Market Maverick Peter Lynch Reveals: The Hidden Growth Playbook for Savvy Investors

Companies

2025-03-09 19:35:18Content

In a recent market analysis, legendary investor Peter Lynch offered his trademark blend of wisdom and practical insights into navigating today's complex stock market landscape. Drawing from his renowned track record of success at Fidelity's Magellan Fund, Lynch emphasized the importance of understanding individual companies beyond mere financial metrics.

"Invest in what you know," has long been Lynch's mantra, and he continues to advocate for investors to leverage their personal knowledge and observations. He suggests that everyday experiences can reveal promising investment opportunities that might be overlooked by traditional financial analysis.

Lynch's stock selection strategy remains rooted in fundamental research and a deep understanding of a company's competitive advantages. He recommends investors look for businesses with strong management, consistent growth potential, and clear competitive edges in their respective markets.

Highlighting the current market volatility, Lynch advised investors to maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. He stressed the significance of patience and thorough research in building a robust investment portfolio.

For individual investors, Lynch continues to be a beacon of practical investment wisdom, encouraging them to approach the stock market with curiosity, diligence, and a keen eye for genuine value.

Mastering Investment Wisdom: Unveiling Peter Lynch's Legendary Stock Market Strategies

In the dynamic world of financial investments, few names resonate as powerfully as Peter Lynch, the legendary investor who transformed Fidelity's Magellan Fund into a beacon of investment success. His unparalleled approach to stock selection and market analysis has inspired generations of investors to look beyond conventional wisdom and develop a more nuanced understanding of financial markets.Unlock the Secrets of Legendary Investment Strategies That Can Transform Your Financial Future!

The Philosophical Foundation of Lynch's Investment Approach

Peter Lynch's investment philosophy transcends traditional market analysis, representing a holistic approach that combines deep research, intuitive understanding, and a unique perspective on company potential. Unlike many investors who rely solely on numerical data, Lynch advocated for a comprehensive investigation that goes beyond balance sheets and financial statements. His methodology emphasized understanding a company's core business model, competitive advantages, and potential for growth. Lynch believed that individual investors could outperform professional money managers by conducting thorough research and developing a genuine understanding of the businesses they invest in. This approach democratized investment strategy, suggesting that careful observation and intellectual curiosity could be powerful tools in wealth creation.Decoding the Art of Stock Selection

The art of stock selection, according to Lynch, is not about following market trends but understanding the intrinsic value of a company. He popularized the concept of "investing in what you know," encouraging investors to leverage their personal experiences and professional knowledge when making investment decisions. Lynch's strategy involved meticulously analyzing a company's fundamentals, including its earnings growth, competitive positioning, and management quality. He was particularly interested in companies with strong, sustainable business models and the potential for long-term expansion. His famous "ten-bagger" concept highlighted investments that could potentially increase tenfold, demonstrating his belief in identifying undervalued opportunities before they become mainstream.Navigating Market Volatility with Strategic Insight

Market volatility is an inevitable aspect of investing, and Lynch developed sophisticated strategies for managing uncertainty. He emphasized the importance of maintaining a diversified portfolio and avoiding emotional decision-making during market fluctuations. Lynch's approach recommended regular portfolio review and a willingness to adapt investment strategies based on changing market conditions. He believed that successful investing requires patience, discipline, and a long-term perspective. By focusing on fundamental company strengths rather than short-term market noise, investors could develop more resilient investment strategies.Psychological Dimensions of Successful Investing

Beyond technical analysis, Lynch recognized the critical psychological components of successful investing. He understood that investor psychology plays a significant role in decision-making, often leading to irrational choices driven by fear or excessive optimism. By cultivating emotional intelligence and maintaining a rational approach, investors could overcome common psychological pitfalls. Lynch advocated for continuous learning, self-reflection, and a disciplined approach to investment that separates emotional impulses from strategic decision-making.Practical Implementation of Lynch's Investment Principles

Implementing Lynch's investment principles requires a multifaceted approach that combines rigorous research, strategic thinking, and personal insight. Investors can start by developing a comprehensive understanding of potential investment targets, examining their business models, competitive landscapes, and growth potential. Lynch recommended maintaining a curious and open mindset, continuously expanding financial knowledge, and being willing to challenge conventional market narratives. By developing a systematic approach to investment research and maintaining intellectual humility, investors can create more robust and adaptable investment strategies.RELATED NEWS

Companies

Career Rocket Fuel: 50 Companies Supercharging Talent with AI Skills and Growth Opportunities

2025-04-08 13:00:00

Companies

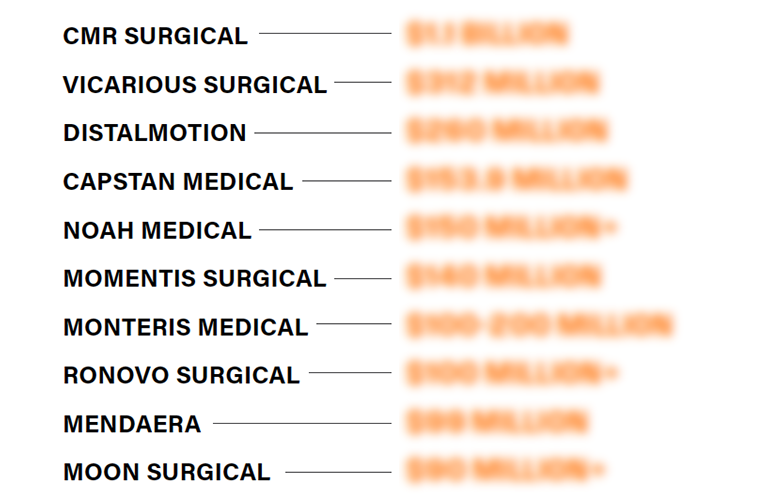

Cutting-Edge Robotics: The 10 Surgical Innovators Revolutionizing Medicine

2025-03-10 18:07:03