Silicon Valley's Quiet Reality: Why US Tech Manufacturing Isn't Surging

Manufacturing

2025-04-16 16:54:54Content

Tech Giants Boost US Manufacturing: Trump Highlights Massive Chip Investments

In a significant push for domestic technology manufacturing, US President Donald Trump has celebrated major investments by semiconductor powerhouses Nvidia and Taiwan Semiconductor Manufacturing Company (TSM), which are pouring hundreds of billions of dollars into American production facilities.

However, Yahoo Finance Tech Editor Dan Howley offers a nuanced perspective, cautioning that these headline-grabbing investments might not immediately translate into a substantial transformation of the US tech manufacturing landscape.

During an insightful discussion with Wealth Host Brad Smith, Howley unpacked the complexities behind these semiconductor investments, highlighting that while the dollar amounts are impressive, the actual impact on domestic manufacturing could be more modest than initially portrayed.

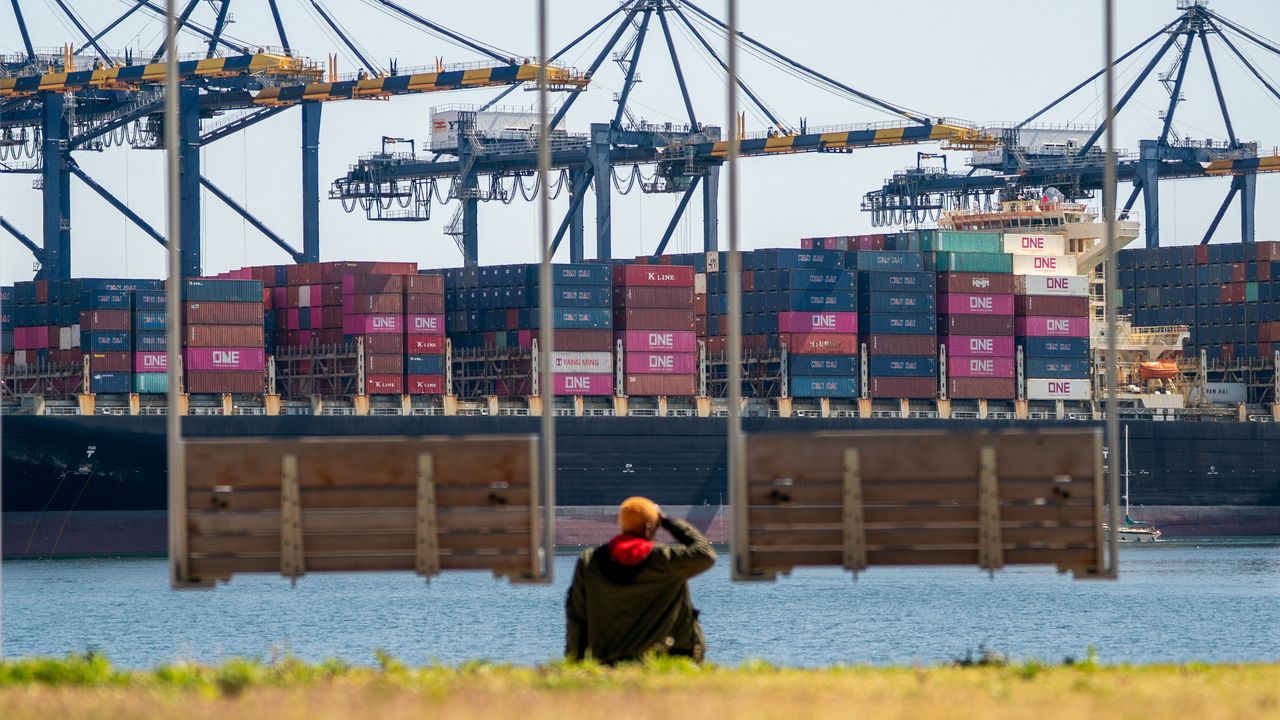

The investments signal a strategic shift in the tech industry's approach to production, potentially reducing dependence on overseas manufacturing and addressing national security concerns surrounding semiconductor supply chains.

For more expert analysis and in-depth market insights, viewers are encouraged to explore additional content on Wealth, where industry professionals continue to break down the latest technological and economic developments.

Tech Titans' Gamble: Unraveling the Complexities of US Manufacturing Investments

In the rapidly evolving landscape of technological innovation, semiconductor giants are making unprecedented moves that promise to reshape the American manufacturing ecosystem. The recent surge of massive investments by industry leaders like Nvidia and Taiwan Semiconductor Manufacturing Company (TSM) has sparked intense debate about the true impact of these strategic commitments on domestic production capabilities.Decoding the Silicon Valley Strategy: More Than Meets the Eye

The Investment Mirage: Challenging Conventional Narratives

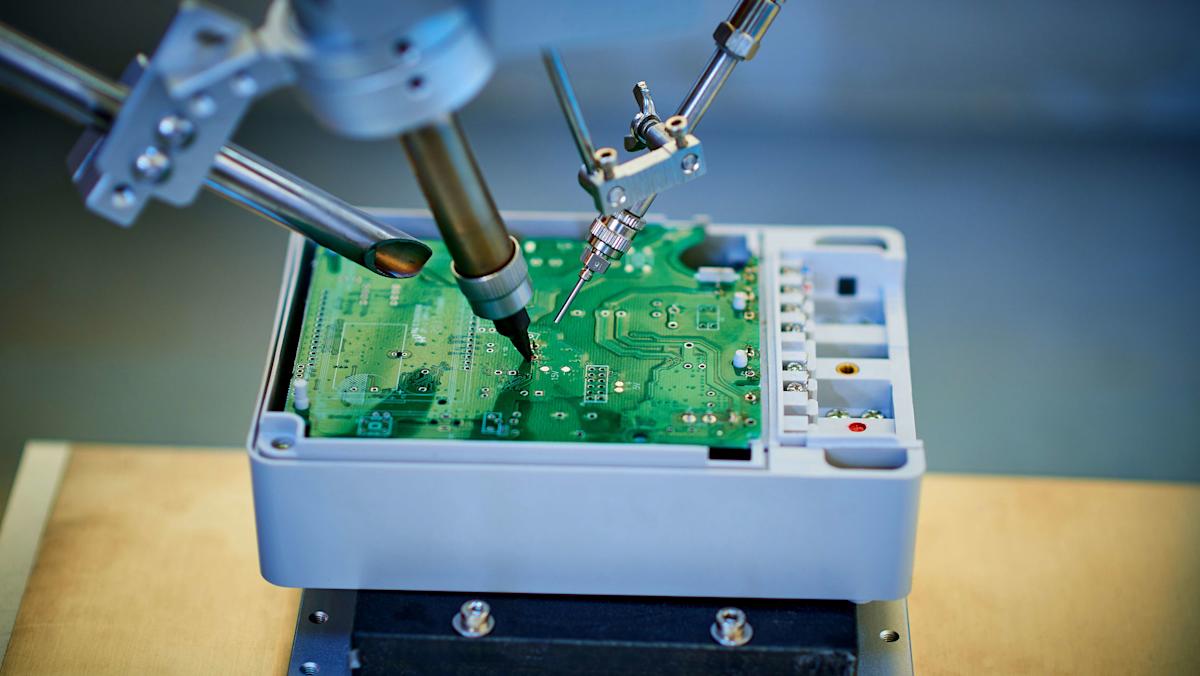

The semiconductor industry stands at a critical crossroads, where massive financial commitments do not necessarily translate into immediate transformative manufacturing capabilities. Despite the headline-grabbing billions of dollars pledged by tech behemoths, the reality of domestic manufacturing remains far more nuanced and complex than simple dollar figures suggest. Experts argue that these investments represent a sophisticated strategic positioning rather than an immediate revolution in US-based tech production. The intricate global supply chains, deeply entrenched manufacturing ecosystems in Asia, and the immense capital requirements for cutting-edge semiconductor fabrication create significant barriers to rapid domestic transformation.Geopolitical Chess: Understanding the Broader Context

The semiconductor investment landscape is fundamentally a geopolitical battleground where technological sovereignty intersects with economic strategy. These investments are not merely financial transactions but calculated moves in an intricate global competition for technological supremacy. Nations like the United States are increasingly recognizing the strategic importance of semiconductor manufacturing, viewing it as a critical infrastructure comparable to national defense. The recent investments by Nvidia and TSMC represent a complex interplay of economic incentives, government policy, and long-term strategic positioning.Economic Implications and Technological Sovereignty

The pursuit of domestic semiconductor manufacturing goes beyond simple economic calculations. It represents a profound reimagining of technological independence, where nations seek to reduce reliance on international supply chains and secure critical technological infrastructure. However, the path to establishing a robust domestic semiconductor ecosystem is fraught with challenges. The astronomical costs of advanced fabrication facilities, the need for specialized talent, and the rapid pace of technological innovation create significant hurdles that cannot be overcome through financial investment alone.The Human Capital Equation

Perhaps the most critical yet overlooked aspect of these massive investments is the requirement for specialized human capital. Semiconductor manufacturing demands an intricate blend of engineering expertise, advanced scientific knowledge, and sophisticated technical skills that cannot be developed overnight. The success of these investments will ultimately depend not just on financial commitments but on the ability to cultivate a robust ecosystem of education, research, and professional development in advanced technological domains.Future Trajectories: Beyond Current Investments

As the technological landscape continues to evolve, these initial investments should be viewed as foundational steps rather than definitive solutions. The semiconductor industry's future will be characterized by continuous adaptation, collaborative innovation, and a nuanced understanding of global technological dynamics. The current investments by Nvidia and TSMC represent a promising beginning, but the true measure of success will be the ability to create a sustainable, innovative, and competitive domestic manufacturing environment that can respond dynamically to emerging technological challenges.RELATED NEWS

Intel's Radical Transformation: New CEO Reshapes Manufacturing and AI Strategy