Manufacturing Pulse: China's Economic Heartbeat Revealed in Latest PMI Snapshot

Manufacturing

2025-03-02 21:25:44Content

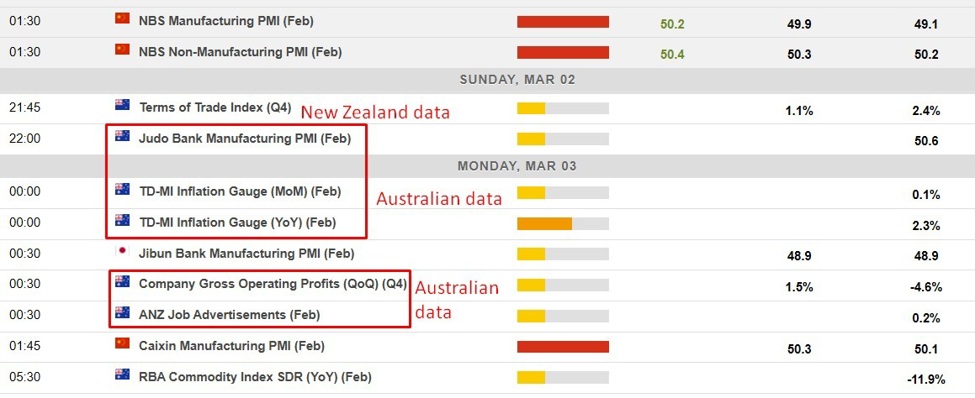

Asian Economic Calendar: Key Events and Consensus Expectations for 03 March 2025

As investors and market analysts gear up for a dynamic day of economic insights, the Asian financial landscape promises several critical events that could significantly impact regional and global markets. Here's a comprehensive overview of the key economic indicators and events scheduled for March 3rd, 2025.

Japan: Economic Indicators in Focus

The Bank of Japan (BOJ) will release its latest economic data, with particular attention on monetary policy indicators and potential shifts in the nation's economic strategy. Analysts are closely monitoring potential adjustments to the current monetary framework, which could have substantial implications for currency markets and regional investment trends.

China: Economic Performance and Policy Signals

China's National Bureau of Statistics is set to publish crucial economic metrics, including manufacturing performance and service sector activity. Investors will be keenly analyzing these reports for insights into the country's economic recovery trajectory and potential policy interventions.

Australia: Key Economic Releases

The Reserve Bank of Australia's latest economic assessment will provide valuable perspectives on the nation's economic health. Trade balance figures and employment data are expected to offer comprehensive insights into Australia's economic resilience and potential growth strategies.

Market Expectations and Potential Impacts

Financial markets are anticipating nuanced movements across various sectors. Potential volatility is expected in currency exchange rates, particularly for the Japanese Yen, Chinese Yuan, and Australian Dollar. Institutional investors and traders should remain vigilant and prepared for potential market recalibrations.

Global Context and Interconnectedness

While these events are regionally focused, their implications extend far beyond Asia. Global investors and economic strategists will be closely monitoring these developments for potential ripple effects in international markets.

Disclaimer: Economic forecasts and market predictions are subject to change. Investors are advised to conduct thorough research and consult financial professionals before making investment decisions.

Navigating the Economic Landscape: Asia's Financial Pulse on March 3rd, 2025

In the intricate world of global finance, Asia stands as a pivotal arena where economic dynamics continuously reshape the international monetary ecosystem. As markets awaken and investors lean forward with anticipation, the economic calendar for March 3rd, 2025, promises to unveil critical insights that could potentially recalibrate investment strategies and economic forecasts across multiple sectors and regions.Decoding Market Movements: Where Opportunity Meets Precision

Macroeconomic Indicators: Unveiling Economic Resilience

The Asian economic landscape presents a complex tapestry of interconnected financial indicators that demand meticulous analysis. Central banks across the region are preparing to release comprehensive data sets that will provide nuanced perspectives on economic performance, inflation trajectories, and potential monetary policy adjustments. Economists and market strategists are particularly focused on understanding the underlying currents driving economic momentum. The intricate interplay between domestic production, international trade flows, and consumer sentiment creates a multidimensional framework for interpreting potential market movements.Monetary Policy Signals: Deciphering Central Bank Strategies

Central banking institutions in key Asian economies are expected to communicate subtle yet significant signals regarding their monetary policy stance. These communications carry profound implications for investors, potentially influencing currency valuations, bond markets, and broader investment sentiment. The delicate balance between stimulating economic growth and managing inflationary pressures remains a critical challenge. Policymakers must navigate complex economic terrains, considering global geopolitical tensions, supply chain dynamics, and emerging technological disruptions that could reshape traditional economic models.Sector-Specific Performance Metrics

Different economic sectors are poised to reveal their unique performance characteristics. Technology, manufacturing, services, and financial services sectors will provide granular insights into their respective growth trajectories, innovation capabilities, and adaptability in an increasingly volatile global environment. Technological advancements and digital transformation continue to play a pivotal role in reshaping economic landscapes. The intersection of artificial intelligence, blockchain technologies, and traditional economic frameworks presents both unprecedented opportunities and complex challenges for businesses and investors.Global Interconnectedness and Regional Dynamics

The Asian economic ecosystem does not exist in isolation but represents a critical node in the global economic network. International trade relationships, cross-border investments, and geopolitical considerations create a sophisticated web of economic interactions that demand sophisticated analytical approaches. Emerging markets within Asia demonstrate remarkable resilience and adaptability, challenging traditional economic paradigms. The ability to rapidly integrate technological innovations, develop robust infrastructure, and cultivate human capital distinguishes these economies in the global competitive landscape.Investment Implications and Strategic Considerations

Sophisticated investors are meticulously analyzing these economic indicators to develop nuanced investment strategies. The ability to interpret complex economic signals and anticipate potential market movements requires a combination of data-driven analysis and strategic foresight. Risk management remains paramount, with diversification strategies becoming increasingly sophisticated. The integration of advanced predictive analytics and machine learning technologies is transforming traditional investment decision-making processes, enabling more precise and dynamic approaches to portfolio management.RELATED NEWS

Manufacturing Mood Swings: Dallas Fed Survey Reveals Economic Pulse Amid Quiet Market Week

When the Next Pandemic Strikes: Why Local Vaccine Production Could Save Millions