Markets Reel as Trump's Tariff Bombshell Meets Ukraine's Aerial Assault on Moscow

Politics

2025-03-11 11:05:52Content

In a bold economic move that sent ripples through financial markets, President Donald Trump defended his controversial tariff strategy after stock prices experienced a notable decline. The White House swiftly moved to minimize concerns about the market's reaction to new trade penalties imposed on Canada and Mexico.

Despite the immediate market volatility, Trump and his administration remained steadfast in their trade policy, arguing that the short-term market fluctuations were a small price to pay for what they believe are necessary economic protections for American industries. The president has consistently maintained that his tariff approach is designed to level the international trade playing field and protect domestic economic interests.

Financial analysts and market watchers closely observed the market's response, with some expressing concern about the potential broader economic implications of the new trade measures. However, the administration remained confident that their strategic trade interventions would ultimately benefit the United States' economic position on the global stage.

The market dip served as a stark reminder of the delicate balance between aggressive trade policies and investor sentiment, highlighting the complex interplay of international economic relationships in the current global marketplace.

Economic Tremors: Trump's Tariff Gambit Shakes Global Markets

In the complex landscape of international trade and economic diplomacy, presidential decisions can send rippling waves through financial markets, creating unprecedented challenges and opportunities for global economic stability. The recent tariff implementation against Canada and Mexico represents a pivotal moment in contemporary economic policy, revealing the intricate dynamics of international trade relations.Navigating Turbulent Economic Waters: A Presidential Strategy Unveiled

The Geopolitical Chessboard of Trade Negotiations

The implementation of tariffs against Canada and Mexico represents a sophisticated strategic maneuver within the intricate geopolitical landscape of international trade. Presidential administrations have long utilized economic instruments as diplomatic leverage, creating complex negotiations that extend far beyond simple monetary transactions. These tariffs are not merely economic tools but sophisticated diplomatic instruments designed to reshape bilateral relationships and economic power dynamics. The nuanced approach demonstrates a calculated risk assessment, where potential short-term market volatility is weighed against long-term strategic objectives. Economic experts have extensively analyzed these maneuvers, recognizing them as part of a broader negotiation strategy that seeks to rebalance trade relationships and protect domestic economic interests.Market Volatility and Institutional Responses

Financial markets are inherently sensitive ecosystems, responding with remarkable speed and complexity to governmental policy shifts. The stock market's immediate reaction to these tariffs highlights the delicate interconnectedness of global economic systems. Institutional investors, hedge fund managers, and economic analysts closely monitor such developments, interpreting them as potential indicators of broader economic trends. The White House's measured response to market fluctuations suggests a deliberate strategy of maintaining investor confidence while pursuing aggressive trade policies. By downplaying short-term market reactions, the administration signals a long-term perspective on economic restructuring, emphasizing strategic national interests over immediate market sentiment.Diplomatic and Economic Implications

Tariffs against neighboring trading partners like Canada and Mexico carry profound implications beyond immediate economic metrics. These actions represent a fundamental recalibration of established trade relationships, challenging existing multilateral agreements and potentially triggering retaliatory measures. The complex web of international trade requires nuanced understanding, where economic policies are not implemented in isolation but as part of a sophisticated global strategy. Each tariff, each policy adjustment becomes a potential catalyst for broader economic transformations, reshaping international economic landscapes in ways that extend far beyond immediate financial calculations.Technological and Strategic Considerations

Modern trade negotiations increasingly incorporate technological considerations, recognizing that economic power is intrinsically linked to technological innovation and strategic capabilities. The tariff implementation reflects a broader strategy of economic positioning, where traditional trade barriers intersect with emerging technological domains. Sophisticated economic actors understand that these policy decisions are not simply about immediate financial gains but about long-term strategic positioning in an increasingly complex global economic environment. The interplay between trade policy, technological innovation, and geopolitical strategy creates a multidimensional landscape of economic interaction.Future Outlook and Economic Resilience

As global economic systems continue to evolve, the ability to adapt and respond to dynamic policy environments becomes increasingly critical. The tariff strategy represents more than a singular economic intervention; it symbolizes a broader approach to economic governance that prioritizes national strategic interests while navigating complex international relationships. Economic resilience emerges not from rigid adherence to traditional models but from the capacity to innovate, adapt, and strategically respond to changing global conditions. The ongoing narrative of international trade continues to unfold, with each policy decision contributing to a complex and ever-changing economic narrative.RELATED NEWS

Politics

Spectacle Over Substance: How Entertainment Drives Populist Political Victories

2025-04-26 18:00:07

Politics

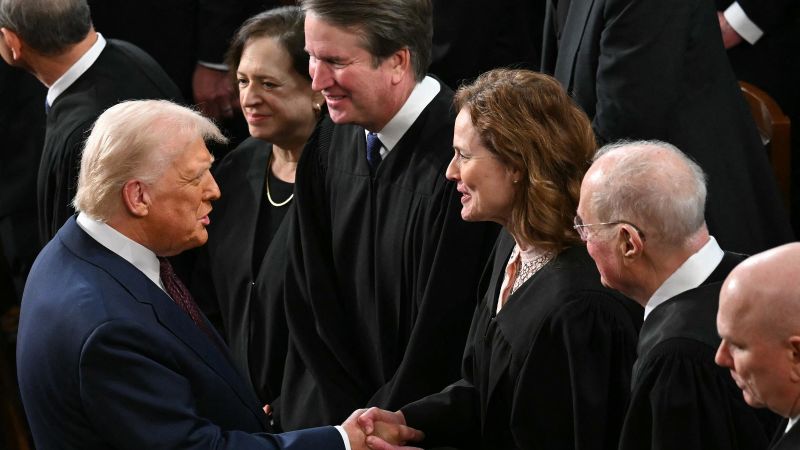

Supreme Showdown: Trump's Last-Ditch Plea to the High Court's Final Verdict

2025-04-01 08:00:36

:quality(75)/https:/assets.lareviewofbooks.org/uploads/Gulliver Taking His Final Leave of the Land of the Houyhnhnms.jpg)