Semiconductor Titan: Inside Taiwan's Tech Powerhouse and the Global Chip Revolution

Manufacturing

2025-03-19 17:06:55Content

In our ongoing analysis of Jim Cramer's stock recommendations, we're diving deep into Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) to evaluate its performance and potential. During a recent episode of Mad Money, Cramer's passionate commentary sparked our curiosity about this tech industry heavyweight.

Taiwan Semiconductor, or TSM, stands at a critical intersection of global technology and investment strategy. As one of the world's leading semiconductor manufacturers, the company has been a focal point for investors seeking exposure to the rapidly evolving tech landscape.

Our comprehensive review aims to dissect Cramer's insights and provide a nuanced perspective on TSM's market position. By examining recent trends, financial performance, and industry dynamics, we'll help investors understand whether this stock aligns with their investment goals.

Stay tuned as we break down the key factors that make Taiwan Semiconductor a compelling—or potentially challenging—investment opportunity in today's complex market environment.

Decoding Market Insights: Jim Cramer's Stock Recommendations Unveiled

In the dynamic world of financial markets, investors constantly seek guidance from seasoned experts who can navigate the complex landscape of stock investments. Jim Cramer, the renowned financial commentator, has long been a beacon of insight for traders and investors looking to make informed decisions in an increasingly volatile economic environment.Unraveling the Secrets of Successful Stock Picking: Expert Analysis Revealed

The Significance of Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing Company (TSM) stands as a pivotal player in the global semiconductor industry, representing a critical intersection of technological innovation and investment potential. The company's strategic position in the global supply chain has made it a focal point for investors and market analysts alike. Unlike traditional manufacturing entities, TSM has carved out a unique niche in semiconductor production, serving as a critical backbone for numerous high-tech industries worldwide. The semiconductor giant's performance is intrinsically linked to global technological advancement, with its manufacturing capabilities powering everything from smartphones to advanced computing systems. Investors closely monitor the company's strategic moves, recognizing that its success is deeply intertwined with the broader technological ecosystem.Analyzing Jim Cramer's Market Perspective

Jim Cramer's approach to stock analysis goes far beyond surface-level observations. His methodology involves a deep dive into company fundamentals, market trends, and potential future developments. The recent episode of Mad Money highlighted the complexities of stock evaluation, particularly when it comes to companies like Taiwan Semiconductor Manufacturing Company. Cramer's insights provide a nuanced view of market dynamics, challenging investors to look beyond simple numerical metrics. His frustration, as mentioned in recent broadcasts, stems from the multifaceted nature of stock performance – a reminder that investment success requires more than just following conventional wisdom.The Global Semiconductor Landscape

The semiconductor industry represents a critical battleground of technological supremacy and economic strategy. Taiwan Semiconductor Manufacturing Company emerges as a central figure in this complex narrative, bridging technological innovation with global economic interests. The company's ability to navigate geopolitical challenges while maintaining technological leadership sets it apart from competitors. Investors must consider the broader context of semiconductor production, including supply chain resilience, technological innovation, and global economic shifts. TSM's position is not just about manufacturing chips, but about maintaining a strategic advantage in a rapidly evolving technological landscape.Investment Strategies and Market Considerations

Navigating the investment potential of companies like Taiwan Semiconductor requires a multifaceted approach. Sophisticated investors look beyond simple stock prices, examining the company's technological capabilities, market positioning, and potential for future growth. Cramer's analysis provides a starting point for deeper investigation, challenging investors to develop a more comprehensive understanding of market dynamics. The semiconductor industry continues to be a critical driver of technological innovation, with TSM at the forefront of this transformative landscape. Investors must remain adaptable, recognizing that market success depends on understanding complex interconnections between technology, economics, and global trends.Future Outlook and Market Potential

As the technological landscape continues to evolve, Taiwan Semiconductor Manufacturing Company represents a critical investment consideration. The company's ability to adapt to changing market conditions, invest in cutting-edge technology, and maintain a competitive edge will be crucial to its long-term success. Investors should approach the semiconductor market with a combination of strategic insight and cautious optimism. The potential for growth remains significant, but success requires a nuanced understanding of the complex global technological ecosystem.RELATED NEWS

Manufacturing

Indiana's Nuclear Renaissance: Lawmakers Push Forward with Energy Innovation Bill

2025-04-23 13:57:32

Manufacturing

Nuclear Power Meets Manufacturing: Dow's Bold Texas Energy Revolution

2025-03-31 21:56:26

Manufacturing

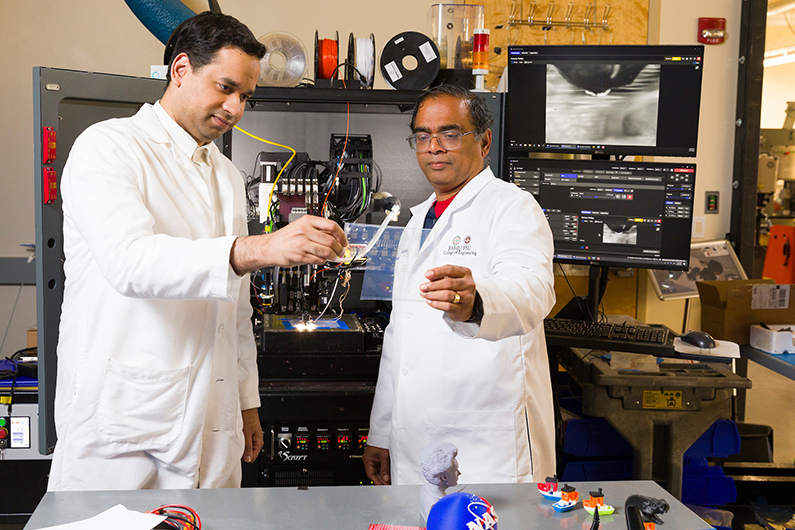

Space Innovation Breakthrough: NASA Pumps $5 Million into Revolutionary Manufacturing Research at FAMU-FSU

2025-04-07 09:11:44