Teeing Up Profits: Analysts Reveal the Hidden Gem in Golf Stocks

Sports

2025-04-13 21:27:48Content

Exploring Top Golf Stocks: A Closer Look at Amer Sports, Inc.

In our recent exploration of the most promising golf stocks recommended by industry analysts, we're diving deeper into the performance and potential of Amer Sports, Inc. (NYSE:AS). As the golf industry continues to evolve and attract investors, understanding the landscape of top golf-related stocks becomes increasingly important.

Golf stocks represent publicly traded companies that play a significant role in the golf industry ecosystem. These can include equipment manufacturers, sporting goods retailers, golf course operators, and technology innovators that are reshaping the sport's landscape.

Amer Sports, Inc. stands out as a compelling player in this competitive market. By examining its market position, recent performance, and analyst recommendations, investors can gain valuable insights into its potential for growth and investment attractiveness.

Our comprehensive analysis aims to provide a nuanced perspective on how Amer Sports compares to other top golf stocks, helping investors make informed decisions in this dynamic sector.

Navigating the Greens: A Deep Dive into Golf Industry Investments and Market Dynamics

In the ever-evolving landscape of sports and leisure investments, the golf industry presents a fascinating arena for strategic financial exploration. As markets continue to shift and investor appetites transform, understanding the nuanced ecosystem of golf-related stocks becomes increasingly critical for discerning financial professionals and passionate enthusiasts alike.Unlock the Potential: Where Smart Money Meets Sporting Excellence

The Emerging Landscape of Golf Industry Investments

The golf industry represents a complex and dynamic investment ecosystem that extends far beyond traditional perceptions. Modern investors are discovering that golf-related stocks encompass a multifaceted landscape of equipment manufacturers, technology innovators, and experiential service providers. Companies like Amer Sports, Inc. are not merely selling golf equipment but are positioning themselves as comprehensive lifestyle and performance brands that intersect technology, design, and athletic performance. Contemporary market analysis reveals that successful golf industry investments require a nuanced understanding of technological innovation, consumer behavior, and global market trends. Investors must look beyond surface-level metrics and examine the strategic positioning of companies within this competitive landscape.Technological Innovation and Market Transformation

The golf equipment sector is experiencing unprecedented technological disruption. Advanced materials, data-driven design, and sophisticated manufacturing techniques are revolutionizing how golf equipment is conceptualized, produced, and marketed. Companies that successfully integrate cutting-edge technologies into their product development strategies are positioning themselves as market leaders. Artificial intelligence and machine learning are increasingly being employed to optimize equipment design, providing players with unprecedented levels of performance customization. This technological convergence creates unique investment opportunities for those who can identify companies at the forefront of these innovations.Global Market Dynamics and Consumer Trends

Golf's global market is experiencing significant transformation, driven by changing demographics and emerging international markets. While traditional golf markets in North America and Europe remain important, rapidly growing economies in Asia and emerging markets are creating new opportunities for golf equipment manufacturers and related service providers. The pandemic has paradoxically accelerated golf's popularity, with many individuals seeking outdoor recreational activities that allow for social distancing. This shift has created unexpected growth opportunities for golf-related businesses, presenting investors with unique strategic entry points.Strategic Investment Considerations

Successful investment in golf industry stocks requires a comprehensive approach that considers multiple interconnected factors. Investors must evaluate not just financial performance, but also a company's innovation pipeline, brand positioning, and ability to adapt to rapidly changing market conditions. Diversification within the golf industry ecosystem becomes crucial. This might involve exploring investments across equipment manufacturers, technology providers, course management companies, and emerging digital platforms that are transforming how golf is experienced and consumed.Risk Management and Future Outlook

While the golf industry presents compelling investment opportunities, prudent investors must also recognize potential challenges. Economic fluctuations, changing consumer preferences, and technological disruptions can significantly impact market dynamics. Sophisticated investors will develop robust risk management strategies that include continuous market monitoring, diversified investment approaches, and a willingness to adapt to emerging trends. The most successful investment strategies will blend traditional financial analysis with forward-looking technological and cultural insights.RELATED NEWS

From Superfan to Owner: Celtics Sold in Record-Shattering $6.1 Billion Deal

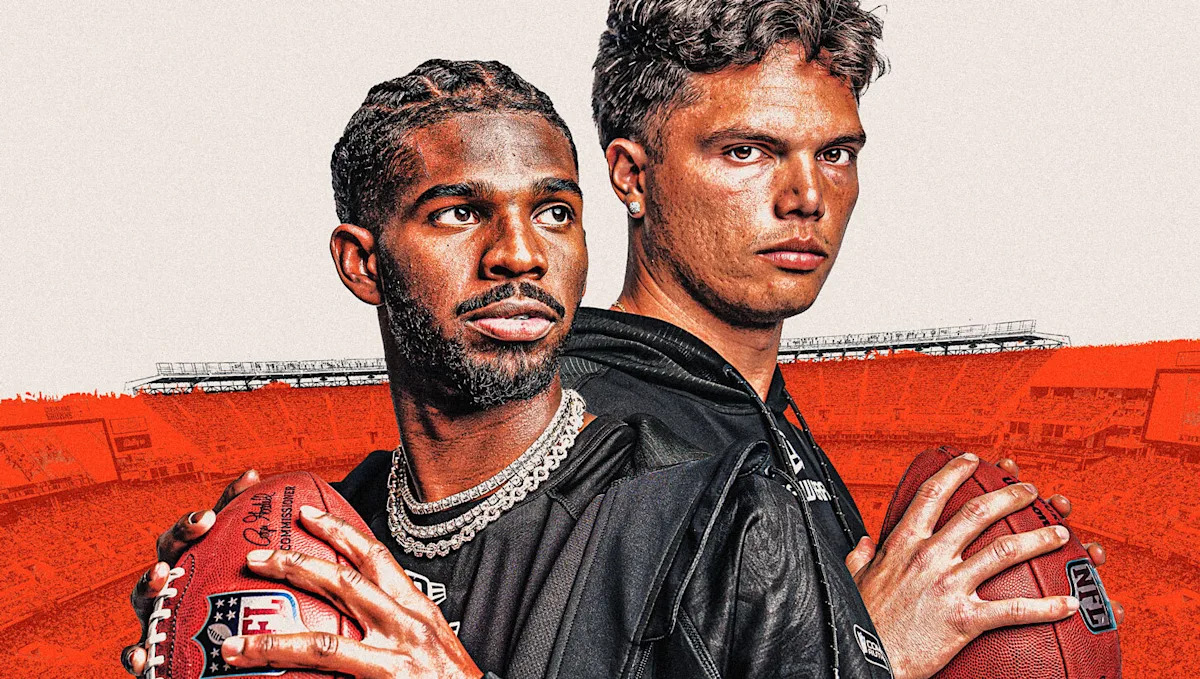

Rookie Rivals: Freshmen Athletes Spark Electrifying Spring Sports Comeback