Trade Tremors: Trump's Protectionist Playbook Rattles Global Markets and Diplomatic Ties

Politics

2025-03-11 17:33:00Content

Wall Street Trembles as Trump's Tariff Tweet Sends Markets Plummeting

In a dramatic midday twist, President Donald Trump's latest social media missive sent shockwaves through financial markets, triggering a sharp downturn before he even stepped into the public spotlight. Though the president wasn't slated to make a public appearance until after market hours, his inflammatory tweet about potential new tariffs was enough to rattle investor confidence.

The financial landscape quickly transformed as traders and investors reacted to Trump's bold proclamation, with stock indices rapidly descending. What began as a seemingly routine Tuesday quickly evolved into a nerve-wracking session of economic uncertainty, underscoring the profound impact a single presidential communication can have on global markets.

As Wall Street absorbed the implications of the president's warning, the ripple effects were immediate and pronounced. Investors scrambled to reassess their positions, with the markets reflecting the heightened tension and unpredictability that has become hallmark of Trump's economic approach.

Market Tremors: Trump's Tariff Threats Rattle Investor Confidence

In the ever-volatile landscape of global economic dynamics, presidential communications have once again demonstrated their profound capacity to instantaneously influence financial markets, revealing the delicate interconnectedness of political rhetoric and economic sentiment.When Presidential Words Become Market Movers

The Unexpected Market Disruption

The financial ecosystem experienced a seismic shift midday when unexpected presidential communication triggered immediate market reactions. Unlike traditional market analysis that relies on scheduled economic reports or corporate earnings, this instance highlighted the unprecedented power of social media platforms in transmitting economic signals that can instantaneously reshape investor perspectives. Sophisticated market analysts observed a rapid descent in market indices following the presidential statement, underscoring the heightened sensitivity of contemporary financial systems to geopolitical communications. The instantaneous market response illustrated the complex relationship between political communication and economic confidence, demonstrating how a single digital missive could potentially trigger substantial economic repercussions.Tariff Threats: A Strategic Communication Mechanism

Presidential tariff discussions have emerged as a nuanced diplomatic and economic instrument, capable of sending multifaceted signals to both domestic and international economic actors. These communications serve not merely as policy declarations but as strategic messaging mechanisms designed to influence negotiation dynamics, trade relationships, and global economic perceptions. The strategic deployment of tariff discussions through social media platforms represents a paradigm shift in governmental communication strategies. By circumventing traditional diplomatic channels, such announcements create immediate market volatility, compelling investors, corporations, and international trade partners to rapidly reassess their economic strategies and risk assessments.Investor Psychology and Market Volatility

The market's instantaneous reaction reveals profound insights into contemporary investor psychology. Modern financial ecosystems are characterized by heightened responsiveness, where information processing occurs at unprecedented speeds, and sentiment can shift dramatically within milliseconds of receiving new information. Investors demonstrated remarkable sensitivity to potential trade policy modifications, reflecting a broader trend of increased geopolitical risk awareness. The rapid market descent illustrated the intricate web of global economic interdependencies, where political communications can instantaneously ripple through complex financial networks, triggering cascading economic responses.Digital Communication's Economic Impact

The incident exemplifies the transformative role of digital communication platforms in shaping economic narratives. Social media has evolved from a mere communication tool to a powerful mechanism for instantaneous global information dissemination, capable of generating immediate and substantial economic consequences. This phenomenon underscores the need for sophisticated market participants to develop robust real-time monitoring and adaptive strategies that can quickly interpret and respond to rapidly evolving communication landscapes. The ability to rapidly decode and contextualize political communications has become a critical competency in modern financial management.Global Economic Implications

Beyond immediate market fluctuations, such presidential communications carry broader geopolitical and economic implications. They signal potential shifts in trade policies, international relations, and economic strategies that can have long-lasting repercussions across multiple economic sectors and international markets. The incident serves as a compelling reminder of the intricate connections between political communication, economic policy, and global market dynamics, highlighting the increasingly complex and interconnected nature of contemporary global economic systems.RELATED NEWS

Politics

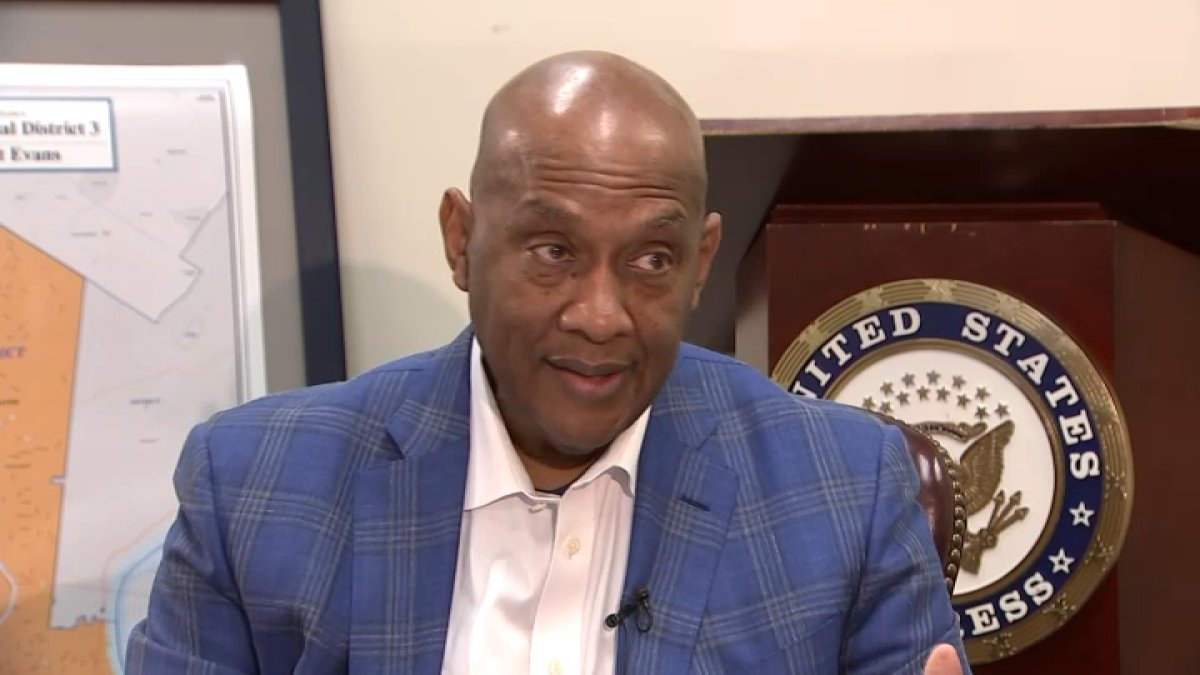

Resilient Rep. Dwight Evans: Philly Lawmaker's Inspiring Stroke Recovery Journey

2025-03-24 00:10:09