses while simultaneously hemorrhaging substantial sums. This humorous observation highlights a fascinating disconnect in corporate financial management. Picture this: a multinational corporation meticulously scrutinizing a $5 taxi receipt while potentially overlooking inefficiencies that could be costing millions. The irony is both comical and revealing. It speaks to a risk-averse culture where penny-pinching becomes a reflexive behavior, often at the expense of more strategic financial thinking. This phenomenon isn't just a joke—it's a real insight into organizational psychology. Many companies develop complex expense tracking systems that can detect the smallest financial discrepancies, yet struggle to address systemic waste or strategic missteps that drain far more resources. The lesson here is clear: true financial wisdom lies not in micromanaging every cent, but in understanding the broader economic landscape and focusing on value creation. Sometimes, the most expensive mistakes are the ones hidden in plain sight, masked by an obsession with trivial details. MORE...

Wall Street's Hidden Gem: Is Carlisle Companies the Investment Opportunity You've Been Overlooking?

Companies

2025-04-23 11:39:44

Madison Investments Reveals Mid Cap Fund Performance for First Quarter 2025 In a recent investor letter, Madison Investments provided insights into the performance of its Madison Mid Cap Fund, offering transparency and detailed analysis for investors. The fund's Class Y shares experienced a modest decline of 4.15% during the first quarter, slightly underperforming the Russell Midcap Index, which decreased by 3.40%. Investors interested in a comprehensive review of the fund's performance can download the full investor letter to gain deeper insights into the market dynamics and strategic positioning of the fund's portfolio. The letter not only highlights the fund's quarterly performance but also provides a breakdown of its top holdings, giving investors a clear view of the fund's current investment strategy and potential future opportunities. While the slight underperformance may raise questions, Madison Investments remains committed to delivering value and maintaining a strategic approach to mid-cap investments in an evolving market landscape. Investors and financial professionals are encouraged to review the detailed report to understand the nuanced factors influencing the fund's performance during this quarter. MORE...

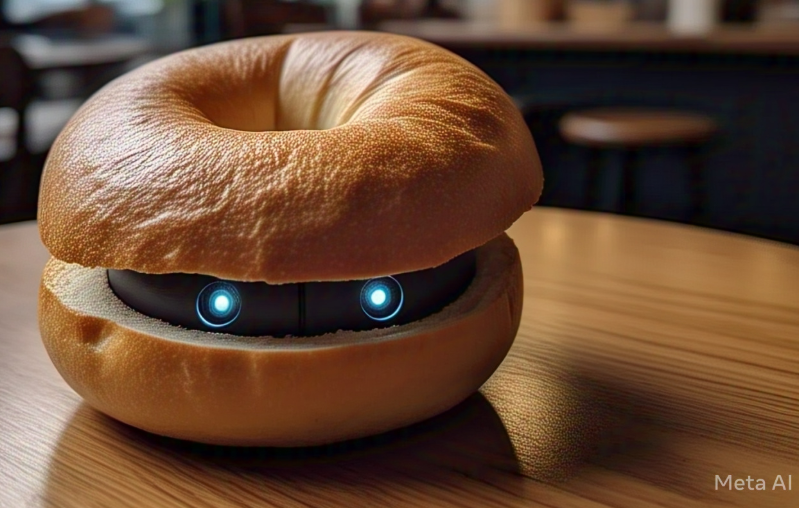

Cracking Customer Insights: Bagel AI Bags $5.5M to Decode Market Desires

Companies

2025-04-23 11:00:25

Bagel AI, an innovative product intelligence startup, has successfully secured $5.5 million in funding to revolutionize how companies understand and develop products that truly resonate with their customers. The emerging tech company aims to bridge the critical gap between customer desires and product development by providing cutting-edge AI-powered insights. By leveraging advanced machine learning algorithms, Bagel AI helps businesses decode complex customer feedback and transform it into actionable product strategies. The recent funding round signals strong investor confidence in the startup's potential to disrupt traditional market research and product development methodologies. With this capital injection, Bagel AI plans to expand its team, enhance its technological capabilities, and accelerate its mission of helping companies build products that customers genuinely want. By offering a data-driven approach to product intelligence, Bagel AI empowers organizations to make more informed decisions, reduce development risks, and create solutions that directly address customer needs. This innovative platform could potentially save companies significant time and resources by providing precise, AI-generated insights into market demands. As the tech industry continues to evolve, startups like Bagel AI are demonstrating how artificial intelligence can transform traditional business processes and drive more customer-centric innovation. MORE...

Loblaw Investors' Golden Ticket: A Staggering 218% Return Over Five Years

Companies

2025-04-23 10:59:25

When investing in stocks, savvy investors understand that every investment carries inherent risks. While it's true that a stock could potentially plummet to zero, losing 100% of its value, this stark reality shouldn't deter you from smart, strategic investing. The key lies in selecting robust, well-managed companies with strong fundamentals and growth potential. A high-quality company can transform your investment journey from a nerve-wracking gamble into a calculated opportunity for wealth creation. These exceptional businesses demonstrate resilience, innovative strategies, and consistent performance that can help mitigate potential losses and generate meaningful returns over time. By conducting thorough research, diversifying your portfolio, and maintaining a long-term perspective, you can navigate the complex world of stock investments with confidence and prudence. Remember, successful investing isn't about eliminating risk entirely, but about understanding and managing it intelligently. MORE...

Wall Street Braces: Credit Card Giants Brace for Potential Financial Storm

Companies

2025-04-23 10:50:05

Navigating Economic Uncertainty: Credit Card Companies Brace for Potential Challenges In an era of economic unpredictability, major credit card issuers are strategically positioning themselves to weather potential financial headwinds. Financial institutions are demonstrating remarkable foresight by implementing proactive risk management strategies designed to protect both their interests and their customers. These companies are carefully analyzing market trends, consumer spending patterns, and economic indicators to develop robust contingency plans. By anticipating potential economic downturns, credit card providers are taking preemptive steps to mitigate potential financial risks. Key strategies include: • Tightening credit requirements • Enhancing credit scoring models • Developing more flexible payment options • Increasing reserve funds • Implementing advanced risk assessment technologies The goal is not just survival, but maintaining financial stability and continuing to provide valuable services to consumers during challenging economic periods. Credit card companies are proving that strategic preparation can transform potential challenges into opportunities for resilience and innovation. As the financial landscape continues to evolve, these proactive measures demonstrate the industry's commitment to adaptability and customer protection in an increasingly complex economic environment. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293