Chip Stock Goldmine: Why Taiwan Semiconductor Could Be Your First Investment Breakthrough

Manufacturing

2025-04-06 20:46:46Content

Diving into the World of Starter Stocks: Taiwan Semiconductor's Market Position

In our recent exploration of beginner-friendly investment strategies, we highlighted 12 safe stocks for new investors. Today, we're taking a closer look at Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) and its compelling position in the current market landscape.

As the first quarter of 2025 unfolds, the US stock market has been anything but predictable. Characterized by significant volatility and dynamic shifts, the market presents both challenges and opportunities for investors, especially those just starting their investment journey.

Taiwan Semiconductor (TSM) stands out as a particularly intriguing option for novice investors. Known for its robust performance and critical role in the global semiconductor industry, the company offers a unique blend of stability and growth potential that makes it an attractive choice for those building their initial investment portfolio.

Our analysis reveals why TSM could be a strategic addition to a starter stock collection, providing insights into its market performance, technological leadership, and potential for long-term value creation.

Navigating the Investment Landscape: Taiwan Semiconductor's Strategic Position in 2025

In the dynamic world of global stock markets, investors are constantly seeking robust and promising investment opportunities that can weather economic uncertainties. The technology sector, particularly semiconductor manufacturing, has emerged as a critical focal point for strategic investment decisions, with Taiwan Semiconductor Manufacturing Company (TSM) standing at the forefront of technological innovation and market resilience.Unlock the Potential of Tech's Most Promising Investment Frontier

The Semiconductor Revolution: Understanding Taiwan Semiconductor's Market Dominance

Taiwan Semiconductor Manufacturing Company has established itself as a pivotal player in the global technology ecosystem. Unlike traditional manufacturing entities, TSM represents a sophisticated technological powerhouse that drives innovation across multiple industries. The company's unique positioning stems from its ability to manufacture cutting-edge semiconductor chips for some of the world's most prominent technology companies. The semiconductor industry represents a complex and intricate landscape where technological prowess translates directly into market value. TSM's strategic approach goes beyond mere manufacturing, encompassing advanced research and development that consistently pushes the boundaries of technological capabilities. Their commitment to innovation has positioned them as a critical infrastructure provider for global technology ecosystems.Investment Dynamics: Analyzing TSM's Strategic Market Performance

Investors seeking stable and growth-oriented opportunities find Taiwan Semiconductor an intriguing prospect. The company's financial performance reflects a robust business model that transcends traditional market fluctuations. By maintaining a diversified client base and investing heavily in technological research, TSM has created a resilient investment platform. The company's global reach extends far beyond traditional manufacturing boundaries. With strategic partnerships across multiple technological sectors, TSM has developed a comprehensive approach to semiconductor production that mitigates risks associated with market volatility. Their ability to adapt to changing technological landscapes provides investors with a sense of confidence and potential long-term growth.Technological Innovation: The Cornerstone of TSM's Competitive Advantage

At the heart of Taiwan Semiconductor's success lies an unwavering commitment to technological innovation. The company consistently invests significant resources into research and development, enabling them to stay ahead of emerging technological trends. Their advanced manufacturing processes allow for the creation of increasingly sophisticated semiconductor chips that power everything from smartphones to advanced computing systems. The semiconductor industry represents a critical infrastructure for global technological advancement. TSM's role in this ecosystem goes beyond mere manufacturing; they are essentially architects of technological progress. By developing increasingly efficient and powerful semiconductor technologies, the company continues to shape the future of global technological innovation.Global Economic Implications: TSM's Broader Market Impact

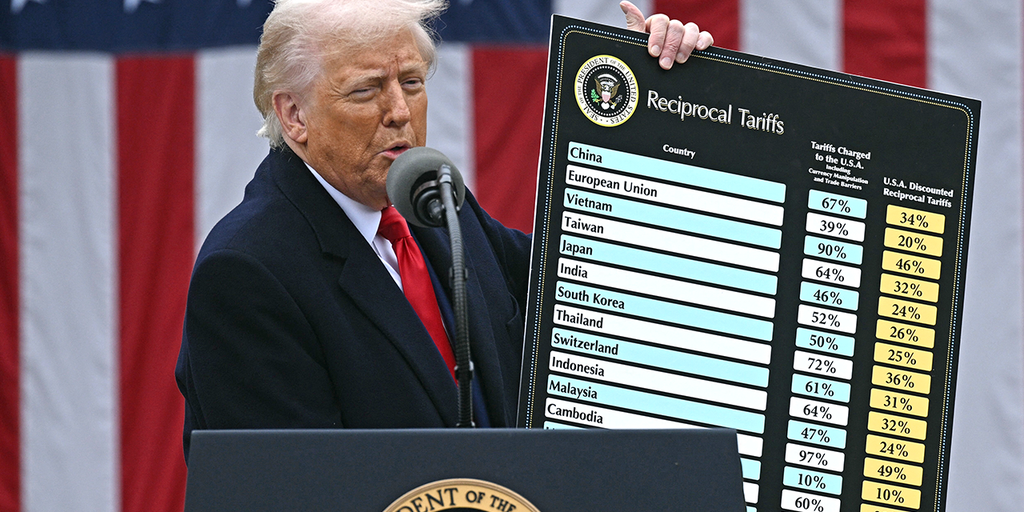

Taiwan Semiconductor's influence extends well beyond its immediate market segment. As a critical component of global technology supply chains, the company plays a significant role in international economic dynamics. Their ability to produce high-quality semiconductor chips impacts industries ranging from consumer electronics to advanced computing and artificial intelligence. The geopolitical landscape surrounding semiconductor manufacturing adds another layer of complexity to TSM's market position. With increasing global tensions and supply chain uncertainties, the company's strategic location and advanced manufacturing capabilities provide a unique advantage in a rapidly evolving technological marketplace.Future Outlook: Navigating Technological and Investment Frontiers

Looking toward the future, Taiwan Semiconductor continues to position itself as a forward-thinking organization. Their ongoing investments in next-generation semiconductor technologies suggest a trajectory of sustained growth and innovation. For investors, this represents an opportunity to engage with a company that is not just responding to technological changes but actively driving them. The semiconductor industry remains a critical component of global technological infrastructure. TSM's strategic approach, combining technological innovation with robust financial performance, makes them a compelling consideration for investors seeking exposure to cutting-edge technological developments.RELATED NEWS

Manufacturing

Green Victory: How Giant Eagle Turned Waste Management into a Zero-Waste Revolution

2025-05-06 15:40:42

Manufacturing

Biotech Meets Robotics: Astellas and Yaskawa Forge Groundbreaking Cell Therapy Manufacturing Alliance

2025-03-07 20:35:00

Manufacturing

Manufacturing Meltdown: How Trump's Trade War Crushes China's Industrial Heartland

2025-04-18 06:19:13