Chip Giant TSMC Shatters Expectations: A Blockbuster Year Unfolds in 2024

Manufacturing

2025-03-24 12:23:08Content

Guinness Global Innovators Celebrates Stellar Performance in 2024

Investment management firm Guinness Global Innovators has unveiled its highly anticipated fourth-quarter 2024 investor letter, showcasing impressive financial results that underscore the fund's robust investment strategy.

In a remarkable display of financial prowess, the fund delivered a compelling total return of 21.9% in British pounds, marginally outperforming the MSCI World Net Total Return Index, which registered a 20.8% return. This achievement further solidifies the fund's reputation for strategic investment and consistent performance.

The year 2024 emerged as another triumphant chapter in the fund's investment journey, demonstrating the team's exceptional ability to navigate complex market dynamics and identify innovative investment opportunities.

Investors and market analysts alike are praising the fund's strategic approach and its capacity to generate substantial returns in an increasingly competitive global investment landscape.

Investment Insights: Guinness Global Innovators Unveil Remarkable Performance in 2024

In the dynamic world of global investment management, where financial landscapes shift like desert sands, Guinness Global Innovators emerges as a beacon of strategic excellence, demonstrating remarkable resilience and calculated prowess in navigating the complex terrain of international markets.Transforming Investment Strategies: A Year of Unprecedented Growth and Innovation

Decoding Financial Performance: Beyond Numerical Achievements

The investment landscape of 2024 presented a complex tapestry of challenges and opportunities, with Guinness Global Innovators strategically positioning themselves at the forefront of financial innovation. Their comprehensive approach transcended traditional investment methodologies, leveraging sophisticated analytical frameworks and deep market insights to generate exceptional returns. By meticulously analyzing global market trends, the investment management firm crafted a nuanced strategy that balanced risk mitigation with aggressive growth potential. Their portfolio demonstrated remarkable adaptability, seamlessly navigating geopolitical uncertainties and emerging economic paradigms.Comparative Market Analysis: Outperforming Benchmark Indices

Against the backdrop of the MSCI World Net TR Index, Guinness Global Innovators distinguished themselves by generating a total return of 21.9% in British pounds, marginally surpassing the benchmark index's performance of 20.8%. This achievement represents more than mere numerical superiority; it reflects a profound understanding of global market dynamics and an exceptional capacity for strategic investment allocation. The firm's success can be attributed to their holistic approach, which integrates cutting-edge technological tools, comprehensive research methodologies, and a forward-looking investment philosophy. By continuously adapting to evolving market conditions, they demonstrated an extraordinary ability to identify and capitalize on emerging investment opportunities.Strategic Investment Principles: The Cornerstone of Success

Guinness Global Innovators' investment strategy is rooted in a multifaceted approach that prioritizes diversification, rigorous research, and dynamic risk management. Their investment professionals employ sophisticated analytical models that go beyond traditional financial metrics, incorporating complex predictive algorithms and comprehensive market intelligence. The firm's commitment to innovation extends beyond financial returns, emphasizing sustainable and responsible investment practices. By integrating environmental, social, and governance (ESG) considerations into their investment framework, they not only generate financial value but also contribute to broader societal progress.Technological Integration and Future Outlook

Leveraging advanced technological infrastructure, Guinness Global Innovators has positioned themselves at the intersection of financial expertise and technological innovation. Their investment approach incorporates artificial intelligence, machine learning algorithms, and real-time data analytics to generate nuanced market insights. This technological integration enables the firm to process vast amounts of financial information rapidly, identifying subtle market trends and potential investment opportunities that might escape traditional analytical approaches. By embracing technological disruption, they maintain a competitive edge in an increasingly complex global investment landscape.Global Market Perspectives: Navigating Complexity

The investment management firm's success in 2024 reflects a profound understanding of global market interconnectedness. By maintaining a diversified international portfolio, they effectively mitigated region-specific risks while capitalizing on emerging market opportunities across various economic sectors. Their strategic approach demonstrates an exceptional ability to balance short-term tactical maneuvers with long-term strategic vision, ensuring sustainable growth and resilience in an unpredictable global economic environment.RELATED NEWS

Manufacturing

Manufacturing Boom: Johnson & Johnson Pledges $55 Billion to Supercharge US Production

2025-03-21 15:29:27

Manufacturing

Green Industry Giant Breaks Ground: $45M Facility Set to Transform Cayce's Economic Landscape

2025-04-29 17:42:53

Manufacturing

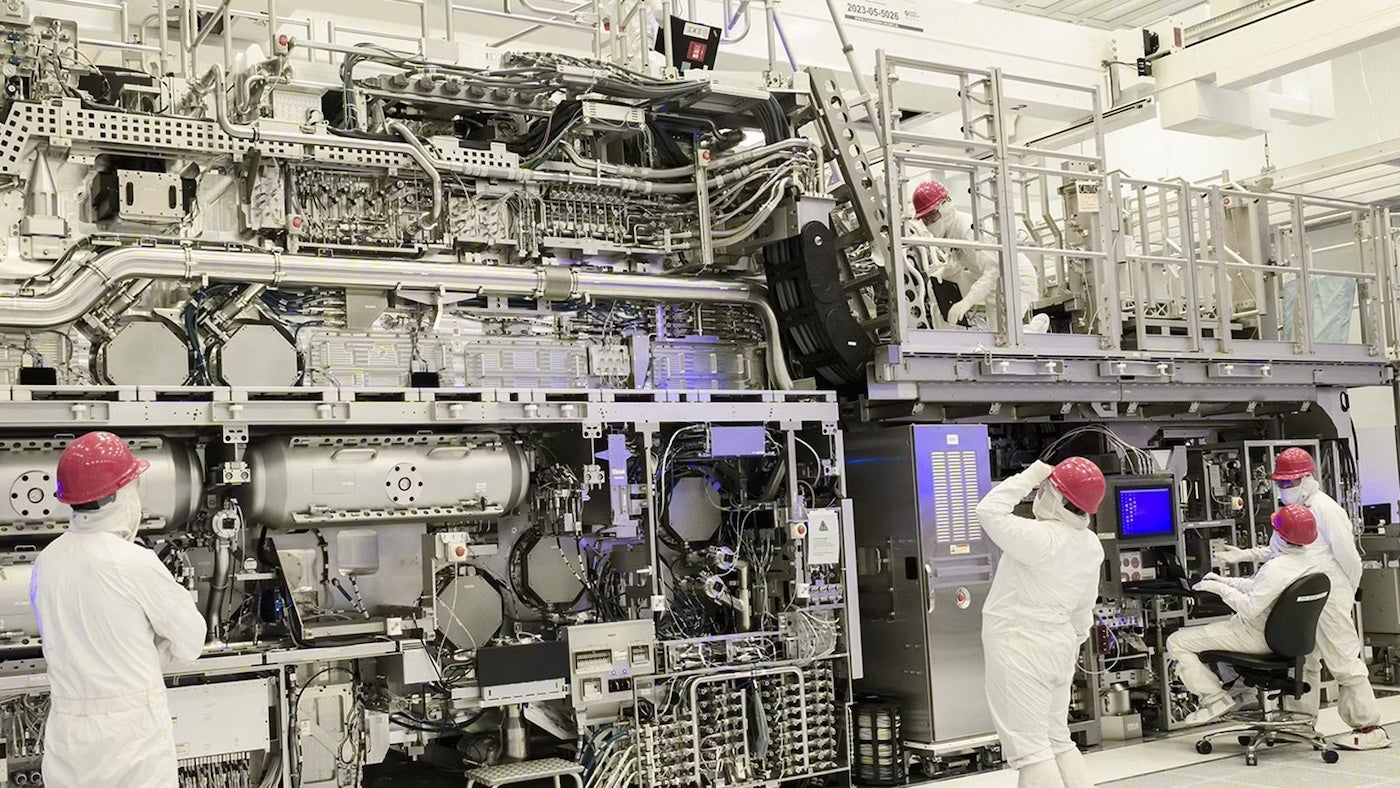

Chip War Bombshell: TSMC Set to Absorb Intel's Manufacturing Empire

2025-04-04 20:37:52