Pharma Giant Eli Lilly Unleashes Massive $50B Manufacturing Surge Across America

Manufacturing

2025-04-13 18:55:36Content

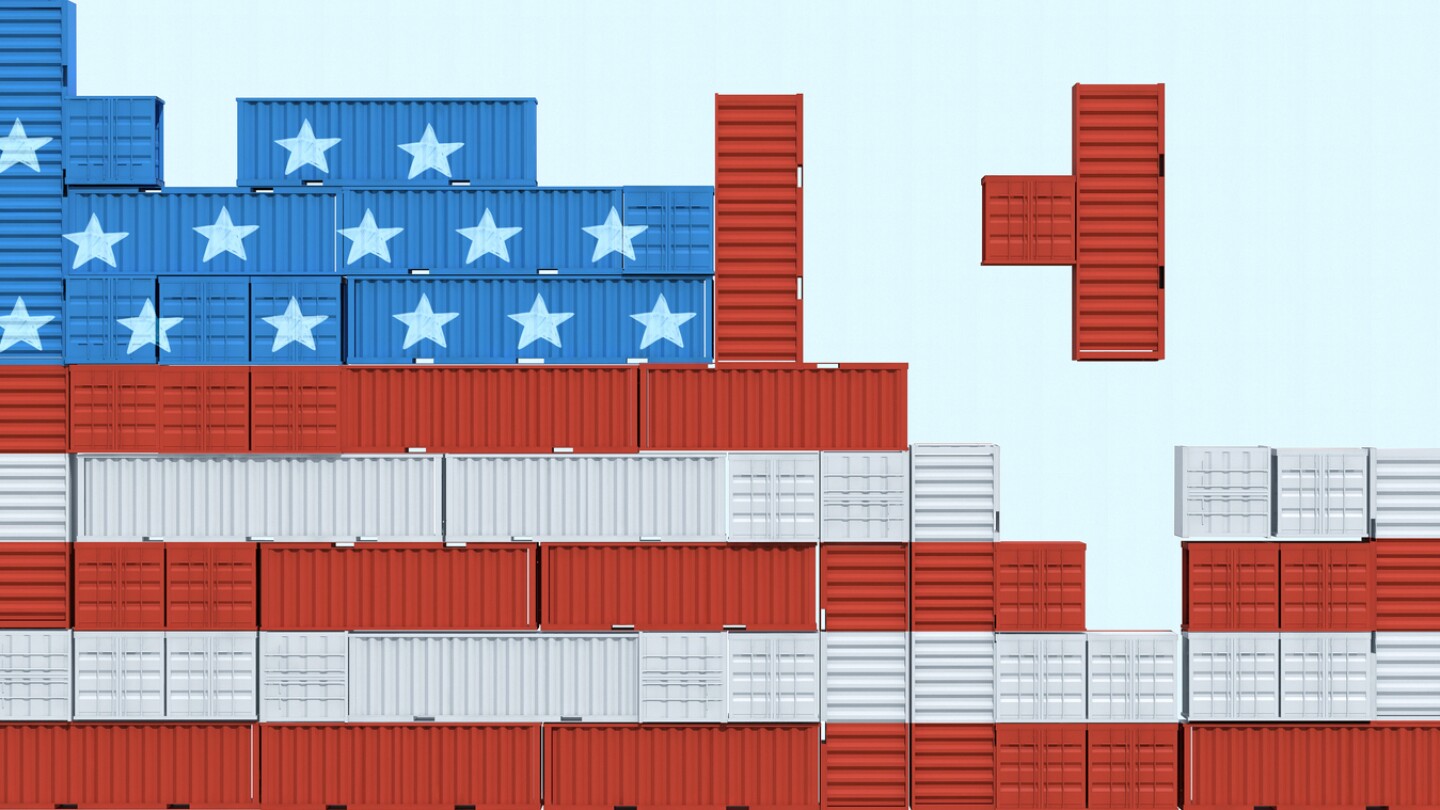

Pharmaceutical giant Eli Lilly is making a bold strategic move with an impressive $50 billion investment to dramatically expand its U.S. manufacturing infrastructure. This ambitious expansion signals the company's commitment to strengthening domestic production capabilities and positioning itself at the forefront of pharmaceutical innovation.

The substantial investment comes at a critical time when the healthcare industry is increasingly focusing on resilient and localized manufacturing strategies. By significantly boosting its domestic manufacturing footprint, Eli Lilly aims to enhance production efficiency, reduce supply chain vulnerabilities, and potentially create numerous high-skilled jobs across the United States.

Financial analysts are expressing optimism about the company's strategic direction, with projections indicating an average target price of $1,016.77 for Eli Lilly's stock. This forecast reflects confidence in the company's long-term growth potential and the strategic value of its extensive manufacturing expansion plan.

The multi-billion dollar investment is expected to modernize Eli Lilly's production facilities, incorporate advanced manufacturing technologies, and potentially accelerate the development and distribution of critical pharmaceutical products. This move not only demonstrates the company's financial strength but also its commitment to innovation and domestic economic development.

Pharmaceutical Giant's Bold Manufacturing Revolution: A $50 Billion Leap into America's Industrial Future

In the rapidly evolving landscape of pharmaceutical manufacturing, one company stands poised to redefine industrial capabilities through unprecedented strategic investment. The pharmaceutical sector is witnessing a transformative moment that could reshape domestic production paradigms and set new standards for medical innovation and economic development.Revolutionizing Healthcare Manufacturing: Where Ambition Meets Infrastructure

Strategic Investment Landscape

Eli Lilly's monumental $50 billion expansion represents more than a mere financial commitment—it's a comprehensive reimagining of pharmaceutical manufacturing infrastructure in the United States. This strategic initiative signals a profound understanding of the critical need for robust, domestically-controlled production capabilities in an increasingly complex global healthcare ecosystem. The investment transcends traditional capital allocation, embodying a holistic approach to addressing supply chain vulnerabilities and technological limitations that have long plagued the pharmaceutical industry. By committing such substantial resources, Eli Lilly demonstrates an unwavering commitment to technological advancement and national economic resilience.Technological Innovation and Manufacturing Capabilities

At the core of this expansive strategy lies a sophisticated blueprint for technological transformation. The planned investments will likely incorporate cutting-edge automation, artificial intelligence-driven production processes, and advanced biotechnological infrastructure that can dramatically enhance manufacturing efficiency and precision. Modern pharmaceutical manufacturing demands unprecedented levels of technological integration. Eli Lilly's approach suggests a comprehensive reimagining of production methodologies, potentially introducing modular manufacturing systems that can rapidly adapt to emerging medical challenges and evolving market demands.Economic and Industrial Implications

The $50 billion expansion carries profound implications for the broader American industrial landscape. By significantly investing in domestic manufacturing capabilities, Eli Lilly is not merely expanding its own operational capacity but contributing to a broader narrative of industrial revitalization and technological leadership. This strategic move could potentially create thousands of high-skilled jobs, stimulate regional economic development, and position the United States as a global leader in pharmaceutical manufacturing innovation. The investment represents a powerful statement about the potential for domestic industrial renaissance in critical technological sectors.Market Response and Financial Projections

Financial analysts have responded enthusiastically to Eli Lilly's ambitious plans. Projected target prices reflect growing confidence in the company's strategic vision, with current estimates suggesting significant potential for long-term value creation. The market's positive reception underscores the strategic brilliance of investing in domestic manufacturing capabilities during a period of global economic uncertainty. By demonstrating commitment to infrastructure development, Eli Lilly is simultaneously mitigating supply chain risks and positioning itself for sustained competitive advantage.Future-Proofing Pharmaceutical Production

This expansive initiative represents more than a traditional capital investment—it's a comprehensive strategy for future-proofing pharmaceutical production. By integrating advanced technologies, sustainable practices, and flexible manufacturing approaches, Eli Lilly is establishing a blueprint for next-generation industrial development. The company's vision extends beyond immediate operational improvements, suggesting a profound understanding of the complex, interconnected nature of modern healthcare manufacturing. This holistic approach positions Eli Lilly not just as a pharmaceutical manufacturer, but as a pioneering force in technological and industrial innovation.RELATED NEWS

Manufacturing

Collaborative Robots: The Smart Way to Automate Without Compromising Worker Safety

2025-03-14 16:04:26

Manufacturing

Hedge Fund Titans Bet Big: Why Taiwan Semiconductor Could Be the Next Wall Street Darling

2025-04-19 20:08:23

Manufacturing

Chip Giants Clash: How ASML, NVIDIA, Intel, and TSMC Are Reshaping the Global Semiconductor Landscape

2025-04-16 08:20:00