Investment Shift: Ruffer LLP Trims Stake in Tech Giant Taiwan Semiconductor

Manufacturing

2025-03-09 11:55:24Content

In a strategic portfolio adjustment, Ruffer LLP has significantly reduced its investment in Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM). The prominent institutional investor trimmed its stake by an impressive 24.4% during the fourth quarter, according to recent SEC filings.

Following the divestment, Ruffer LLP now holds 329,971 shares of the semiconductor giant, having sold off 106,759 shares. This move reflects the firm's dynamic approach to managing its investment portfolio and potentially signals a nuanced view of the semiconductor market's current landscape.

Taiwan Semiconductor Manufacturing Company, a global leader in semiconductor manufacturing, continues to be a closely watched stock among institutional investors. Ruffer LLP's partial stake reduction offers an interesting glimpse into the evolving investment strategies of sophisticated financial players in the tech sector.

Semiconductor Giant's Strategic Portfolio Shift: Ruffer LLP Trims Taiwan Semiconductor Stake

In the dynamic world of global semiconductor investments, institutional investors continually recalibrate their portfolios, responding to market fluctuations, technological advancements, and strategic considerations that shape the complex landscape of technology investments.Navigating Investment Strategies in the High-Stakes Tech Ecosystem

Institutional Investment Dynamics

The semiconductor industry represents a critical nexus of technological innovation and financial strategy, where institutional investors like Ruffer LLP make calculated decisions that can significantly impact market perceptions. Taiwan Semiconductor Manufacturing Company (TSMC), a global leader in semiconductor manufacturing, has long been a focal point for sophisticated investment strategies. Ruffer LLP's recent portfolio adjustment, involving a 24.4% reduction in their TSMC holdings, signals a nuanced approach to managing technological investment risks and opportunities. Institutional investors carefully analyze multiple factors when modifying their investment positions, including technological trends, geopolitical considerations, and potential market disruptions. The semiconductor sector, characterized by rapid technological evolution and intense global competition, demands constant strategic reassessment. Ruffer LLP's decision to reduce their stake suggests a sophisticated understanding of the complex dynamics governing semiconductor investments.Market Implications and Strategic Considerations

The reduction of 106,759 shares, leaving Ruffer LLP with 329,971 shares, represents more than a simple numerical adjustment. It reflects a broader narrative of institutional investors navigating an increasingly complex global technology landscape. TSMC, recognized as the world's largest semiconductor foundry, continues to play a pivotal role in global technology supply chains, making any institutional investment modification a matter of significant market interest. Semiconductor manufacturing has emerged as a critical battleground in global technological competition, with geopolitical tensions and supply chain complexities adding layers of complexity to investment decisions. Ruffer LLP's strategic repositioning provides insights into how sophisticated investors assess risk and opportunity in this volatile sector. Their measured approach demonstrates the importance of adaptability and strategic thinking in managing high-stakes technology investments.Technological and Financial Ecosystem

The semiconductor industry represents a fascinating intersection of technological innovation, financial strategy, and global economic dynamics. TSMC's position as a leading manufacturer of advanced semiconductor chips makes it a bellwether for technological and investment trends. Institutional investors like Ruffer LLP play a crucial role in signaling market sentiment and potential strategic shifts. By reducing their stake, Ruffer LLP may be responding to various factors such as valuation considerations, potential market volatility, or strategic portfolio rebalancing. Their decision underscores the complexity of investment strategies in the technology sector, where understanding nuanced market signals requires deep analytical capabilities and forward-thinking approaches.Future Outlook and Investment Perspectives

As the semiconductor industry continues to evolve rapidly, driven by emerging technologies like artificial intelligence, 5G networks, and advanced computing systems, institutional investors must remain agile and responsive. Ruffer LLP's strategic adjustment reflects a broader trend of sophisticated investment approaches that prioritize flexibility and strategic positioning. The ongoing transformation of the semiconductor landscape presents both challenges and opportunities for institutional investors. By carefully managing their investment portfolios, firms like Ruffer LLP demonstrate the importance of continuous assessment and strategic adaptation in navigating the complex world of technology investments.RELATED NEWS

Manufacturing

Grid Revolution: Switched Source Pumps $5M into Cutting-Edge Manufacturing Hub

2025-03-20 10:00:00

Manufacturing

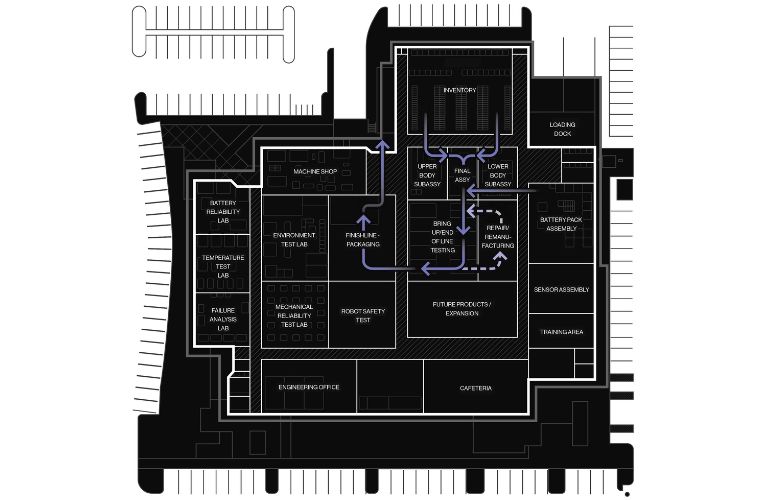

Robots Rising: Figure AI's Massive Humanoid Factory Signals New Era of AI Manufacturing

2025-03-20 21:24:15

Manufacturing

AI Revolution: Nvidia Unveils Massive $500B Infrastructure Plan to Supercharge American Tech Dominance

2025-04-15 18:18:52