Investor Shift: M. Kulyk & Associates Trims Stakes in Tech Giant Taiwan Semiconductor

Manufacturing

2025-03-09 11:38:16Content

In a strategic portfolio adjustment, M. Kulyk & Associates LLC has significantly reduced its stake in Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM). According to the firm's recent Form 13F filing with the Securities & Exchange Commission, the institutional investor trimmed its holdings by an impressive 21.2% during the fourth quarter.

Following this strategic divestment, M. Kulyk & Associates LLC now maintains a position of 58,102 shares in the global semiconductor manufacturing giant. This move reflects the firm's dynamic approach to investment management and potential reassessment of its technology sector exposure.

Taiwan Semiconductor Manufacturing Company, widely known as TSMC, remains a critical player in the global semiconductor industry, making such institutional investment shifts particularly noteworthy for market observers and investors.

Semiconductor Giant's Strategic Portfolio Adjustment: A Deep Dive into Institutional Investment Trends

In the dynamic world of technological investments, institutional investors continually recalibrate their portfolios, reflecting the ever-changing landscape of global semiconductor markets. The recent strategic moves by investment firms provide crucial insights into the intricate dance of financial positioning and market sentiment.Navigating the Complex Terrain of Semiconductor Investments

Institutional Investment Landscape

The semiconductor industry represents a critical nexus of technological innovation and financial strategy. M. Kulyk & Associates LLC's recent portfolio adjustment illuminates the nuanced approach institutional investors take when managing high-tech investments. By reducing their holdings in Taiwan Semiconductor Manufacturing Company (TSM), the firm signals a sophisticated understanding of market dynamics and potential strategic realignments. Institutional investors like M. Kulyk & Associates LLC play a pivotal role in shaping market perceptions and investment trends. Their decision to trim holdings by 21.2% during the fourth quarter is not merely a numerical adjustment but a calculated response to broader market conditions, technological shifts, and potential economic indicators.Taiwan Semiconductor's Market Position

Taiwan Semiconductor Manufacturing Company stands as a global leader in semiconductor manufacturing, commanding significant attention from institutional investors worldwide. The company's strategic importance in the global technology supply chain makes every investment decision a matter of intense scrutiny. The 58,102 shares retained by M. Kulyk & Associates LLC represent more than a simple numerical figure. It reflects a carefully considered investment strategy that balances risk mitigation with potential growth opportunities. Such precise portfolio management demonstrates the sophisticated approach modern institutional investors employ in navigating complex technological markets.Investment Strategy and Market Implications

The reduction in holdings provides a fascinating glimpse into the broader investment ecosystem. Institutional investors like M. Kulyk & Associates LLC continuously assess market conditions, technological trends, and potential future developments. Their strategic decisions are informed by comprehensive analysis, including factors such as global supply chain dynamics, technological innovation, and geopolitical considerations. This particular portfolio adjustment suggests a nuanced approach to semiconductor investments. The 21.2% reduction is not a wholesale divestment but a calculated repositioning that reflects the firm's adaptive investment philosophy. Such strategic moves are critical in an industry characterized by rapid technological change and complex global dynamics.Future Outlook and Market Dynamics

The semiconductor industry continues to be a critical battleground of technological innovation and financial strategy. Institutional investors must navigate a complex landscape of emerging technologies, geopolitical tensions, and rapidly evolving market conditions. M. Kulyk & Associates LLC's recent portfolio adjustment exemplifies the sophisticated approach required to succeed in this challenging environment. As global technology continues to advance, the role of institutional investors becomes increasingly crucial. Their ability to anticipate market trends, assess technological potential, and make strategic investment decisions will be paramount in shaping the future of the semiconductor industry.RELATED NEWS

Manufacturing

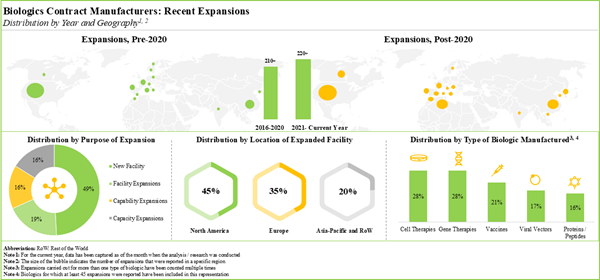

Biologics Manufacturing: The High-Stakes Battle for Pharma's Next Frontier

2025-03-18 09:02:00

Manufacturing

Trade War Squeeze: China's Factory Sector Shrinks Under Tariff Pressure

2025-04-30 01:47:26

.jpg)