Tech Titans Trembling: How Apple and Silicon Valley Are Caught in the Crossfire of the US-China Trade Showdown

Manufacturing

2025-04-09 15:56:15Content

Wall Street Braces for Continued Market Turbulence as Tariff Tensions Rattle Investor Confidence

The U.S. stock market continues to experience significant volatility, with investors closely monitoring the ongoing trade tensions and their potential economic implications. Stocks most vulnerable to tariff-related disruptions have been particularly susceptible to dramatic price swings, reflecting the uncertainty surrounding international trade policies.

Recent weeks have witnessed a substantial sell-off across multiple sectors, as traders and investors grapple with the potential long-term consequences of escalating trade disputes. The market's unpredictable nature has created a challenging environment for both institutional and individual investors, who are seeking to navigate the complex landscape of global economic interactions.

Sectors with substantial international exposure and supply chain dependencies are experiencing the most pronounced market fluctuations. Companies reliant on international trade are finding themselves at the epicenter of this financial uncertainty, with stock prices reflecting the rapid shifts in geopolitical dynamics.

As market participants continue to assess the potential impact of tariffs and trade negotiations, volatility remains a defining characteristic of the current investment landscape. Investors are advised to maintain a cautious and strategic approach while monitoring emerging economic developments.

Market Tremors: How Trade Tensions Are Reshaping the U.S. Stock Landscape

In the complex and ever-shifting terrain of global financial markets, investors find themselves navigating a precarious landscape where geopolitical tensions and trade policies can trigger seismic shifts in stock valuations. The current economic environment demands unprecedented strategic awareness and adaptive investment approaches.Unraveling the Economic Chessboard: Trade Policies and Market Volatility

The Tariff Tremor: Understanding Market Dynamics

The contemporary financial ecosystem is experiencing unprecedented turbulence, driven by intricate trade negotiations and protectionist policies. Investors are witnessing a remarkable transformation in market sentiment, where traditional investment strategies are being systematically challenged by geopolitical uncertainties. The implementation of tariffs represents more than mere economic policy—it's a sophisticated diplomatic instrument that reverberates through global financial networks. Sophisticated market analysts are closely monitoring the ripple effects of these trade tensions. Each tariff announcement creates a cascading impact across multiple sectors, generating complex interdependencies that challenge conventional economic models. The stock market's response is not merely reactive but represents a nuanced interpretation of potential long-term economic implications.Sectoral Vulnerabilities: Identifying Investment Risk Zones

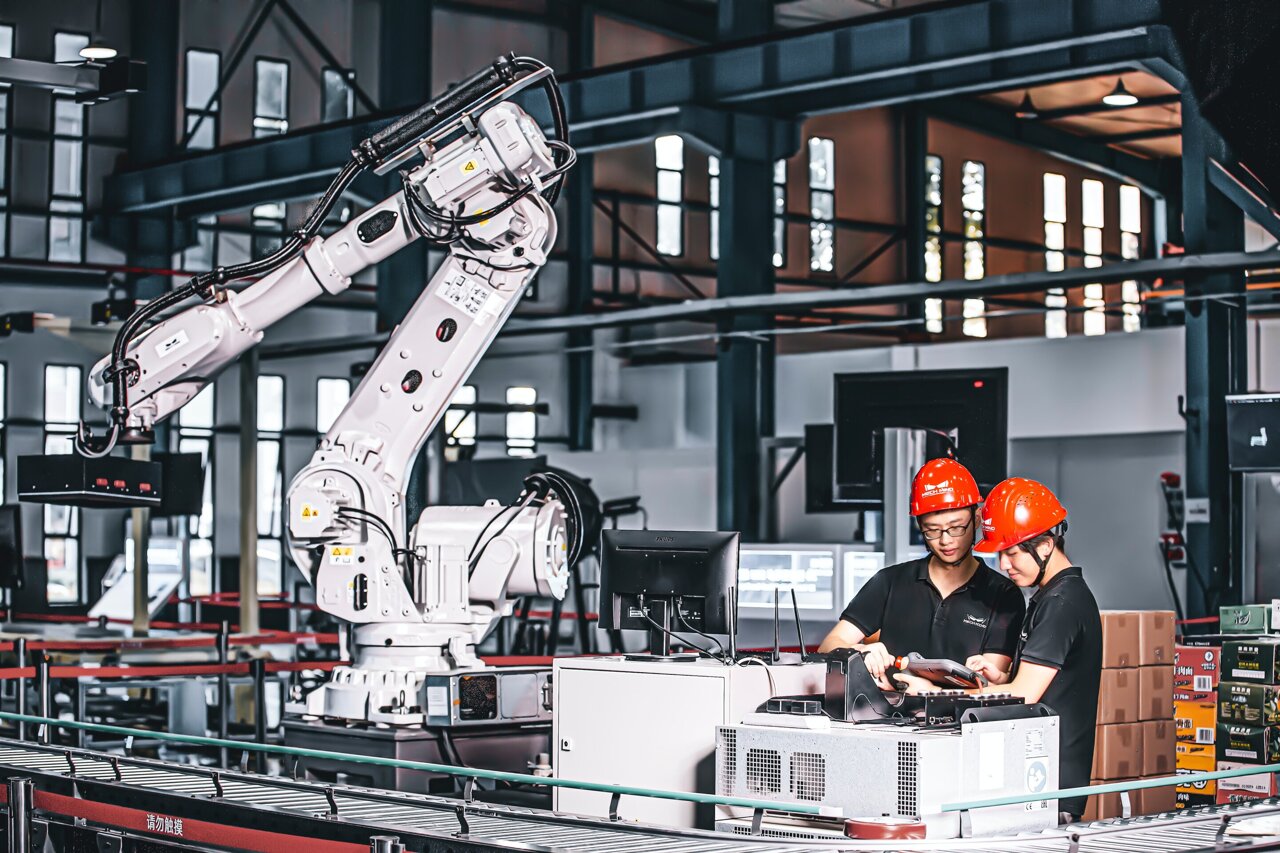

Certain industrial sectors demonstrate heightened sensitivity to trade policy fluctuations. Manufacturing, technology, and agricultural industries are experiencing significant volatility, with stock valuations oscillating dramatically in response to international trade negotiations. Investors must develop sophisticated risk mitigation strategies that transcend traditional portfolio management approaches. The technological sector, in particular, stands at a critical intersection of innovation and geopolitical complexity. Companies with substantial international supply chains face unprecedented challenges in maintaining operational stability and investor confidence. Strategic adaptability has become the primary differentiator between resilient corporations and those susceptible to market disruptions.Psychological Dimensions of Market Volatility

Beyond numerical metrics, market volatility encompasses profound psychological dimensions. Investor sentiment represents a complex emotional landscape where fear, speculation, and strategic calculation intersect. The current economic environment demands exceptional emotional intelligence and analytical rigor. Institutional investors are recalibrating risk assessment models, recognizing that traditional quantitative approaches are insufficient in capturing the multifaceted nature of contemporary market dynamics. The ability to interpret subtle geopolitical signals and anticipate potential policy shifts has become a critical competitive advantage.Global Economic Interconnectedness

The modern financial ecosystem transcends national boundaries, creating intricate networks of economic interdependence. Tariffs and trade policies initiated in one jurisdiction can trigger cascading effects across multiple continents, challenging traditional economic paradigms. Emerging markets are particularly vulnerable to these systemic disruptions. Their economic structures often lack the resilience and diversification mechanisms of more established economies, making them susceptible to external shocks. Sophisticated investors are developing nuanced strategies that account for these complex global interactions.Technological Disruption and Economic Resilience

Technological innovation emerges as a critical factor in economic adaptation. Companies leveraging advanced analytics, artificial intelligence, and predictive modeling are better positioned to navigate volatile market conditions. The convergence of technological capabilities and strategic foresight represents the new frontier of competitive advantage. Digital transformation is not merely a technological imperative but a strategic necessity. Organizations that can rapidly reconfigure their operational models in response to evolving trade dynamics will demonstrate superior market resilience.Strategic Recommendations for Investors

Navigating this complex economic landscape requires a multifaceted approach. Diversification, continuous learning, and maintaining operational flexibility are paramount. Investors must cultivate a holistic perspective that integrates geopolitical analysis, technological trends, and nuanced economic understanding. Developing adaptive investment strategies demands continuous education, sophisticated risk management, and a willingness to challenge existing paradigms. The most successful investors will be those who can synthesize complex information streams and make strategic decisions with clarity and precision.RELATED NEWS

Manufacturing

From Prototype to Production: How Digital Threads Are Revolutionizing 3D Printing

2025-03-03 10:00:00

Manufacturing

Young Innovators Spotlight Manufacturing Magic: Local Students Reveal Industry's Hidden Excitement

2025-03-20 14:48:02

Manufacturing

Steel State Revival: VP Vance Heralds Manufacturing's Bright Future in South Carolina

2025-05-01 23:14:23