Gold Prices Steady as NY Manufacturing Data Signals Economic Resilience

Manufacturing

2025-04-15 12:30:00Content

Dive into the World of Financial Insights with Kitco News

Stay ahead of the curve with Kitco News, your ultimate destination for cutting-edge financial reporting and expert analysis. Our dedicated team of journalists and market specialists brings you real-time updates and in-depth coverage across multiple critical sectors:

• Precious Metals: Uncover the latest trends and movements in gold, silver, platinum, and other valuable commodities

• Cryptocurrency: Navigate the dynamic world of digital currencies with our comprehensive market insights

• Mining Industry: Get exclusive perspectives on global mining operations and emerging technologies

• World Markets: Track global economic shifts and investment opportunities

• Global Economy: Understand complex economic landscapes through expert commentary and analysis

Whether you're an investor, market professional, or simply curious about global financial dynamics, Kitco News provides the most current, reliable, and insightful information to help you make informed decisions.

Stay informed. Stay ahead. Trust Kitco News for your financial intelligence.

Global Market Insights: Navigating the Complex Landscape of Financial Frontiers

In an era of unprecedented economic volatility and technological transformation, understanding the intricate dynamics of global markets has become more critical than ever. Investors, analysts, and financial professionals are constantly seeking comprehensive insights that transcend traditional boundaries, exploring emerging trends that reshape our economic ecosystem.Unraveling Market Complexities: Your Ultimate Guide to Strategic Financial Intelligence

The Evolving Landscape of Financial Reporting and Analysis

Modern financial journalism represents a sophisticated intersection of data science, economic theory, and real-time global communication. Contemporary news platforms are no longer passive information conduits but dynamic ecosystems that synthesize complex economic narratives. Professional analysts meticulously curate information, transforming raw data into actionable intelligence that empowers decision-makers across diverse sectors. The transformation of financial reporting reflects broader technological disruptions. Advanced algorithms, machine learning techniques, and artificial intelligence now play pivotal roles in decoding market signals, providing unprecedented depth and nuance to economic interpretations. These technological innovations enable more precise, predictive, and contextually rich financial insights.Precious Metals, Cryptocurrency, and Emerging Market Dynamics

The contemporary financial landscape is characterized by remarkable interconnectedness and rapid metamorphosis. Traditional asset classes like precious metals are experiencing profound reimagination alongside digital currencies, creating a complex, multifaceted investment environment. Sophisticated investors recognize that understanding these intricate relationships requires holistic, interdisciplinary approaches. Cryptocurrency and blockchain technologies have fundamentally disrupted conventional financial paradigms, introducing decentralized mechanisms that challenge established economic frameworks. Meanwhile, precious metals continue to serve as critical hedging instruments, offering stability amidst technological and geopolitical uncertainties. The symbiotic relationship between these seemingly disparate asset classes represents a fascinating area of financial exploration.Global Economic Trends and Strategic Intelligence

Comprehensive economic analysis transcends mere numerical interpretation. It demands nuanced understanding of geopolitical dynamics, technological innovations, and complex systemic interactions. Professional financial intelligence platforms synthesize multidimensional data streams, providing stakeholders with holistic perspectives that illuminate potential opportunities and mitigate potential risks. Emerging markets present particularly intriguing investment landscapes, characterized by rapid technological adoption, demographic shifts, and evolving regulatory environments. Navigating these complex terrains requires sophisticated analytical frameworks that integrate quantitative metrics with qualitative contextual understanding.Technological Disruption and Financial Communication

The digital revolution has fundamentally transformed how financial information is generated, disseminated, and consumed. Modern news platforms leverage cutting-edge technologies to deliver real-time, contextually rich insights that empower global audiences. Machine learning algorithms, natural language processing, and advanced data visualization techniques have revolutionized financial communication. These technological innovations enable more transparent, accessible, and democratized financial knowledge. Investors and professionals can now access sophisticated analytical tools that were previously available only to institutional players, fundamentally reshaping the global financial information ecosystem.Navigating Uncertainty: Strategic Perspectives for Modern Investors

In an increasingly complex and interconnected world, successful financial navigation demands adaptability, continuous learning, and sophisticated analytical capabilities. Professional financial intelligence platforms serve as critical resources, providing nuanced insights that transcend traditional reporting models. The most effective strategies embrace complexity, recognizing that economic systems are dynamic, nonlinear, and fundamentally unpredictable. By cultivating comprehensive understanding and maintaining flexible perspectives, investors and professionals can transform uncertainty into strategic opportunity.RELATED NEWS

Manufacturing

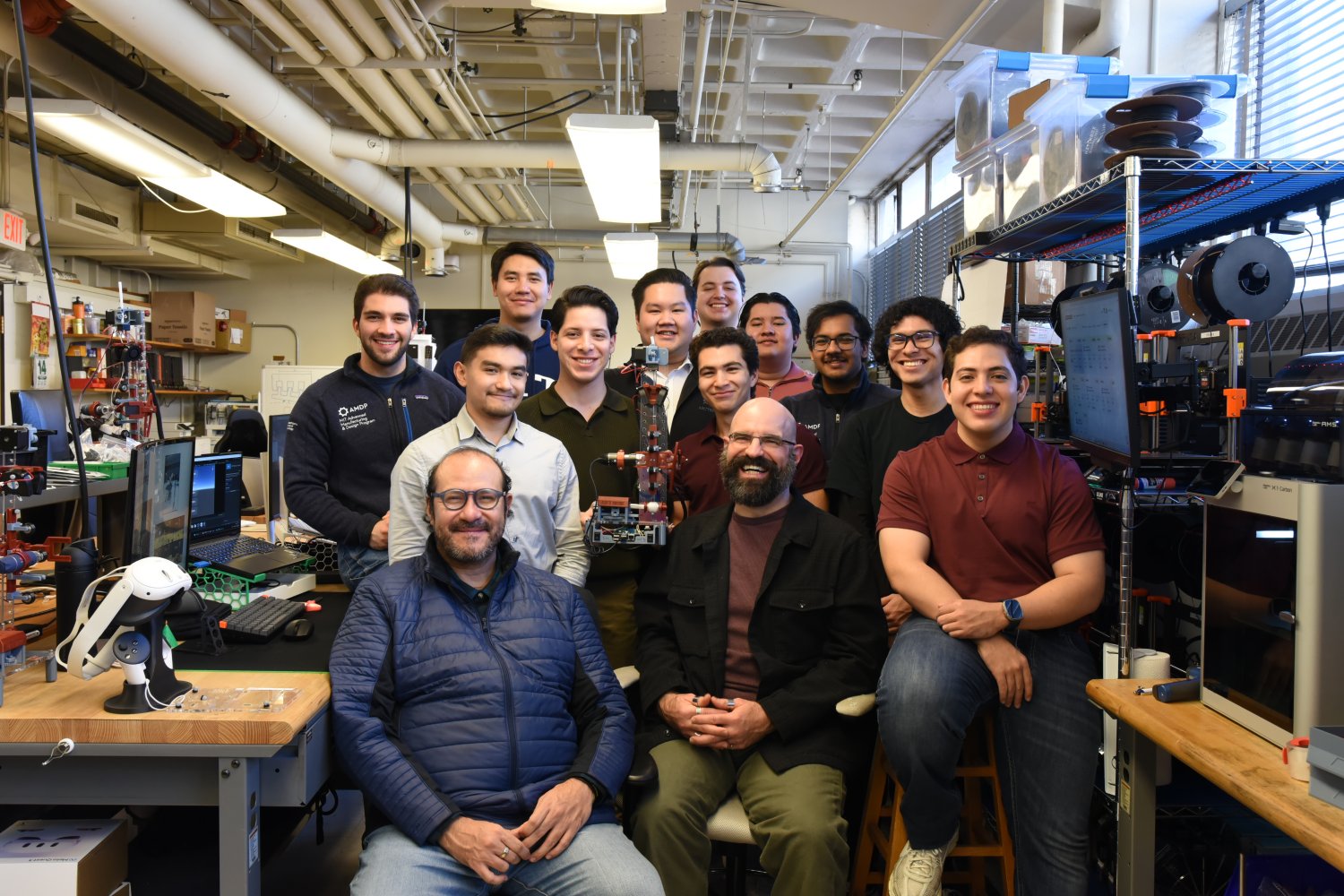

Metal Manufacturing Giant United Performance Metals Supercharges Innovation with Strategic Fabrisonic Buyout

2025-03-24 05:10:21

Manufacturing

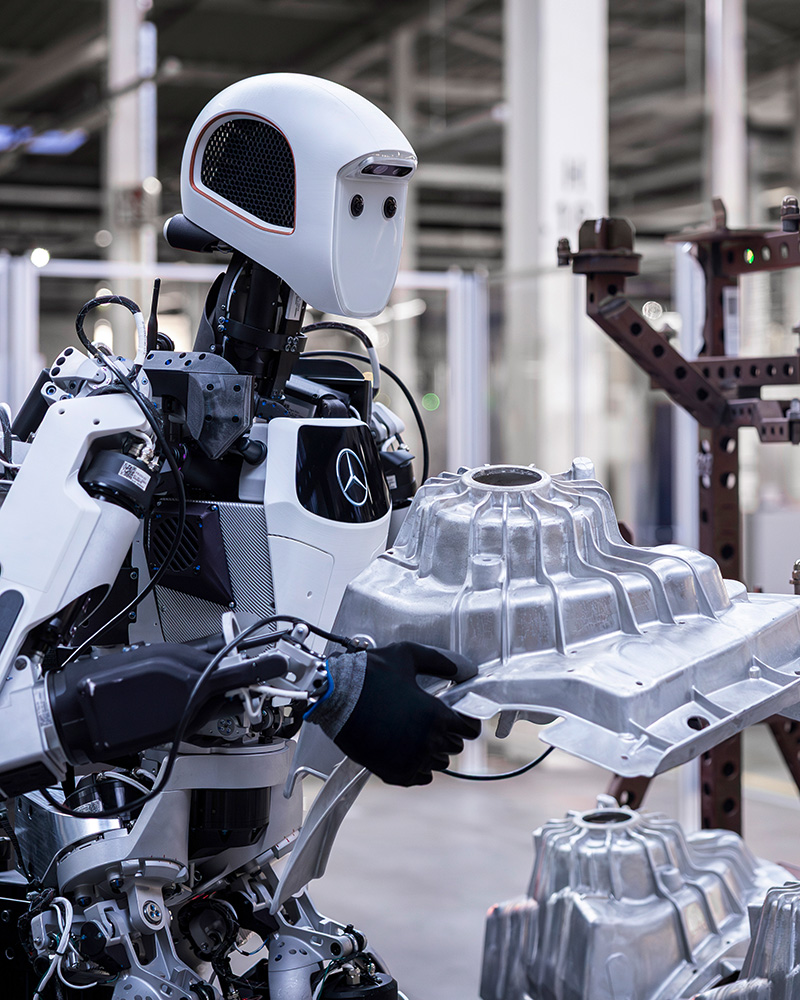

Robots Meet Luxury: Mercedes-Benz Revolutionizes Production with AI and Humanoid Workers

2025-03-19 15:41:25

Manufacturing

FDA Slaps Dexcom with Warning Letter: Manufacturing Woes Spark Regulatory Scrutiny

2025-03-07 22:51:50