Chip Giant TSM Takes a Hit: Taiwan Semiconductor Shares Tumble 4% in Market Shakeup

Manufacturing

2025-03-01 23:18:46Content

Taiwan Semiconductor Manufacturing (TSM): Navigating Market Volatility

Investors are closely watching Taiwan Semiconductor Manufacturing (TSM) as the stock experiences a notable 4% decline in recent trading. This movement has sparked discussions about the company's current market position and potential investment strategies.

Understanding the Market Dynamics

TSM, a global leader in semiconductor manufacturing, is facing short-term market pressures that have triggered this recent downturn. While the decline might seem concerning, it's crucial to look beyond the immediate fluctuation and consider the company's long-term fundamentals.

Key Considerations for Investors

- TSM remains a critical player in the global semiconductor supply chain

- The company continues to be a primary manufacturer for major tech giants

- Long-term growth prospects remain strong despite short-term volatility

Should You Sell?

Before making any hasty decisions, investors should:

- Analyze the broader market context

- Review the company's recent financial performance

- Consider personal investment goals and risk tolerance

While the current 4% decline might be unsettling, it's not necessarily a signal to sell. TSM's robust market position and technological leadership suggest that this could be a temporary market adjustment.

Final Recommendation

Prudent investors should maintain a balanced perspective, potentially viewing this dip as a potential buying opportunity rather than a reason to panic sell.

Semiconductor Giant's Market Tremors: Navigating TSM's Volatile Trading Landscape

In the high-stakes world of semiconductor manufacturing, Taiwan Semiconductor Manufacturing (TSM) stands as a technological colossus, whose every market movement sends ripples through global technology ecosystems. Today's trading dynamics present a complex narrative of investor sentiment, technological innovation, and strategic market positioning that demands nuanced understanding and strategic insight.Unraveling the Market's Most Critical Semiconductor Investment Opportunity

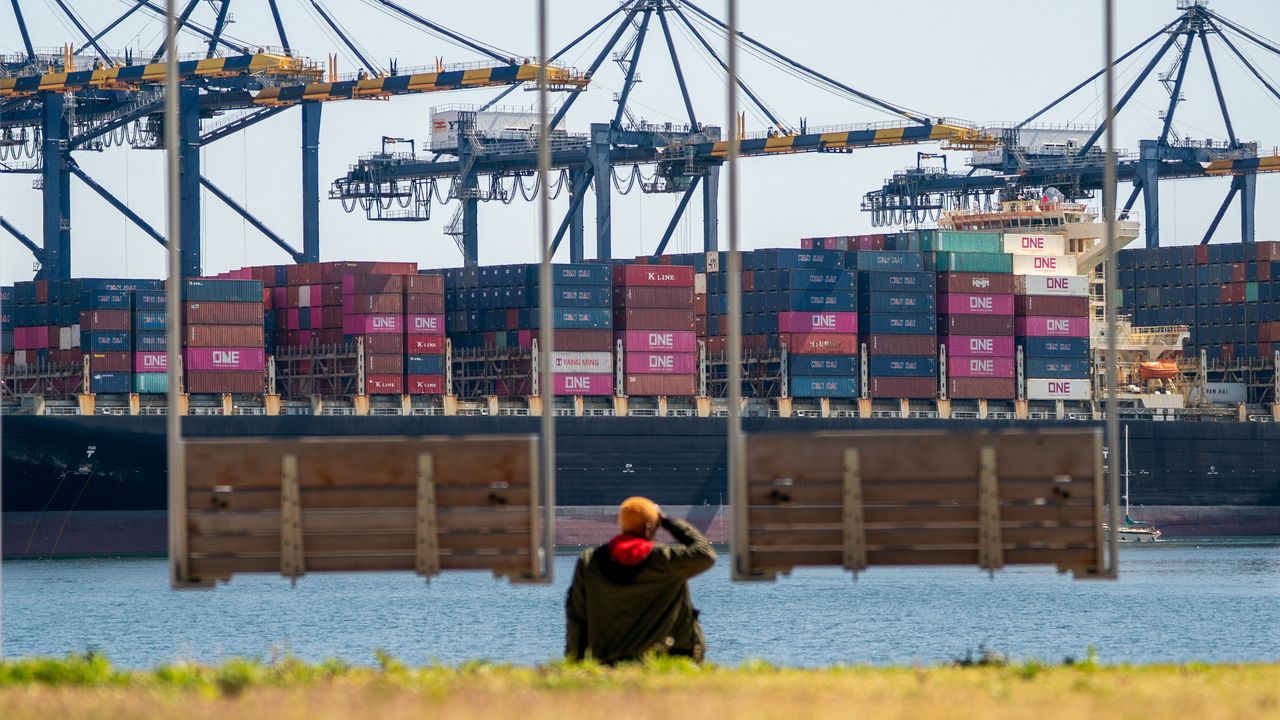

The Global Semiconductor Ecosystem: Understanding TSM's Strategic Position

Taiwan Semiconductor Manufacturing represents more than a mere corporate entity; it embodies the technological backbone of global digital infrastructure. As the world's largest contract chipmaker, TSM's performance transcends traditional market metrics, reflecting broader technological trends and geopolitical dynamics. The company's intricate manufacturing processes and cutting-edge semiconductor technologies position it as a critical player in global technological advancement. The semiconductor industry's complexity demands sophisticated analysis beyond surface-level trading indicators. TSM's market movements reflect intricate interactions between technological innovation, global supply chains, and geopolitical tensions. Investors must recognize that each percentage point of market fluctuation represents profound technological and economic implications.Market Volatility and Investor Strategic Considerations

Contemporary market conditions present investors with a multifaceted decision-making landscape. The 4% trading decline signals potential opportunities and challenges that require comprehensive evaluation. Sophisticated investors understand that short-term market movements do not necessarily correlate with long-term strategic value. Technological disruption and semiconductor demand continue driving TSM's fundamental value proposition. The company's robust research and development infrastructure, coupled with its global manufacturing capabilities, provide substantial competitive advantages. Investors must look beyond immediate trading fluctuations and assess the company's broader technological ecosystem and strategic positioning.Technological Innovation: TSM's Competitive Edge

TSM's technological prowess extends far beyond traditional manufacturing paradigms. The company's advanced semiconductor manufacturing processes represent the pinnacle of technological engineering, enabling increasingly sophisticated electronic devices across multiple industries. From artificial intelligence infrastructure to advanced computing systems, TSM's innovations underpin global technological progression. The semiconductor industry's rapid evolution demands continuous innovation and strategic adaptability. TSM's commitment to research and development ensures its continued relevance in an increasingly complex technological landscape. Investors should view the company's market movements through the lens of long-term technological transformation rather than short-term trading volatility.Geopolitical Dynamics and Market Resilience

Global geopolitical tensions significantly influence semiconductor manufacturing dynamics. TSM's strategic positioning in Taiwan creates both opportunities and challenges within the international technological ecosystem. The company's ability to navigate complex geopolitical landscapes demonstrates remarkable resilience and strategic acumen. Investors must consider broader geopolitical contexts when evaluating TSM's market performance. International trade policies, technological restrictions, and regional economic strategies directly impact the semiconductor industry's operational environment. Understanding these nuanced interactions provides deeper insights into the company's potential trajectory.Future Outlook: Navigating Technological and Market Uncertainties

The semiconductor industry represents a critical intersection of technological innovation, economic strategy, and global connectivity. TSM's ongoing performance reflects broader technological trends that extend far beyond traditional market analysis. Investors capable of comprehending these complex interactions will be better positioned to make informed strategic decisions. Technological progression continues to accelerate, with semiconductors serving as fundamental infrastructure for emerging technologies. TSM's continued investment in advanced manufacturing processes and technological research ensures its potential for sustained growth and market leadership.RELATED NEWS

Battery Breakthrough: How Volklec is Electrifying the UK's Energy Independence