Glennon Small Cap Fund Reveals Surprising Net Tangible Asset Performance for March 2025

Companies

2025-03-09 21:27:33Content

Glennon Small Companies Ltd (ASX: GC1) Reveals Latest Net Tangible Asset Performance

Investors and market watchers take note: Glennon Small Companies Ltd has just released its unaudited Net Tangible Asset (NTA) values, providing a transparent snapshot of the company's current financial standing. The update, dated March 6th, offers valuable insights into the fund's performance and asset valuation.

The company's commitment to timely and clear financial reporting continues to distinguish it in the investment landscape. By sharing these unaudited NTA values, Glennon Small Companies demonstrates its dedication to keeping shareholders and potential investors well-informed about its financial health.

While specific numerical details were not provided in the original brief, the release of these NTA values represents an important milestone for the company, offering a glimpse into its current market positioning and asset management strategy.

Investors are encouraged to review the full details of the NTA update and consider how this information might impact their investment decisions.

Glennon Small Companies Ltd: Unveiling Financial Insights and Market Dynamics

In the ever-evolving landscape of investment and financial markets, Glennon Small Companies Ltd emerges as a compelling entity, offering investors a nuanced perspective on strategic asset management and market performance. The company's recent disclosure of unaudited Net Tangible Asset (NTA) values provides a critical window into its financial health and potential investment opportunities.Navigating Financial Frontiers: A Deep Dive into Investment Strategy and Market Positioning

Understanding Net Tangible Asset Valuation

The intricate world of financial valuation demands meticulous analysis and comprehensive understanding. Net Tangible Asset (NTA) represents a critical metric that offers investors profound insights into a company's underlying financial structure. For Glennon Small Companies Ltd, this valuation serves as a transparent mechanism to communicate the genuine economic value of its investment portfolio. Investors and market analysts closely scrutinize NTA values as they provide a realistic snapshot of a company's tangible assets, excluding intangible elements. This approach enables a more grounded assessment of potential investment returns and organizational financial stability. By presenting unaudited NTA values, Glennon Small Companies Ltd demonstrates a commitment to financial transparency and proactive communication with stakeholders.Market Dynamics and Investment Landscape

The contemporary investment ecosystem is characterized by rapid transformations and complex market interactions. Glennon Small Companies Ltd operates within this intricate environment, leveraging sophisticated strategies to navigate potential challenges and capitalize on emerging opportunities. Small-cap investment vehicles like Glennon represent a unique segment of the financial market, offering investors exposure to potentially high-growth enterprises that might be overlooked by larger institutional investors. The company's approach involves carefully curated investment selections, rigorous risk management, and a forward-looking perspective that distinguishes it from conventional investment platforms.Strategic Asset Management Approach

Effective asset management requires a delicate balance between risk mitigation and potential growth opportunities. Glennon Small Companies Ltd exemplifies this approach through its meticulous investment selection process and comprehensive market analysis. The company's strategy likely involves diversification across multiple sectors, careful evaluation of emerging market trends, and a nuanced understanding of economic indicators. By maintaining a dynamic and adaptive investment portfolio, Glennon positions itself to respond swiftly to changing market conditions while preserving investor interests.Technological Integration and Financial Innovation

Modern investment platforms increasingly rely on technological innovations to enhance decision-making processes and operational efficiency. Glennon Small Companies Ltd appears to be at the forefront of integrating advanced analytical tools and data-driven insights into its investment methodology. Sophisticated algorithms, real-time market monitoring, and predictive analytics play crucial roles in contemporary asset management. By embracing these technological advancements, the company can potentially optimize investment strategies, minimize risks, and generate more consistent returns for its stakeholders.Investor Confidence and Market Perception

Transparency and consistent performance are fundamental in building and maintaining investor confidence. The recent disclosure of unaudited NTA values represents more than a mere financial update—it is a strategic communication tool that reinforces the company's commitment to open and honest engagement with its investment community. Market perception can significantly influence an organization's ability to attract and retain investors. By providing clear, timely, and comprehensive financial information, Glennon Small Companies Ltd demonstrates its dedication to fostering trust and maintaining a reputation for reliability in a competitive investment landscape.RELATED NEWS

Companies

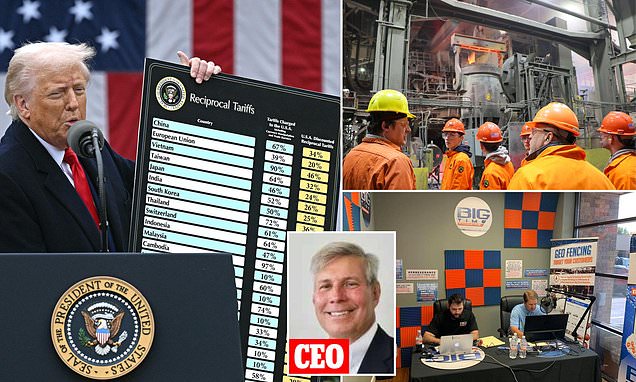

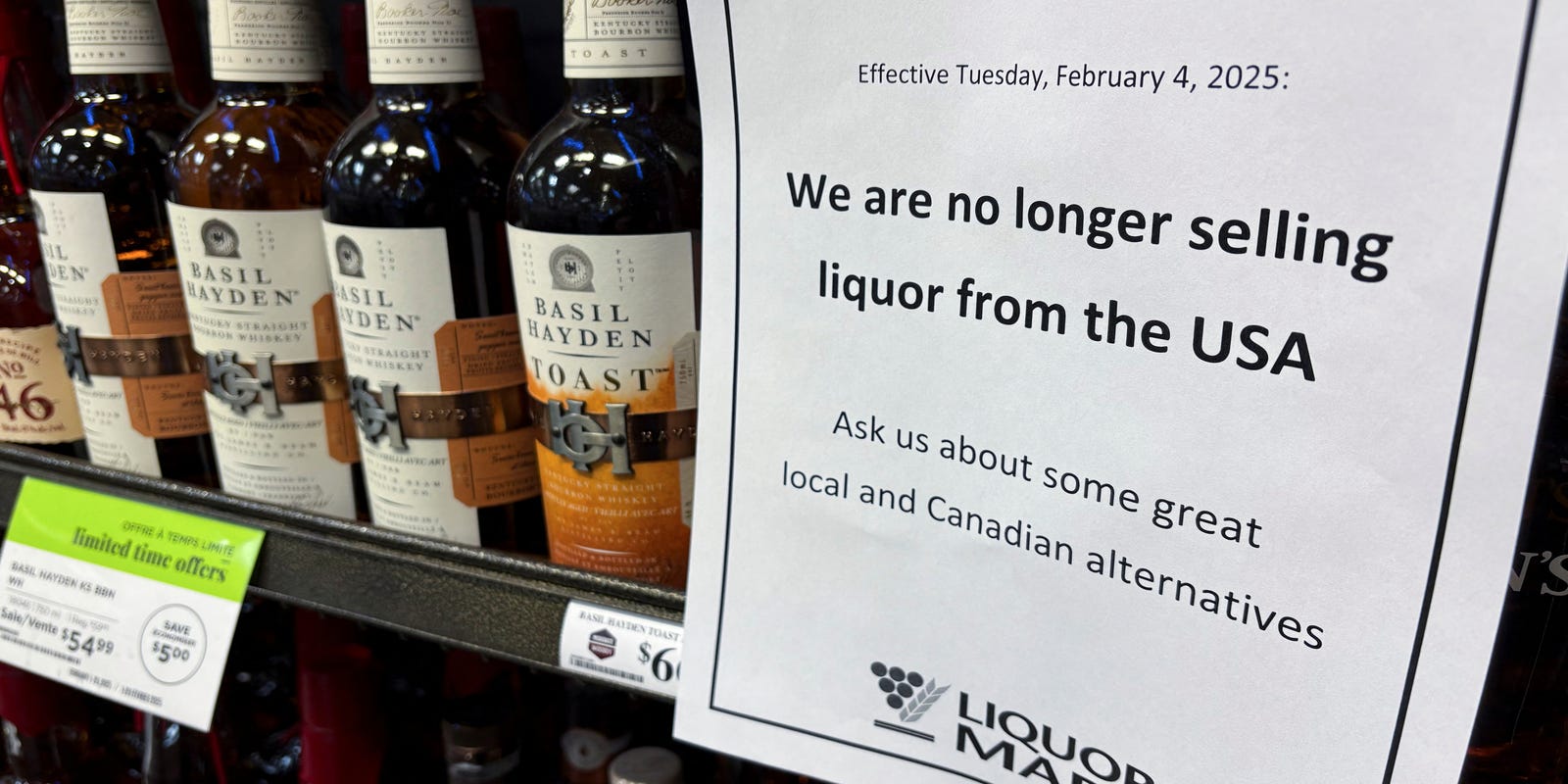

Trade Tensions Simmer: Will Canadian Consumer Anger Spark a U.S. Goods Boycott?

2025-03-07 21:59:17

Companies

Breaking: BCG's Bold AI Leap Transforms Scientific Research with Groundbreaking New Institute

2025-04-15 04:01:00

Companies

SEC's New Enforcer: Kevin O'Leary Warns of Crackdown on Chinese Stock Market Intruders

2025-04-11 12:12:42