Manufacturing's Rollercoaster: Why 2025's Industrial Landscape Is Shifting Gears

Manufacturing

2025-02-27 21:30:49Content

The industrial construction landscape is experiencing a subtle shift, with the latest data revealing a modest decline in ongoing projects. As of January, the United States saw 346.2 million square feet of industrial space in various stages of development, marking a slight decrease from the previous month's 349.6 million square feet. This marginal reduction hints at potential changes in the commercial real estate market, reflecting evolving economic conditions and business expansion strategies across the nation.

Industrial Real Estate Landscape: A Comprehensive Analysis of Construction Trends and Market Dynamics

The industrial real estate sector continues to experience dynamic shifts, reflecting complex economic forces and evolving market strategies that reshape the landscape of commercial infrastructure across the United States. As developers and investors navigate increasingly sophisticated market conditions, understanding the nuanced trends in industrial space construction becomes paramount for strategic decision-making.Transforming Warehousing: The Future of Commercial Infrastructure Unfolds

Market Contraction and Strategic Recalibration

The industrial construction sector is experiencing a subtle yet significant transformation, with recent data revealing a marginal decline in total square footage under development. From 349.6 million square feet in the previous reporting period to 346.2 million square feet in January, this reduction signals a potential strategic recalibration within the commercial real estate ecosystem. Investors and developers are increasingly adopting a more measured approach to expansion, carefully evaluating market demands and economic indicators. This nuanced strategy reflects a sophisticated understanding of risk management and long-term sustainability in an increasingly volatile economic environment.Technological Integration and Spatial Optimization

Modern industrial spaces are no longer mere storage facilities but sophisticated technological hubs designed to maximize operational efficiency. Advanced automation, robotics, and intelligent logistics systems are fundamentally reshaping the concept of warehousing and distribution centers. The marginal reduction in construction volume suggests a shift towards higher-quality, more technologically integrated facilities rather than expansive, traditional warehouse models. Companies are prioritizing smart infrastructure that can adapt quickly to changing market demands and technological innovations.Economic Indicators and Regional Variations

The industrial construction landscape varies significantly across different regions, influenced by local economic conditions, supply chain dynamics, and regional growth patterns. While the national aggregate shows a slight contraction, individual markets may experience divergent trends. Factors such as proximity to transportation networks, emerging technological corridors, and regional economic policies play crucial roles in determining industrial space development. Sophisticated investors are conducting granular market analyses to identify potential growth opportunities beyond broad national statistics.Sustainability and Future-Proofing Industrial Infrastructure

Contemporary industrial construction is increasingly focused on sustainability and environmental considerations. Green building technologies, energy-efficient designs, and reduced carbon footprint are becoming critical differentiators in the commercial real estate market. The subtle reduction in construction volume might also indicate a more deliberate approach to developing environmentally responsible industrial spaces. Developers are investing in long-term, sustainable solutions that align with evolving regulatory frameworks and corporate sustainability goals.Investment Strategies and Market Resilience

Despite the marginal decline in construction, the industrial real estate sector demonstrates remarkable resilience. Institutional investors and real estate investment trusts continue to view industrial properties as stable, long-term assets with potential for consistent returns. The current market dynamics suggest a period of strategic consolidation, where quality and efficiency are prioritized over rapid expansion. This approach reflects a mature, sophisticated understanding of market cycles and investment potential.RELATED NEWS

Manufacturing

Tech Titan's Stock Shuffle: Fisher Asset Management Trims TSM Holdings

2025-03-01 11:20:11

Manufacturing

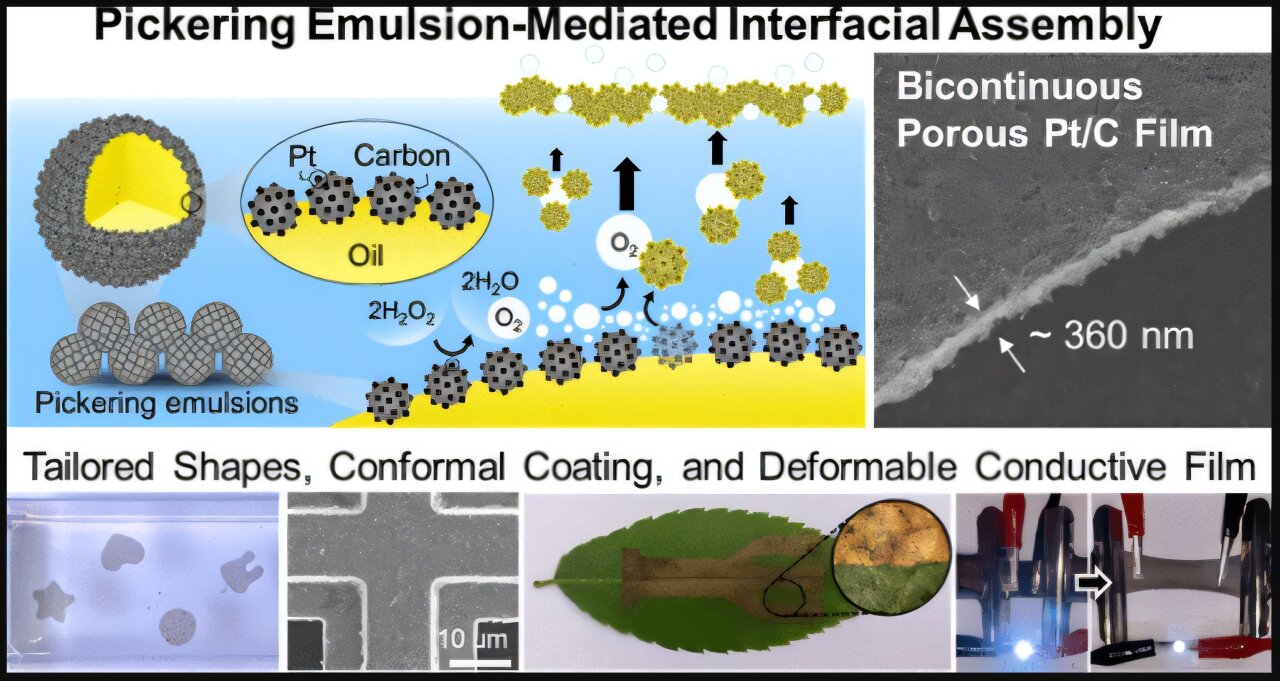

Breaking: Scientists Unveil Game-Changing Water-Oil Method for Instant Thin Film Production

2025-03-21 15:00:04

Manufacturing

Solar Surge: India's Bold $1 Billion Gambit to Supercharge Domestic Panel Production

2025-02-25 05:24:51