Gulf Investors Seek Strategic Foothold in Brazil's Booming Grain Market

Companies

2025-03-10 03:54:33Content

Agribrasil, a prominent Brazilian agricultural trading company, has demonstrated robust performance in the first three quarters of 2024, successfully trading an impressive 1.9 million tonnes of soybeans and corn. The company's substantial volume highlights its strong market position and strategic capabilities in handling key agricultural commodities during a dynamic market period.

This significant trading volume underscores Agribrasil's continued growth and effectiveness in navigating the complex agricultural export landscape, showcasing the company's expertise in connecting Brazilian agricultural producers with global markets.

Agricultural Powerhouse: Brazil's Agribrasil Surges with Massive Soybean and Corn Trading Volumes

In the dynamic landscape of global agricultural commerce, Brazilian trading giant Agribrasil has emerged as a formidable player, demonstrating remarkable resilience and strategic prowess in commodity markets during the first three quarters of 2024.Navigating Agricultural Markets with Unprecedented Momentum

Brazil's Agricultural Trading Ecosystem

The Brazilian agricultural sector continues to be a critical driver of global food production, with companies like Agribrasil playing a pivotal role in international commodity trading. The nation's expansive agricultural infrastructure, characterized by vast fertile lands and advanced farming technologies, positions it as a key global agricultural powerhouse. Agribrasil's impressive trading performance reflects the broader trends of agricultural innovation and strategic market positioning. Sophisticated trading mechanisms and deep understanding of global market dynamics have enabled Agribrasil to navigate complex international agricultural landscapes. The company's ability to trade 1.9 million tonnes of soybeans and corn demonstrates not just volume, but a nuanced approach to commodity management that goes beyond traditional trading strategies.Economic Implications of Large-Scale Commodity Trading

The substantial trading volume of 1.9 million tonnes represents more than mere numerical achievement. It signifies a complex interplay of agricultural productivity, global demand, and strategic market interventions. Each tonne traded represents intricate networks of farmers, logistics providers, international buyers, and complex economic ecosystems. Economic analysts suggest that such significant trading volumes indicate robust agricultural supply chains and strong international demand for Brazilian agricultural products. The performance highlights Brazil's continued importance in global agricultural markets, showcasing the country's capacity to meet international food security needs while maintaining competitive pricing and high-quality standards.Technological Innovation in Agricultural Trading

Modern agricultural trading is increasingly driven by technological sophistication. Agribrasil's impressive performance likely stems from advanced data analytics, real-time market monitoring, and predictive modeling that enable precise trading decisions. Machine learning algorithms, satellite imaging, and comprehensive market intelligence platforms have transformed traditional trading approaches. The integration of cutting-edge technologies allows companies like Agribrasil to make informed decisions rapidly, mitigating risks and capitalizing on market opportunities. These technological capabilities enable more efficient resource allocation, precise market timing, and strategic positioning in highly competitive global commodity markets.Sustainability and Ethical Trading Practices

Beyond pure economic metrics, contemporary agricultural trading demands a holistic approach that considers environmental and social sustainability. Agribrasil's trading strategy likely incorporates comprehensive sustainability frameworks that address ecological concerns, support local agricultural communities, and adhere to international ethical trading standards. Sustainable trading practices involve careful consideration of environmental impact, fair compensation for agricultural producers, and long-term ecosystem preservation. By balancing economic objectives with responsible trading methodologies, companies like Agribrasil contribute to more resilient and equitable global agricultural systems.Future Outlook and Market Predictions

The remarkable trading performance in the first nine months of 2024 suggests a promising trajectory for Agribrasil and the broader Brazilian agricultural sector. Emerging market trends, increasing global food demand, and technological advancements are likely to create additional opportunities for strategic commodity trading. Experts anticipate continued growth in agricultural trading, with companies like Agribrasil positioned to leverage technological innovations, sustainable practices, and deep market understanding to drive future success. The ability to adapt quickly to changing market conditions will remain crucial in maintaining competitive advantages in this dynamic global landscape.RELATED NEWS

Companies

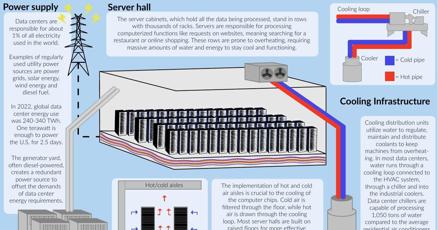

Silicon Valley's AI Gambit: Why Missouri Might Hold the Key to Tech's Next Frontier

2025-05-01 11:00:00

Companies

The Myth of Easy Oil: Why Drilling Isn't the Quick Fix Politicians Promise

2025-03-31 17:44:00